Most investors are familiar with the concept of asset allocation, but they may be less certain about the rebalancing process. While funds handle these processes automatically, self-directed investors must rebalance their portfolios on a regular basis to ensure that their asset allocation matches with their investment goals.

Let’s take a look at why rebalancing matters, different rebalancing strategies, and some tips to keep in mind to minimize your tax exposure and transaction costs.

Learn about other portfolio management concepts here.

Why Rebalancing Matters

Asset allocation, or the way that you divide your portfolio among asset classes, is arguably the most important decision in the investment process. In fact, asset allocation accounts for a whopping 88% of all volatility and returns, according to Vanguard. The way that you divide up investments matters much more than selecting any individual investment.

Keep track of stocks going ex-dividend by using our free Ex-Dividend Date Search tool.

The optimal asset allocation depends on an investor’s risk tolerance, investment goals, and time horizon. For example, a young investor with a high risk tolerance may allocate most of their capital to stocks, while an investor who’s already retired with a low risk tolerance may allocate most of their capital into bonds that produce a stable yield.

Rebalancing is the process of maintaining an asset allocation over time. If one part of a portfolio outperforms another, an investor may find that their asset allocation has changed and no longer reflects their risk tolerance and investment goals. Rebalancing involves buying and selling assets to restore the balance and ensure the right fit.

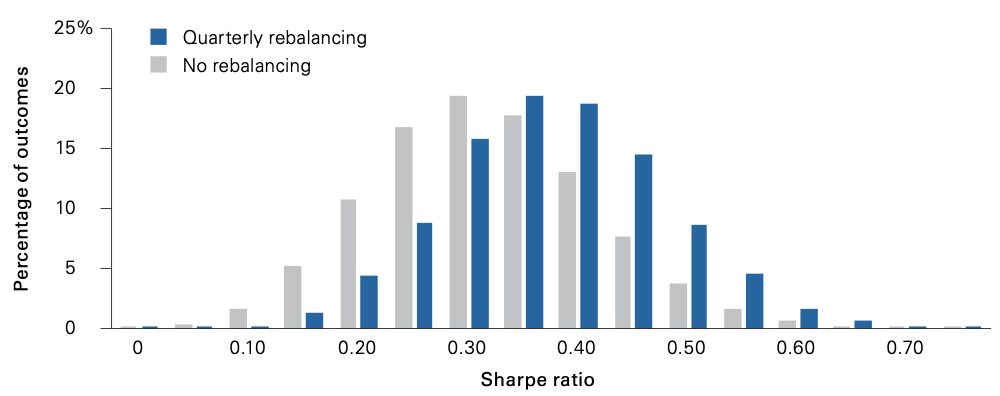

Source: Vanguard

As shown in the above chart, it can be seen that a rebalanced portfolio usually produces more return per unit of risk (i.e., Sharpe ratio) than a non-rebalanced portfolio.

Click here to learn about the different types of portfolio rebalancing techniques.

Setting a Rebalancing Trigger

The rebalancing process may seem straightforward, but there’s less certainty surrounding how often a portfolio should be rebalanced. Rebalancing too frequently can lead to high costs from commissions along with potential tax consequences while rebalancing too infrequently could leave an investor overexposed to certain asset classes for an extended period of time.

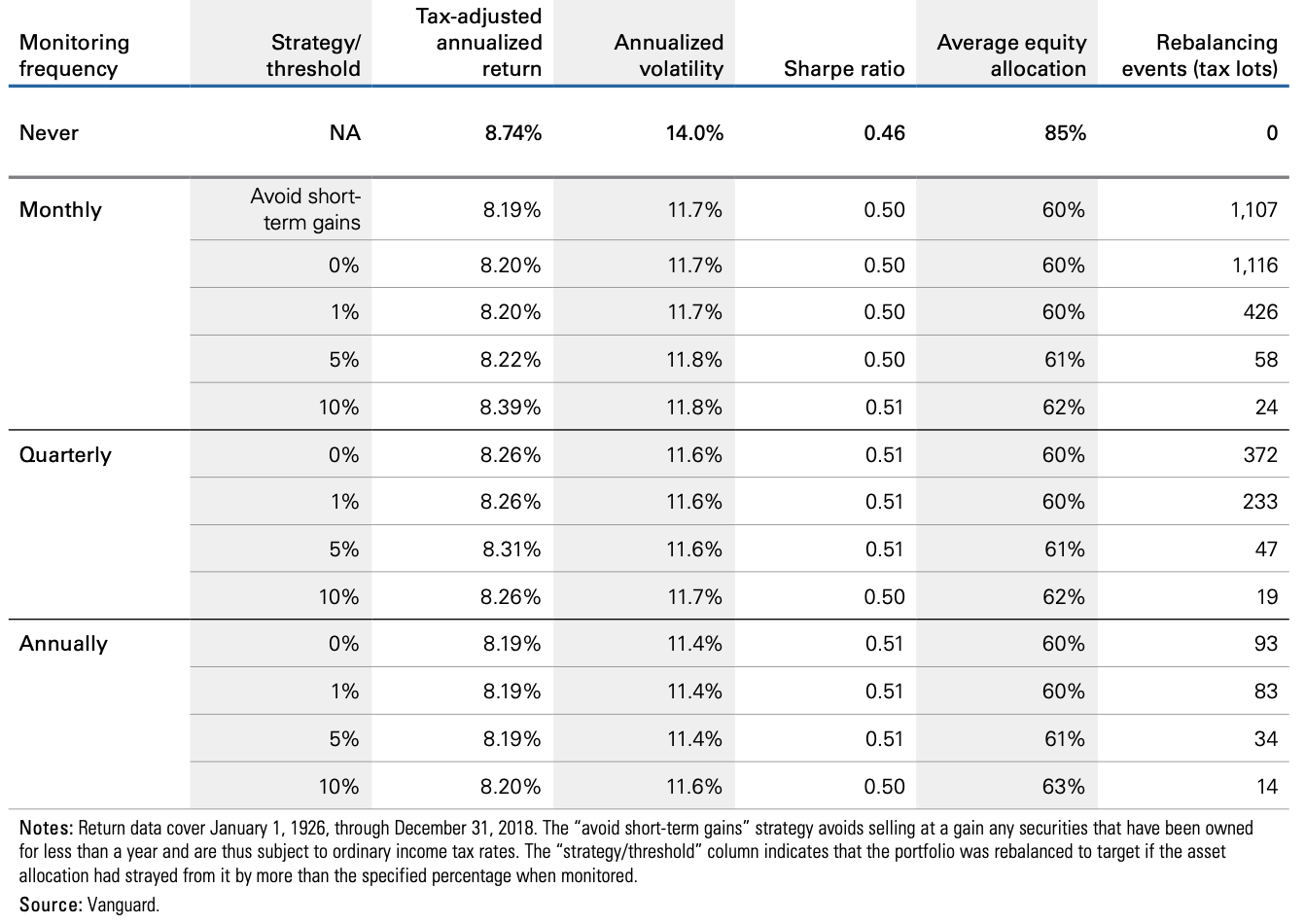

Most investors rebalance their portfolio on an annual or quarterly basis as part of their review process, which is known as time-based rebalancing. While this is the easiest approach, since you only need to remember a handful of times per year, the portfolio could experience a significant drift between rebalancing and throw off the asset allocation.

Threshold-based rebalancing only rebalances the portfolio when there’s a certain drift from the target allocation. For example, you may set a 5% threshold and rebalance the portfolio every time that the asset allocation drifts more than 5% from the target asset allocation. The only downside of this approach is that you could rebalance too frequently at times.

Vanguard’s research showed that the rebalancing strategy matters less than the act of rebalancing. In fact, researchers were unable to find a specific threshold or frequency that consistently outperforms other forms of rebalancing over time. The key is choosing a rebalancing strategy that you’re comfortable with and sticking to it.

Track how your portfolio’s dividend income changes when stocks increase or decrease their dividend by using our Free Dividend Assistant tool.

How to Go About Rebalancing

The primary cost of rebalancing stems from commission and taxes. If you rebalance frequently, you could end up paying short-term capital gains tax rates rather than lower long-term capital gains tax rates. More frequent rebalancing could also increase commissions and other transaction costs that you incur, reducing your overall return on investment.

There are several considerations to consider when rebalancing your portfolio:

Tax-Advantaged Accounts

Rebalancing transactions within tax-advantaged accounts, such as IRAs, are tax-free since you’re only taxed on withdrawals. If you have the option, it may be best to adjust your overall asset allocations through changes to your tax-advantaged accounts rather than taxable accounts.

Cost Considerations

Rebalancing with higher cost basis shares in taxable accounts may improve after-tax returns without increasing risk exposure. Or, you may focus on asset classes that are extremely overweight and underweight to limit both taxes and transaction costs.

Portfolio Cash Flows

If you want to take out a required minimum distribution (RMD), consider taking the distribution as part of a rebalancing effort. You can also reinvest the RMD in the underweighted asset class in your non-retirement accounts.

The Bottom Line

Asset allocation is one of the most important decisions that investors must make, but after making the decision, it’s equally important to rebalance the portfolio and ensure that the asset allocation remains near the target. That way, you can maximize your return per unit of risk and minimize your transaction costs and tax exposure.

Check out our Best Dividend Stocks list to view our top rated stocks.