Wall Street loves a guru. And DoubleLine’s Jeffery Gundlach could be one of the biggest gurus around. Gundlach has successfully turned DoubleLine into a behemoth in the fixed income sector and has been anointed by financial media as the new “Bond King.” So, when Gundlach speaks, it can pay to listen.

And right now, Gundlach has some important things to say about the markets, the economy and the fixed income sector in the new year.

In a new webcast, the portfolio manager outlined five important predictions and points that deserve notice. Like many of Gundlach’s calls, some may seem brash, but they have a very good chance of coming true. In that, investors may want to follow his calls with their portfolio allocations.

Total Return Fund’s Latest

After leaving TCW, Jeffrey Gundlach has managed to turn DoubleLine Capital into a powerhouse in the fixed income sector. Chief of which has been Gundlach’s ability to generate high annual returns for the investment manager’s Total Return mutual fund. Since then, Gundlach has become a staple of financial media on TV and in print.

And just like the previous Bond King, Bill Gross, Gundlach often provides his take on a variety of events, market outcomes and investment themes during annual missives and webcasts. It’s in the Total Return Fund’s latest webcast – titled “Peace, Love & Understanding” – that Gundlach, along with fellow DoubleLine manager, Andrew Hsu, gave their opinions on a variety of market conditions and outcomes. 1

To that end, the pair summarized five bold points and predictions for 2024. This included recessionary risk, sectors to buy, a window into the Fed’s thinking and even potential upside for the stock market in the short term.

Five Bold Predictions

Here are the predictions:

1. Upside for Stocks In the Short Run

When it comes to equities, Gundlach has long used a risk pricing mechanism and the CAPE metric to determine if stocks are a value. According to the guru, right now doesn’t look that way at all. In the webcast, Gundlach heighted the so-called risk premium of equities. These days, stocks are currently at a 0.61 premium to bonds. That’s one of the lowest points in the last 17 years by a wide margin. To put that into context, back in 2021, the number stood at 3.5.

Removing the top eight performing stocks – including names like Nvidia, Google and Microsoft – the S&P 500 would only be up around 2%.

To that end, stocks are overvalued by Gundlach’s account, which limits their upside in the long run. However, in the short run, investors may continue to see increases in equity prices. But

2. Good Luck on a Fed Rate Cut

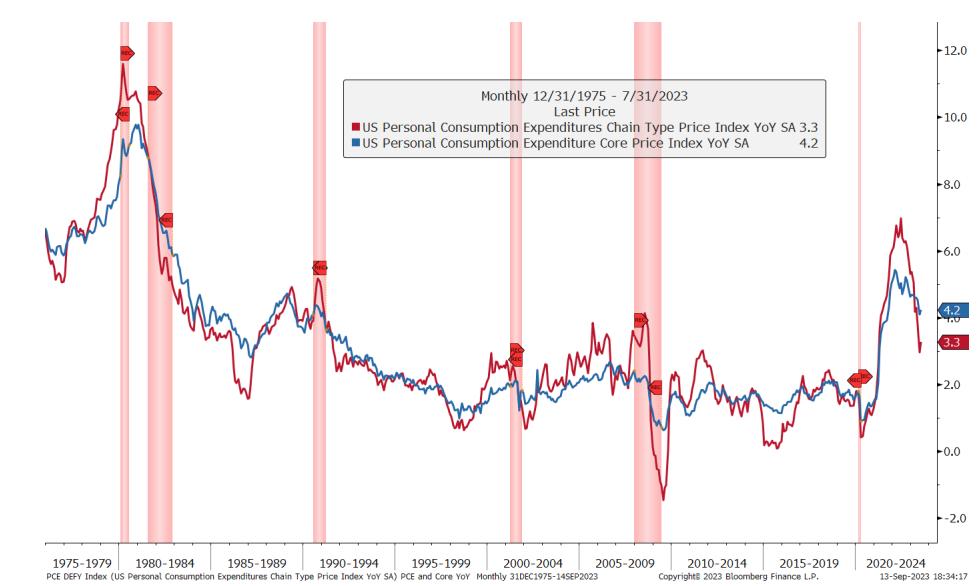

One of the biggest debates right now has to do with the Federal Reserve and when it will finally cut rates. Gundlach doesn’t see that happening until the second half of 2024. Part of that comes down to the Fed’s preferred inflation metric: the Personal Consumption Expenditures Price Index (PCE).

You can see from this slide from the webcast, the PCE is still above the Fed’s target goal. Moreover, the number has been increasing. To that end, investors betting on a Fed cut to support bond prices may be sadly mistaken.

Source: DoubleLine

3. Stagflation Is on the Table

Many market pundits are either calling for continued inflation or a soft landing. However, according to Gundlach, stagflation is a real worry. Stagflation is basically an environment where inflation stays high as economic growth slows and unemployment increases. Thanks to levels of rising unemployment amid rising inflation, this scenario is very possible.

4. Housing Is a Bright Spot

Despite surging mortgage rates, housing demand is still robust. Supply/demand seems to be in balance. Those with low mortgages aren’t selling, while those looking for new homes are still buying. Meanwhile, mortgage payments are still not seeing huge defaults.

5. Default Risk Is Growing

Finally, Gundlach predicts that risky borrowers will have a hard time going forward with the Fed’s rate policies. A lot of debt has been underwritten as floating rate, and with the Fed raising rates, this debt is now very costly to manage. Meanwhile, those who need to roll over debt will be faced with constrained lending and high costs.

Following Gundlach’s Advice

Given Gundlach’s general ability to make more right calls than wrong, investors may want to follow his advice with their portfolios. Positioning themselves for his five calls seems prudent. The easy solution is to bet directly on his DoubleLine Total Return Bond Fund or the SPDR DoubleLine Total Return Tactical ETF. Both funds follow his calls within the bond sector and can be used to directly bet on the guru’s market prowess.

As for being more specific with his calls, there are possible ways to do just that.

Gundlach has long been a fan of mortgage-backed securities as a way to get needed yield without taking on much extra risk. If he’s correct on housing, then the DoubleLine Mortgage ETF should continue to do well. As will the iShares MBS ETF, which is an indexed MBS fund.

With the Fed expected to keep rates high and inflation still running strong, inflation-protected bonds could be a great play. TIPS offer a great play on the continued advancement of inflation and a potentially stagflation environment. The Vanguard Short-Term Inflation-Protected Securities Index Fund makes for a quick and low-cost solution to play Gundlach’s predictions.

Avoiding floating rate debt funds, junk bonds and other high-yielding securities could be the best way to avoid the rising default rates. Investors looking for high yields may want to instead focus on preferred stocks. A fund like the Invesco Preferred ETF offers a chance to own these assets, which feature high yields and higher placement in the bankruptcy ladder.

Finally, with recession risk rising and equity risk growing, it may be time to take some gains off the table with regards to equities. Especially, if you have outsized gains in the key FANG or tech stocks.

Fixed Income ETFs & Mutual Funds

These funds were selected based on their low-cost exposure to Gundlach’s various market predictions and YTD total return, which range from -4% to 2.5%. They have expenses between 0.04% and 0.74% and assets of $100M to $52B. They are currently yielding between 3.5% and 8%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? | |

|---|---|---|---|---|---|---|---|---|

| VTIP | Vanguard Short-Term Inflation-Protected Securities Index Fund | $52.4B | 2.6% | 3.9% | 0.04% | ETF | No | |

| TOTL | SPDR DoubleLine Total Return Tactical ETF | $3.1B | -2.34% | 5.27% | 0.56% | ETF | Yes | |

| DLTNX | DoubleLine Total Return Bond Fund N | $31.9B | -3.09% | 4.12% | 0.74% | MF | Yes | |

| PGX | Invesco Preferred ETF | $4.42B | -3.63% | 7.99% | 0.5% | ETF | No | |

| MBB | iShares MBS ETF | $25.89B | -4.04% | 3.5% | 0.04% | ETF | No | |

| DMBS | DoubleLine Mortgage ETF | $106.25M | N/A | 3.97% | 0.49% | ETF | Yes |

All in all, Gundlach’s predictions paint a mixed picture for investors. One that shows increasing risk across the board. While there are some bright spots like housing, the outcome is still dicey. For investors, it means preparing for the worst.

The Bottom Line

Jeffery Gundlach has quickly cemented himself as a top guru in the fixed income world. That’s why his latest five predictions are worth following. Gundlach presents a nuanced outlook for investors, highlighting concerns from stagflation to increased risk of defaults. It is crucial for investors to strategically position themselves to navigate through the potential economic downturn effectively.

1 DoubleLine (September 2023).