The Chicago PMI raced past projections and surged to a fresh record in May and the ISM Manufacturing PMI continues to show rapid expansion in factory activity—though neither is without accompanying pricing pressures and climbing output costs.

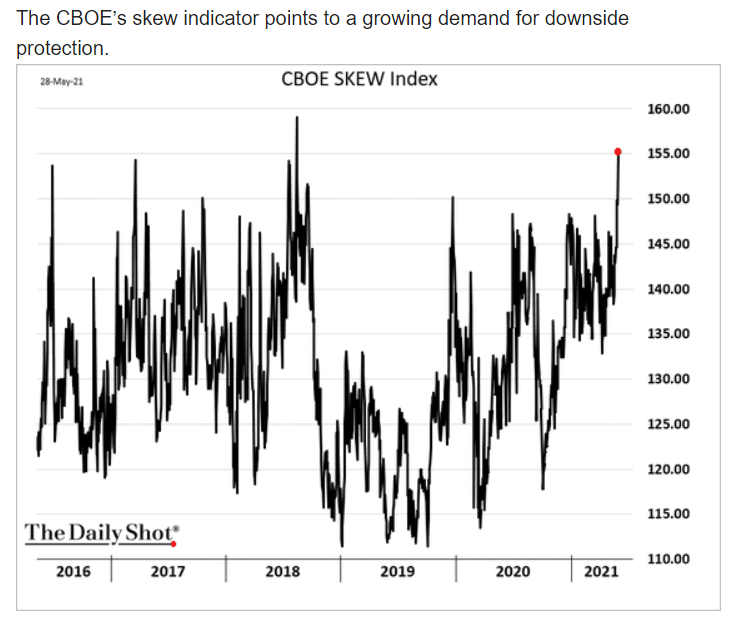

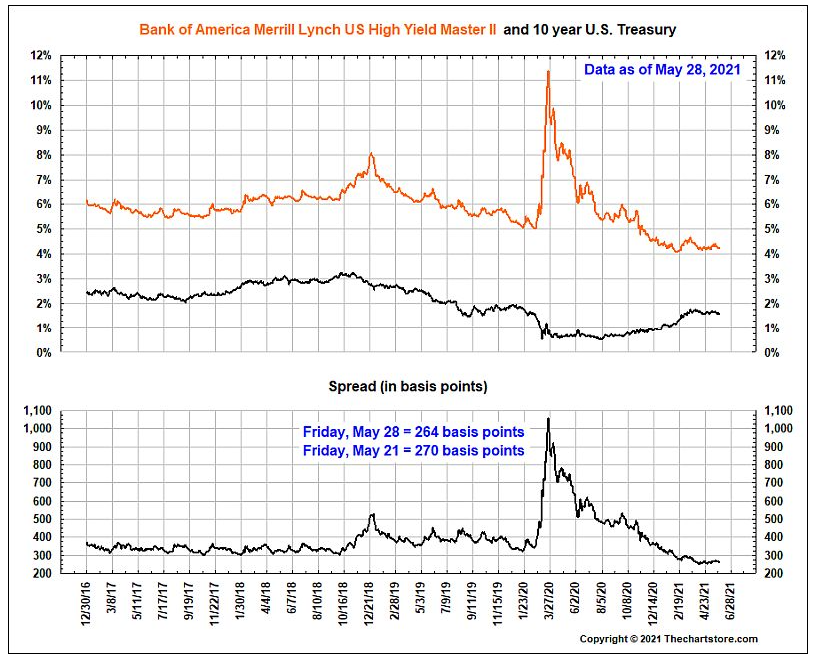

Consumer spending has returned to its pre-pandemic trend, but has purchasing power shifted? And what are the markets forecasting when it comes to inflation? And though the markets saw a relatively sleepy start to June, the CBOE Skew Index—a measure of the perceived probability of outlier equity returns—shows investors growing more nervous about tail risk. Is this yet another tie to inflation anxiety as U.S. bond spreads shrink to their tightest since 2007?

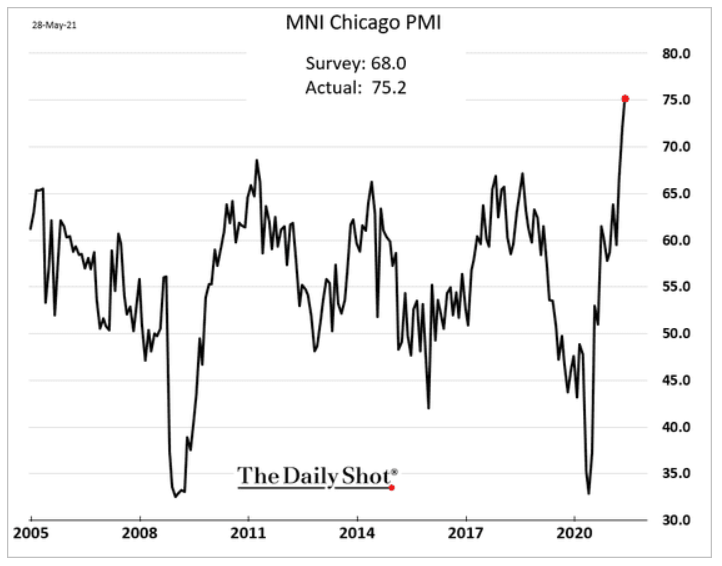

1. The Chicago Regional Fed survey hit a record high:

Source: The Daily Shot, from 6/1/21

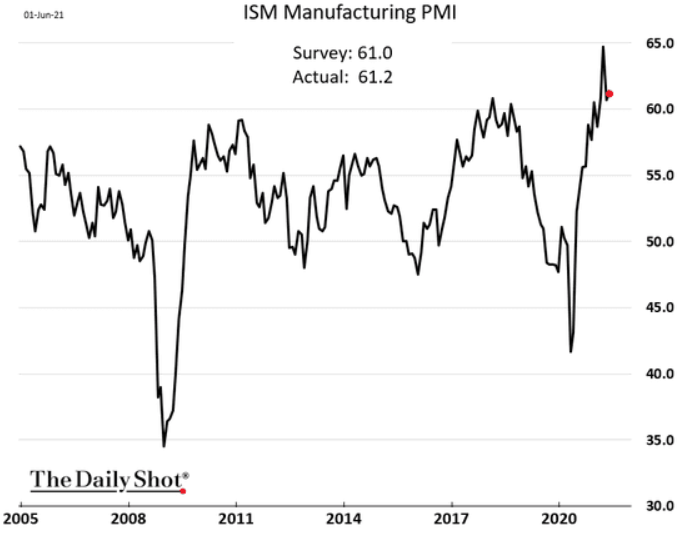

2. U.S. manufacturing, while off its peak, is still in solid growth mode (>50):

Source: The Daily Shot, from 6/2/21

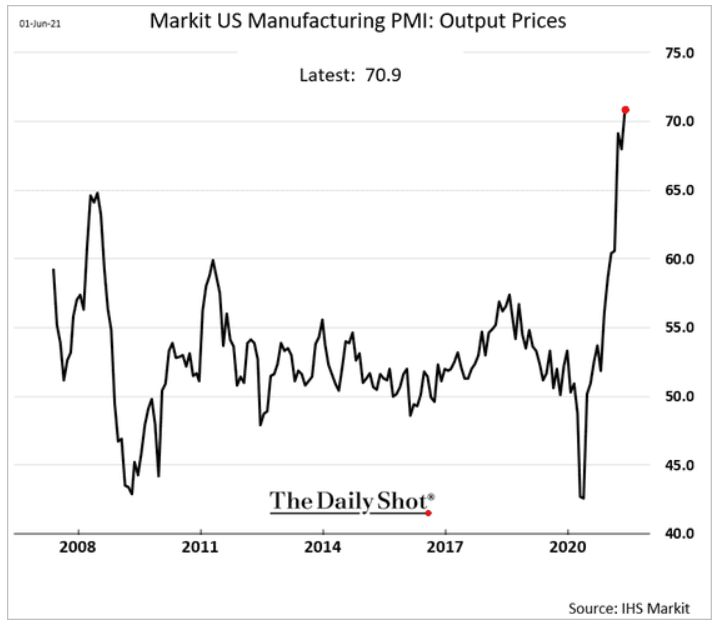

3. Regardless of what the headlines report, price increases are being passed through by manufacturers:

Source: The Daily Shot, from 6/2/21

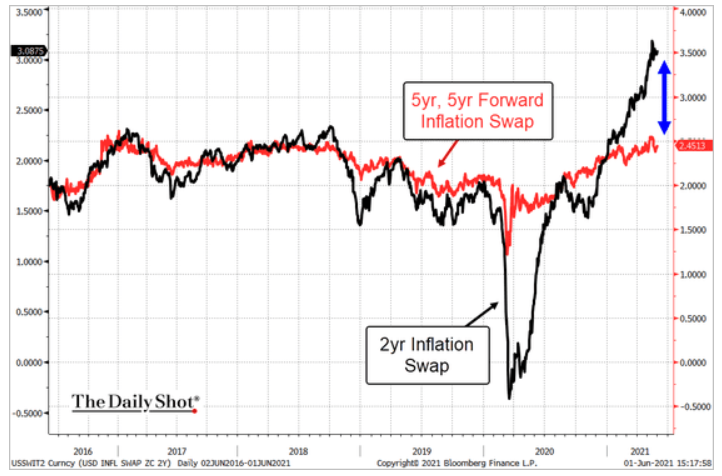

4. Yet even the inflation hawks see inflation as more transitory, with the two-year expectation much higher than the five-year expectation:

Source: Bloomberg Finance, from 6/2/21

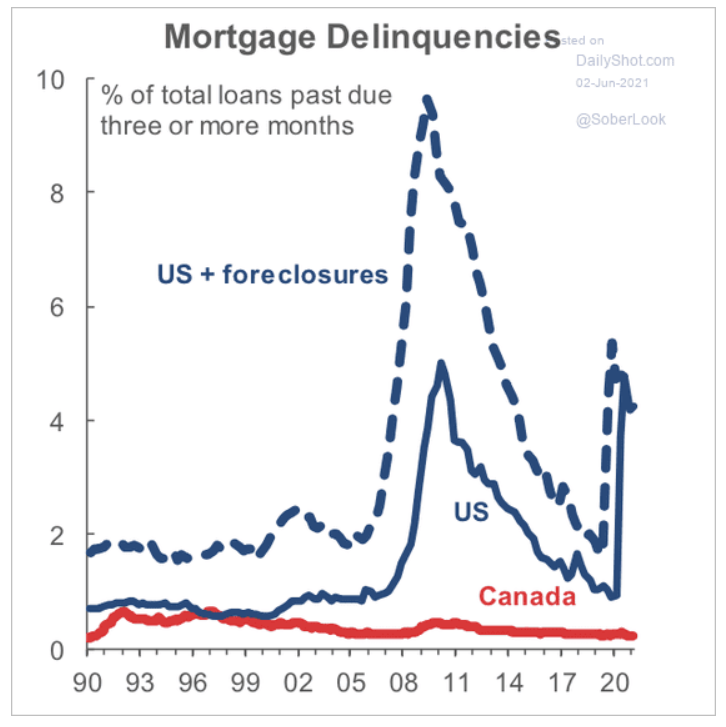

5. A tale of two cities? ~4 million households are behind on their mortgage:

Source: Scotiabank Economics, from 6/2/21

6. Natural skepticism or another indicator?

Source: The Daily Shot, from 6/1/21

7. One can argue that the spreads are razor thin and priced to perfection:

Source: The Chart Store, from 6/1/21

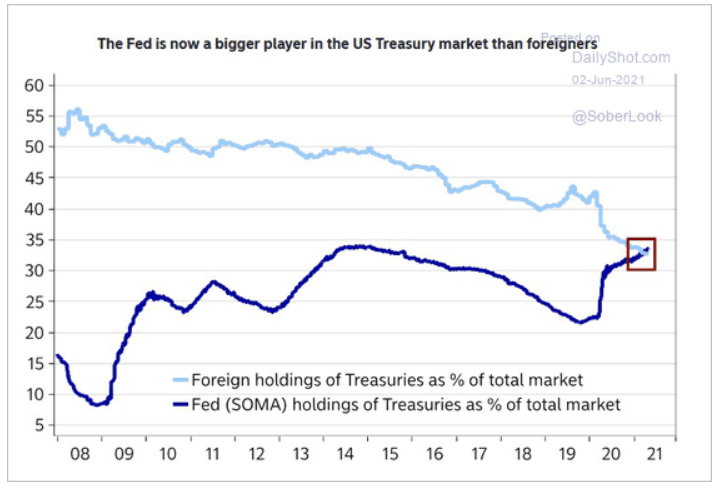

8. Printing money and bonds is not free. Someone has to buy the bonds. What happens when the Fed, the buyer of last resort, stops buying (let alone tapers)? Another reality Washington needs to grapple with:

Source: Macrobond and Nordea, from 6/2/21

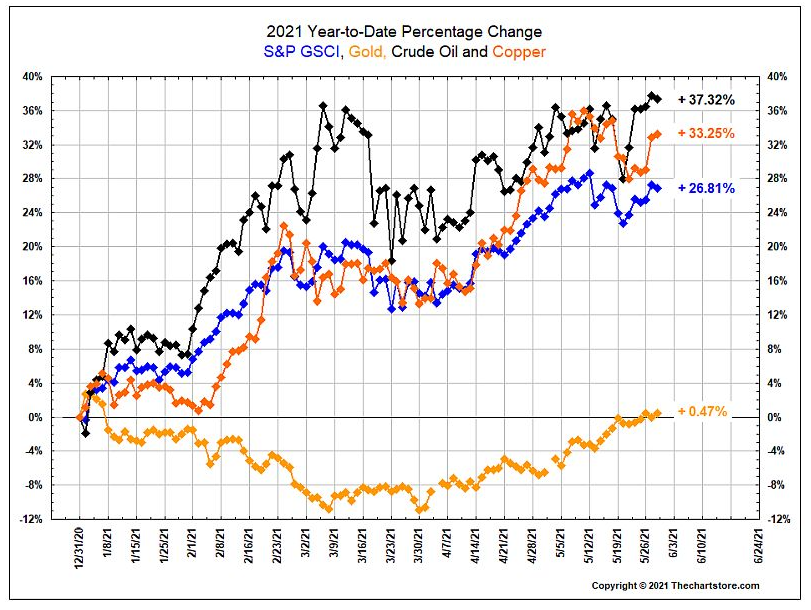

9. Gold, while positive for the year, is lagging most other commodities:

Source: The Chart Store, from 6/1/21

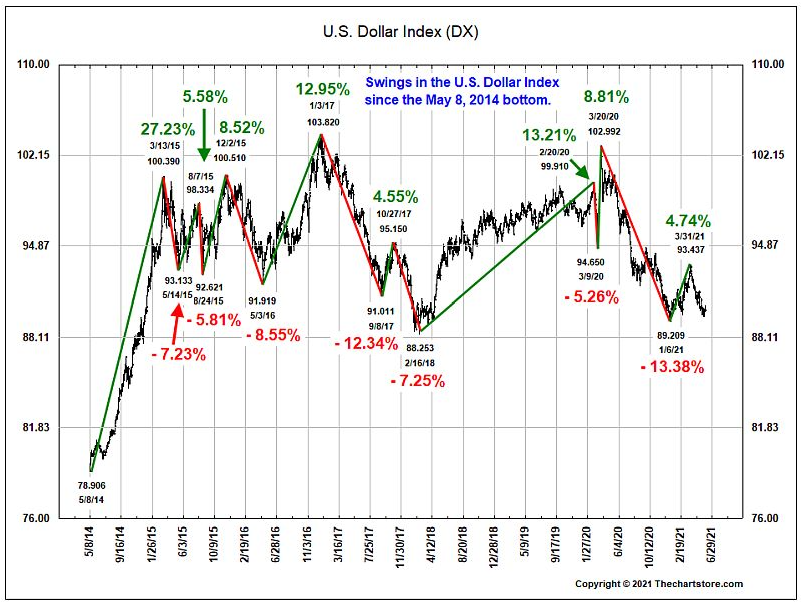

10. The USD is nearing an inflection point. Double bottom or more downside?

Source: The Chart Store, from 6/1/21

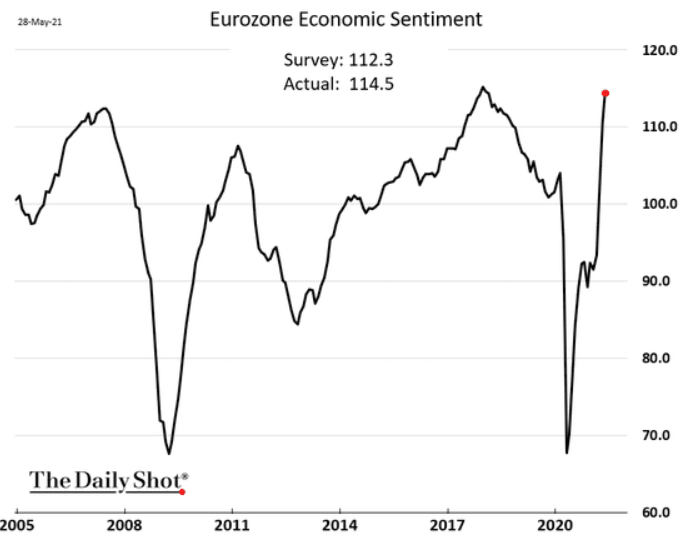

11. It took a while, but Europeans are back in the world is rosy column:

Source: The Daily Shot, from 6/1/21

12. Europe appears to be about a month behind the U.S., but the manufacturing surge is similar:

Source: IHS Markit, from 6/2/21

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

This article was contributed by the Beaumont Capital Management (BCM) Investment Team. For more insights like these, visit BCM’s blog here.

David M. Haviland a Managing Partner of the firm and Lead Portfolio Manager of Beaumont Capital Management (BCM). Check out his full bio here.