While digital assets like Bitcoin – as well as other alternatives, such as private equity and hedge fund strategies – have started to dominate institutional portfolios, the OG standard diversifier is still glittering. Gold has continued to provide plenty of benefits concerning risk management in portfolios.

And now could be the best time to buy it.

A combination of factors – such as stubbornly high inflation, increased central bank buying, and overall risks to the system – has only strengthened gold’s appeal. The best part is investors now have a variety of low-cost ways to add the precious metal to their portfolios.

Strategic Asset Class

Diversification and finding non-correlated asset classes remain top priorities for many institutional and retail investors. Stock and bond correlations have continued to rise, becoming ever so closer. Likewise, owning international assets – and even real estate – hasn’t provided the same “bang for the buck” that it once did when it comes to diversifying a portfolio.

As such, many investors have started to look toward digital assets or other hedge fund strategies to get their diversification fix. Bitcoin has become a portfolio staple for the retail set, while long/short portfolios, merger arbitrage, and other private equity strategies are must-haves for endowments and pension funds.

However, investors may not want to forget about gold in their search. As we focus on what’s shiny and new, the classics often get ignored. That’s a real shame because gold can provide plenty of benefits to a portfolio.

For starters, it truly is an effective diversifier. According to asset manager State Street, gold’s multiple sources of demand and its cyclical nature have allowed it to provide low correlations to other asset classes. This fact along with its safe-haven status has helped it provide diversification benefits. Looking at data stretching back to the 1970s, gold has provided a 0.01 and 0.09 monthly correlation to the S&P 500 Index and Bloomberg US Aggregate Bond Index, respectively.

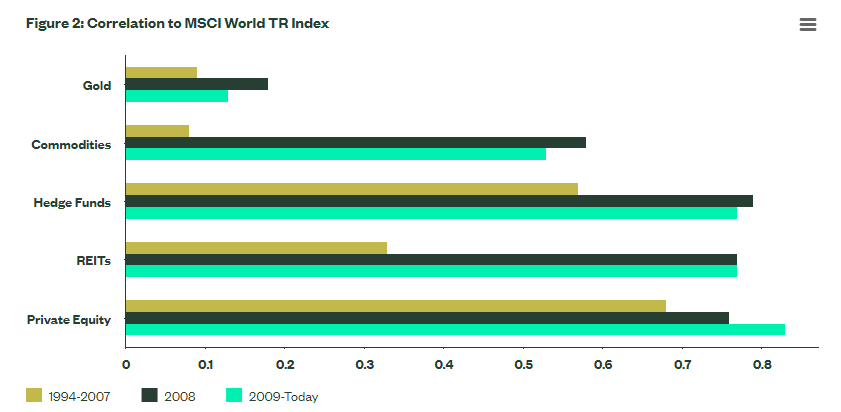

When compared to other alternatives, gold shines bright as well. This chart comparing gold and other alternatives versus the MSCI World Index, which includes all publicly traded stocks, and developed and emerging markets, underscores how gold is even better than private equity, real estate, and hedge fund strategies at providing diversification.

Source: State Street

Aside from its diversity, gold is a great risk management tool. Gold also continues to keep its ‘store of value’ and ‘safe-haven’ moniker. In its survey of institutional investors, State Street mentions that 80% of investors believe that gold will always have monetary value in our society. Moreover, gold has a negative correlation to the U.S. dollar, which hedges against currency debasement.

Finally, gold has long been a successful inflation protection tool. During periods of high inflation as well as sustained long-term moderate inflation, gold has been a top performer. This has allowed investors to maintain purchasing power.

Plenty of Tailwind

So, gold is truly a wonderful strategic asset class for investors – and it could be a wonderful time to buy it.

As we said, gold’s non-correlated nature comes from a variety of demand factors, including central bank buying. And central banks have once again resumed purchasing gold in a big way. Thanks to worries about the U.S. and its rising debts, gold purchases by foreign central banks have started to grow. According to the World Gold Council, central banks purchased more than 1,000 metric tons of gold last year – worth about $63 billion. This was the second-consecutive year of purchases above that mark. The buyers have been diverse as well. Standard buyers, like China and India, have upped their purchases, while nations like Poland, Singapore, the Czech Republic, and Iraq have emerged as big buyers of gold.

At the same time, purchases of jewelry and industrial uses have continued to grow as well. Gold is found in many semiconductors, renewable energy products, and other high-tech gear. With the world starting to become ever more tech-oriented, gold has a new base of demand.

Despite all of this, gold could be trading at a real discount to its potential. This is because as institutional investors have looked toward those shiny, new sources of diversification, buying on this front has dipped, setting up a real potential snap-back as they return to gold.

Adding Gold Exposure

Given the benefits of gold to a portfolio, investors may not want to abandon it for other new diversifiers. This is particularly true since adding gold has never been easier. The exchange-traded fund (ETF) has made adding gold to a portfolio a low-cost affair.

The traditional way to buy gold is, well, to buy gold – as in physical bars and coins. For investors looking for disaster insurance, this is the tried-and-true way to add glitter to a portfolio. However, investors need to keep in mind that owning physical gold can come with extra costs such as storage and insurance fees.

ETFs take those costs and reduce them significantly. By spreading those fees among thousands of investors, some gold ETFs can charge pennies for their exposure. An added benefit remains the liquidity of these ETFs. For many of the top gold funds, millions of shares are traded each day. This provides an instant source of liquidity versus having to sell bullion to other investors or pay fees to dealers.

Gold ETFs

These ETFs were selected based on their ability to provide access to physical gold at a low cost. Their YTD total return is 5.5%, while their dividend yield is 0%. They have assets under management of $524M to $52.5B and expenses of 0.09% to 0.40%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| GLD | SPDR® GOLD TRUST | $52.5B | 5.5% | 0% | 0.40% | ETF | No |

| IAU | iShares Gold Trust | $24.8B | 5.5% | 0% | 0.25% | ETF | No |

| GLDM | SPDR Gold MiniShares | $5.76B | 5.5% | 0% | 0.10% | ETF | No |

| SGOL | abrdn Gold ETF Trust | $2.58B | 5.5% | 0% | 0.17% | ETF | No |

| BAR | GraniteShares Gold Trust | $884M | 5.5% | 0% | 0.17% | ETF | No |

| IAUM | iShares Gold Trust Micro | $865M | 5.5% | 0% | 0.09% | ETF | No |

| OUNZ | VanEck Merk Gold Trust | $686M | 5.5% | 0% | 0.25% | ETF | No |

| AAAU | Goldman Sachs Physical Gold ETF | $524M | 5.5% | 0% | 0.18% | ETF | No |

The best part is that these physically-backed ETFs have done a good job of providing all the benefits of owning gold.

All in all, gold remains a top asset class for diversifying a portfolio. With a variety of benefits and non-correlated features, gold truly shines versus many of its alternatives. With its low cost of ownership, gold should be a part of everyone’s portfolio.

The Bottom Line

Digital assets and other hedge fund strategies have quickly become the top draw for investors looking to diversify their portfolios. However, they shouldn’t be so quick to count out gold. The precious metal often has better diversification and additional benefits for portfolios. And with low-cost ETFs, adding gold can be a cheap, one-ticker decision.

1 State Street (January 2024). Invest in Gold: A Portfolio Diversifier With Staying Power