Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Royalty Pharma, a dividend-paying developer and buyer of pharmaceutical royalties, has taken the first spot in the list after the company announced mixed earnings. Independent Bank Corporation reported falling net income, but maintained its dividend intact. Winmark, a franchiser of used goods resale businesses, has increased its dividend. Northern Trust, a provider of financial services, closes the list.

Don’t forget to read our previous edition of trends here.

Royalty Pharma

Royalty Pharma (RPRX) has taken the first position in the list this past fortnight, seeing its viewership advance 800%. The company’s 2021 revenues have risen nearly 8%, but its net income declined 36% to $620 million. The company has invested around $3 billion in new transactions in 2021.

Royalty Pharma, which receives royalties from drugs like Biogen’s Tysabri, AbbVie’s Imbruvica, and Novartis’ Promacta, among others, pays an annual dividend of $0.76 per share, resulting in a yield of 1.8%. The company’s stock is down 1.4% this year. Last time the company increased its quarterly dividend was in the first quarter of 2021, from $0.15 to $0.17.

The company’s top drug, a cystic fibrosis franchise from Vertex, contributed $196 million in the last quarter of 2021, up from $159 million during the same period last year. Meanwhile, Gilead’s HIV franchise saw revenues collapse 99% to just around $1 million.

The company’s stock might be a bargain, given that it trades at a sales multiple of 11 versus peers’ 14, according to Morgan Stanley, which noted that Royalty Pharma also has higher growth rates.

Check out our Best Dividend Stocks Model Portfolio.

Independent Bank Corporation

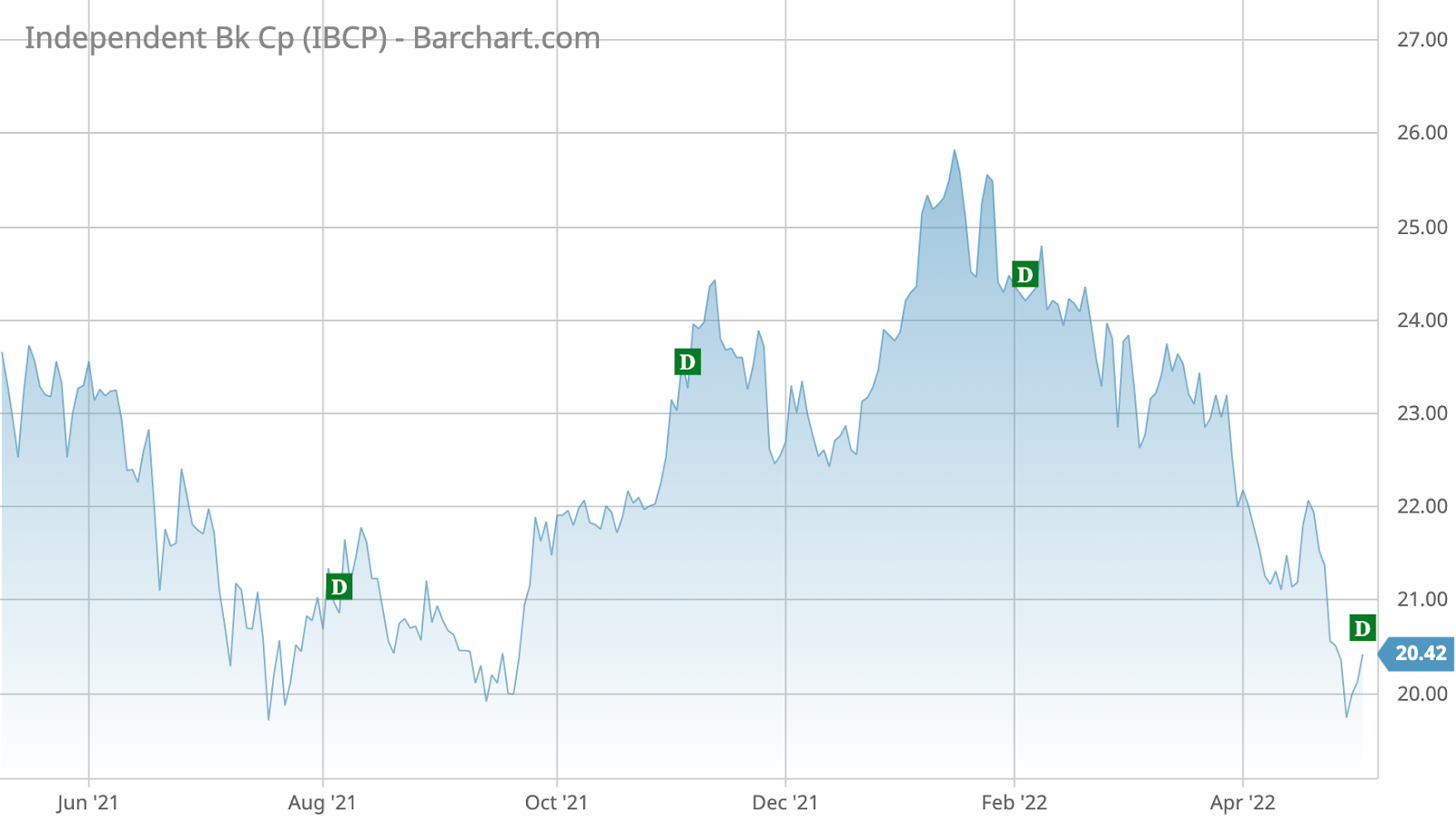

Independent Bank Corporation (IBCP) has taken the second spot in the list this week, seeing its viewership rise 750%. The company’s stock has lost around 22% over the past 12 months, as the company’s revenues and earnings have declined in each of the past three quarters.

In the first quarter of 2021, revenues were down 6.4% to $53.5 million, while net income was down 18.5% to nearly $18 million. The bank, which has 62 branches in rural and suburban Michigan, said the decline was due to a fall in non-interest income and an increase in non-interest expense.

Independent Bank hiked its dividend in the first quarter of 2022 from a quarterly $0.48 per share to $0.51. The company has raised its dividend in each of the past eight years. The bank’s dividend yields 4.4%, which is higher than the financials average of 3.2%. Independent Bank trades relatively cheaply at a price-to-earnings ratio of 7.4.

Winmark Corp

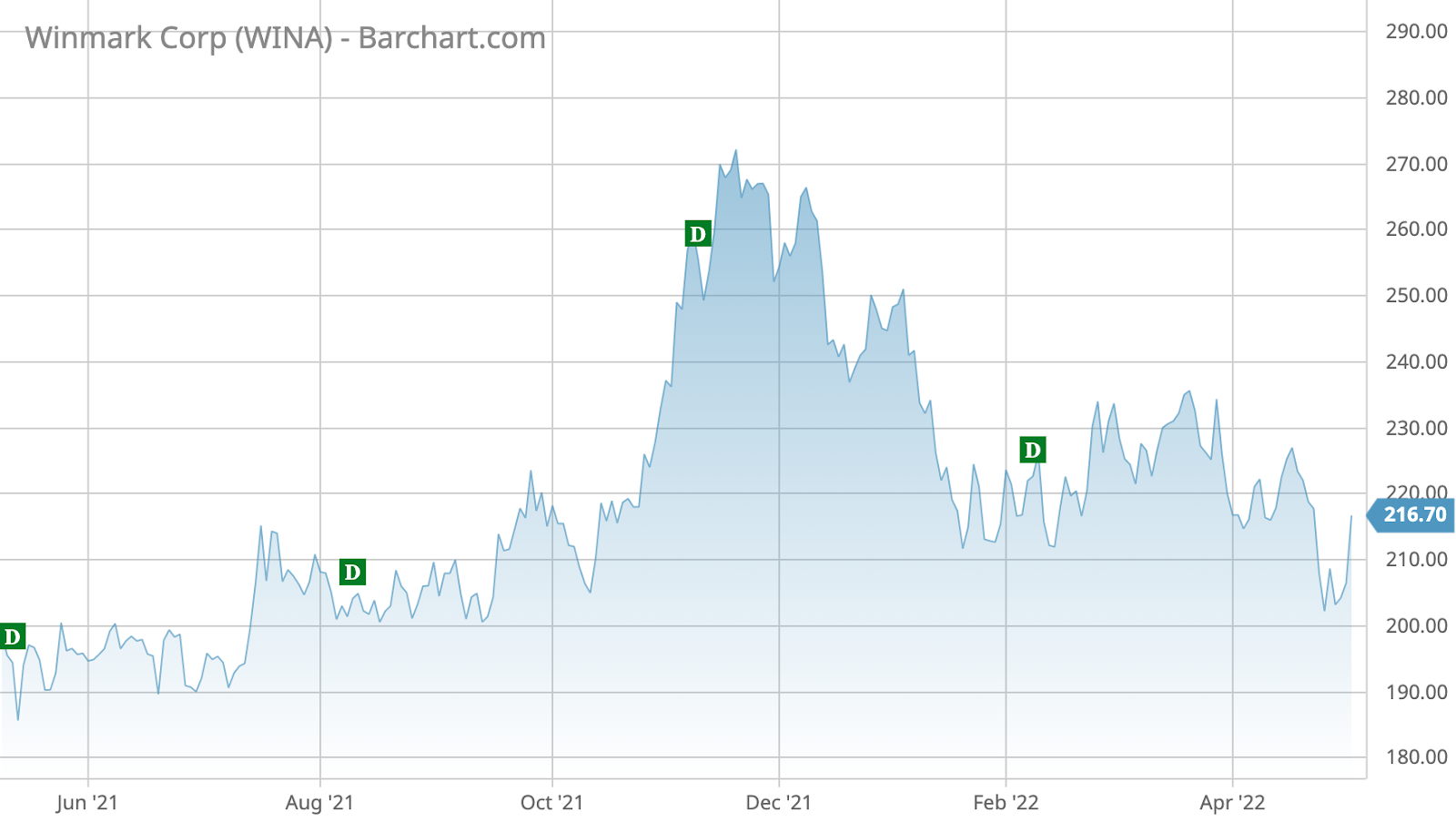

Winmark Corp (WINA) is third in the list, with a surge in viewership of 700%. Winmark trended after the company owning resale franchise brands raised its quarterly dividend by 25 cents per share to 70 cents. The dividend will be paid on June 11 to shareholders of record as of May 11.

In the quarter ended March 26, revenues from royalties increased from $14 million to $15.4 million, while net income was up more than $500,000 to $9.8 million. However, the company’s stock sold off along with the entire market in recent months. Shares have declined 23% since reaching an all-time peak in November 2021.

Winmark’s dividend of $2.80 per share currently yields 1.36%.

Northern Trust

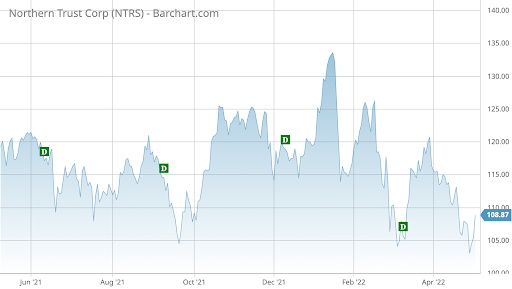

Northern Trust (NTRS) took the third position this fortnight, along with Winmark, seeing a rise in viewership of 700%. Northern Trust, which provides asset management services to ultra-high-net-worth individuals, corporations, and institutional investors, has seen its shares move sideways, despite improving financial results.

Revenues have increased 9.5% in 2021 to nearly $6.6 billion, while net income advanced 28% to $1.6 billion. The improving results combined with flat stock performance has led to a falling of the company’s valuation from an earnings multiple of 18.9 at the end of 2021 to 14.6 now.

Northern Trust pays an annual dividend of $2.8 per share, resulting in a yield of 2.7%. Last time the company increased its dividend was in the third quarter of 2019, from 60 cents quarterly to 70 cents.

The Bottom Line

Royalty Pharma trades cheaper than its peers and might be a bargain. Independent Bank hiked its dividend despite deteriorating financial results. Winmark raised its dividend significantly as royalties have jumped. Northern Trust’s valuation has suffered recently, despite solid results in 2021.

Be sure to check out Dividend.com’s News section for some great dividend investing news.