Emerging markets have moved sharply lower since the beginning of the year.

For instance, the iShares MSCI Emerging Markets Index (EEM), which tracks more than 800 emerging markets stocks across more than 14 countries, fell more than 20 percent between January and September.

Naturally, it raises a question about their impact on investment portfolios. Let’s take a closer look at the trends driving the emerging markets and what they mean for dividend investors.

Be sure to click here to know why global dividends are rising.

What's Happening in Emerging Markets

Rising U.S. interest rates, escalating political risk and U.S. trade policy have become significant threats to emerging markets around the world over the past year.

The dollar’s rise has weakened emerging markets currencies. Turkey’s lira has fallen more than 40 percent; Argentina’s peso more than halved; India’s rupee reached record lows; and, South Africa’s rand, Russia’s rouble, and Brazil’s real each lost between 15 and 20 percent this year. The dollar strength has also raised credit risk since dollar-denominated debts have become more expensive to service in local currencies.

Click here to see why it might make sense to stick around emerging markets.

In response to these dynamics, many emerging markets have opted to hike interest rates. These higher interest rates restricted lending and slowed economic growth rates. South Africa unexpectedly entered a recession during the second quarter, Argentina is expected to follow in the near term and Turkey could experience a hard landing this year. This slowdown has escalated political risks in several countries.

Trade policies in the United States have only exacerbated these issues. New sanctions on Turkey have escalated its currency crisis in recent weeks, while President Trump’s $200 billion in tariffs on Chinese imports has taken a toll on Chinese equities caught in the crossfire. The tariffs could also take a toll on commodity prices if they translate to a real slowdown in trade and infrastructure investments.

China’s economic growth is expected to slow over the coming years – especially with the recent trade war escalation. With China accounting for more than 80 percent of the global increase in metals consumption and nearly 50 percent of the rise in global energy consumption over the past two decades, a slowdown in China could translate to a downturn in both hard and energy assets worldwide.

For example, China’s slowdown and Sino-U.S. trade war concerns have caused crude oil prices to fall from their peak made in July to around $70 per barrel.

Not All Dividend Stocks Are Equal

Dividend stocks are often seen as bond proxies since investors use them for the same purpose: income.

Check out our Dividend Assistant to keep track of projected dividend income of your portfolio.

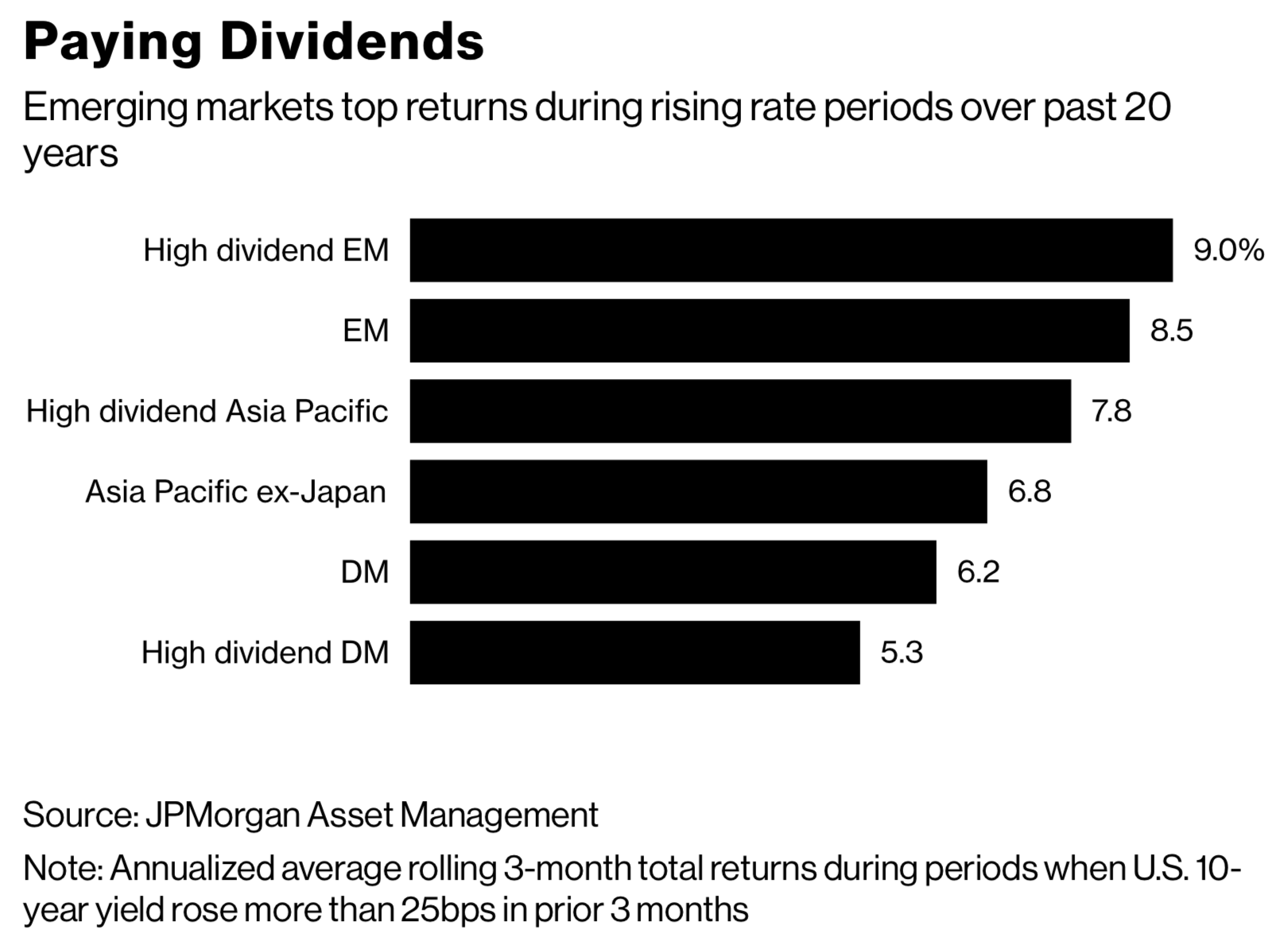

Rising interest rates naturally lead investors to seek higher yields, which puts downward pressure on bond (and dividend stock) prices. According to JPMorgan, domestic high-dividend stocks tended to underperform the broader market during rising rate periods over the past 20 years. This isn’t surprising given how and why investors purchase dividend stocks.

But that’s only true for domestic high-dividend stocks.

As seen from the above graph, JPMorgan found that emerging markets high-dividend stocks outperformed other asset classes during rising rate periods over the past 20 years. Rising interest rates led to a stronger dollar, which weakened emerging markets currencies. Weaker currencies tend to lead to greater demand for high-yield investments. The demand increases the price and lowers the yield in these securities, including dividend stocks. Moreover, these dividend stocks are also relatively a form of safer equity investments compared to riskier growth equities.

Use our Dividend Screener to find high-quality dividend stocks with tools like DARS ratings.

Since the beginning of the year, the WisdomTree Emerging Markets Equity Income Fund (DEM) outperformed the iShares MSCI Emerging Market Index (EEM) by more than seven percent, as of September 18, 2018.

The Impact on U.S. Dividend Stocks

Many U.S. companies have an international presence. According to Dow Jones Indices, about 30 percent of S&P 500 revenue came from foreign sources in 2017. Approximately 10 percent of that revenue came from Asia-Pacific sources and about 2.5 percent came from Africa and the Middle East. That’s not an insignificant figure.

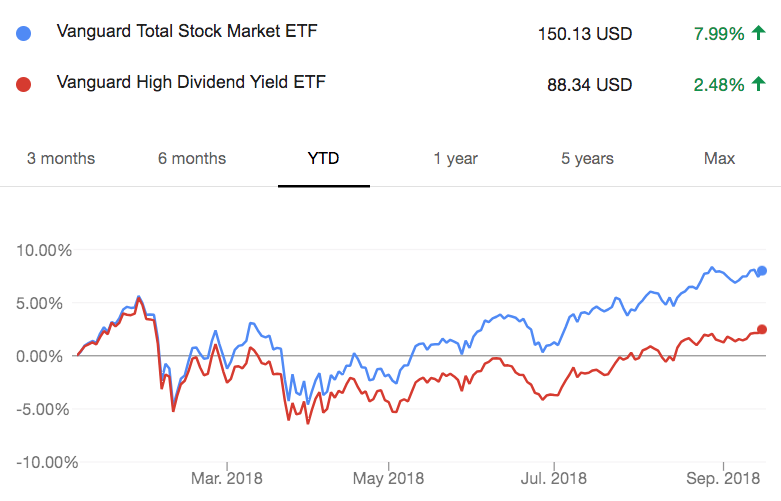

Not surprisingly, U.S. dividend equities have underperformed broader equity indices. The Vanguard Total Stock Market ETF (VTI) rose 7.99 percent compared to just 2.48 percent for the Vanguard High Dividend Yield ETF (VYM) since the beginning of this year. This is likely due to higher U.S. interest rates that have made dividend stocks less appealing.

The interesting thing to note is that high-yield U.S. equities are outperforming high-yield emerging markets equities in a rising interest rate environment, which deviates from the historical norms reported by JPMorgan. But this is likely due to the high level of fear, uncertainty and doubt in emerging markets right now. And these conditions are expected to persist until there’s more clarity for investors.

Investors should watch emerging markets for signs of stabilization and then consider taking positions in emerging markets high-yield equities. When the political risks are removed, these equities could experience an upswing driven by low currency valuations relative to the dollar.

The Bottom Line

Rising U.S. interest rates, escalating political risk and U.S. trade policies have caused a crisis in emerging markets. Dividend-paying emerging markets equities have outperformed broader emerging markets equities, but they have underperformed their U.S. counterparts – in a deviation from the historical norm.

The high level of political risk in emerging markets, combined with central banks that are hiking interest rates, have put pressure on these dividend-paying emerging markets stocks despite weakening local currencies. These trends are likely to persist until there’s more clarity in emerging markets.

That said, a bias toward domestic stocks could hurt your portfolio returns over the long run. For more information, check out this article.