Duke Energy Corporation (DUK ) is an electrical utility company that provides electricity to 7.6 million retail customers predominantly in North Carolina, South Carolina, Florida, Ohio, Kentucky and Indiana. The company also provides natural gas to 1.6 million customers in five states and operates a growing renewable energy portfolio across the U.S.

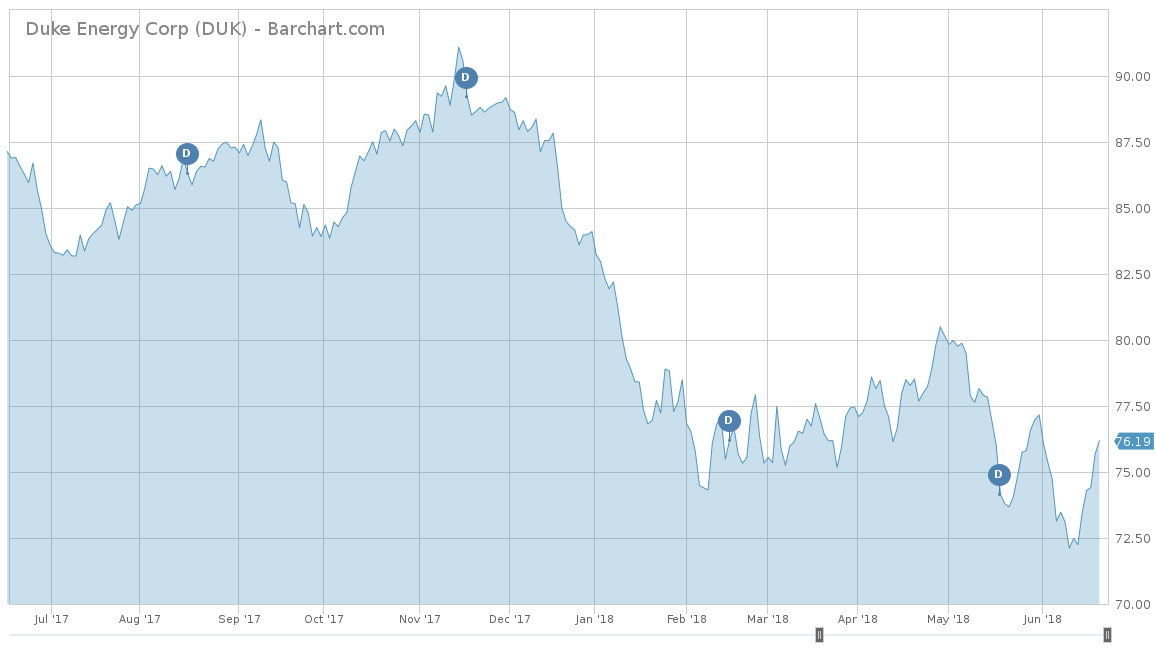

For 2018, Duke Energy has had a rough first half of the year and is down 9.42%. For the trailing one-year, Duke is down 12.33%, but for the trailing five-year, it is up 17.04%. The S&P 500 Index has outperformed Duke Energy in all three time frames, with returns of 3.50%, 13.55% and 74.24%, respectively. A more accurate comparison is with Southern Company (SO ), which is a similar-sized electrical utility company. On a year-to-date basis, SO is down 6.32%, which still outperforms Duke. However, for the trailing one-year and five-years, Southern underperforms Duke with returns of negative 12.88% and positive 6.05%.

Click here to see how utilities like DUK are transitioning away from coal-based generation capacity.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Duke has seen steady revenue growth of 5.6%, with 2017 coming off a modest 3.6% growth to over $23.56 billion. In the first quarter of 2018, Duke reported earnings of $6.13 billion, beating expectations of $5.73 billion. Analysts see Duke pulling in a total of $24.09 billion for the year, making it an increase of 2.22%. For 2019, analysts only see a small bump in revenues equaling $24.62 billion, an increase of 2.17%.

From an earnings-per-share perspective, Duke Energy has had a much better, though turbulent, five-year growth average of 9.6%. It seems that its earnings have been fairly inconsistent in the last five years, with earnings growth of 22.5% in 2013, down 29.3% in 2014, up 52.3% in 2015, down 23.2% in 2016 and finally up 40.2% in 2017. Most of the down years were caused by either higher operational and maintenance expenses or due to weather-related conditions, such as a more mild winter that caused seasonal electrical bills to be lower than normal. For the first quarter of 2018, Duke Energy beat expectations with earnings of $1.28 per share versus the $1.15 estimates. With a good start for the year thanks to constructive outcomes in several regulatory cases, analysts expect Duke to close out 2018 with an earnings-per-share measure of $4.56 per share, equal to a 4.48% increase. Analysts are calling for a 5.48% increase in 2019, equal to $4.81 per share in earnings.

Strengths

Duke Energy is one of the largest electric utility companies in the United States that is now predominantly regulated. The new regulatory landscape helps Duke overcome high initial costs thanks to positive regulatory outcomes, which it has most noticeably seen in Florida. For example, in 2015, Duke Energy received environmental regulatory citations for a total amount of over $114 million in fines. It has drastically reduced that figure in 2017 with fines totalling $19,797. These higher fines were mostly caused by the May 2015 coal ash enforcement agreement, which Duke has now resolved. In the other areas of its business, Duke has had serious headways overcoming local regulatory issues to get final approvals for new rates. In Duke Energy Progress North Carolina, new rates became effective on March 16, as a partial settlement was approved without modification that will lead to a 9.9% return on equity. Duke Energy Kentucky had its new rates effective on May 1, also allowing the approval of the Rider Environmental Surcharge Mechanism (ESM). Finally, in both Duke Energy Carolinas and Ohio, new rates are effective June 1 and are paired with other positive outcomes that will directly benefit Duke’s profitability.

As of the first quarter of 2018, the lionshare of Duke’s revenues comes from its Electrical Utilities and Infrastructure division. This division provided Duke with $750 million in income, which was a significant increase of $635 million from the first quarter of 2017. On an earnings basis, this division increased its profitability by $0.26 per share thanks to more normal winter weather, higher retail volumes and lower operational and maintenance expenses. Another savings incurred in the quarter was due to the new lower income tax expense, which accounted for $0.06 per share of earnings savings.

Growth Catalyst

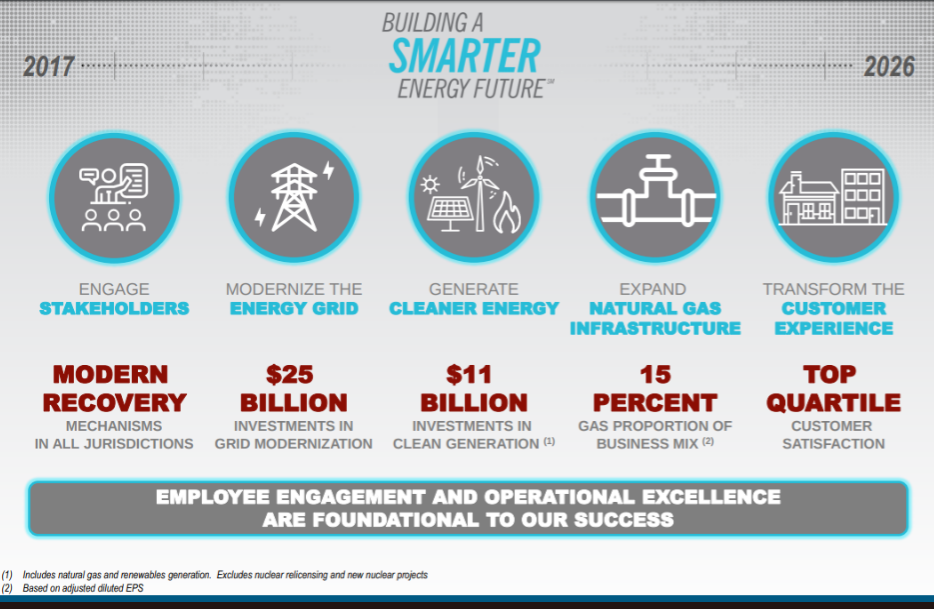

Earlier this year, Duke Energy’s management came out with a very aggressive $37 billion capital expenditure plan. This growth capital plan will pan out from 2018 to 2022 and focus on grid modernization, renewable energy, natural gas investments and environmental remediation. Management expects its earnings base to increase by $3.5 billion by 2021, making the compound annual growth rate equal to 7%. This plan is the first stage of a larger overall plan to build a smarter energy future for the company by 2026. Duke plans to modernize its grid investments over the next ten years by $25 billion. It also plans to invest over $11 billion in clean generation, like natural gas, so that eventually it makes up 15% of the overall business mix. Finally, Duke is also hoping to improve the customer experience with top quartile customer satisfaction.

Dividend Analysis

From a dividend perspective, Duke Energy screens out very well as it has a 4.63% current yield, equal to $3.56 per share on an annual basis. This is considerably higher than the Best Electric Utilities Dividend Stocks List’s average of 2.59%. Another major benefit to shareholders of Duke Energy is that management has made it a focus to increase the company’s dividend, as it has every year for the last eleven years in a row.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 10 consecutive years on our 10-Year Dividend-Increasing Stocks page.

Risks

There are several major risks for any utility company faces and Duke Energy is no different. Weather always seems to be a large component of the Duke’s revenues, as even evidenced between the difference between the first quarters of 2018 and 2017. In 2017, the winter was significantly warmer than normal, which led to lower electric bills. In 2018, the winter weather returned to its normal tendencies and earnings increased as much as $0.16 per share due to this factor alone.

Another risk to Duke Energy is that although the company has had success and built relationships with regulatory bodies in the states that it operates in, that could change. Much of the company’s aggressive growth plans hinge on the success of the company getting regulatory approval. If these relationships turn negative and unfavorable to Duke, that would undoubtedly hurt the company’s long-term prospects.

The Bottom Line

Although Duke Energy’s stock price has lagged the S&P 500 for the last few years, most of this was attributed to the nearly decade-long bull market where growth stocks were the key favorites. With a decent-yielding dividend, favorable regulatory relationships and its aggressive growth plan, Duke Energy looks like a good buying opportunity. Duke would also be a great buy if the stock market continues to remain volatile or even declines into negative territory for the year. Utility stocks are usually the safe haven for fearful investors looking to sell out their profits in exchange for this defensive sector.

Check out our Best Dividend Stocks page by going Premium for free.