Bristol-Meyers Squibb Company (BMY ) is a Fortune 500 company that discovers, develops, licenses, manufactures, markets, and distributes pharmaceutical and nutritional products.

The company works on a global scale, with offices in the United States, Europe and Asia. Its medicines are helping millions of patients around the world in disease areas such as oncology, cardiovascular, immunoscience and fibrosis. Through its research and development organization, BMY has built a sustainable pipeline of potential therapies that can hopefully help millions more that are in need of treatment.

The company has a robust product line of drugs, specifically in the oncology area. BMY’s top selling drug in 2016 was Opdivo with sales of $3.8 billion. Opdivo is a prescription medicine used to treat a type of advanced stage lung cancer (called non-small cell lung cancer) that has spread or grown. The company’s second highest selling drug is Eliquis with $3.3 billion in sales, which helps to reduce the risk of stroke due to nonvalvular Atrial Fibrillation (AFib). The company also has several other major drugs in the marketplace like Orencia, Sprycel and Yervoy.

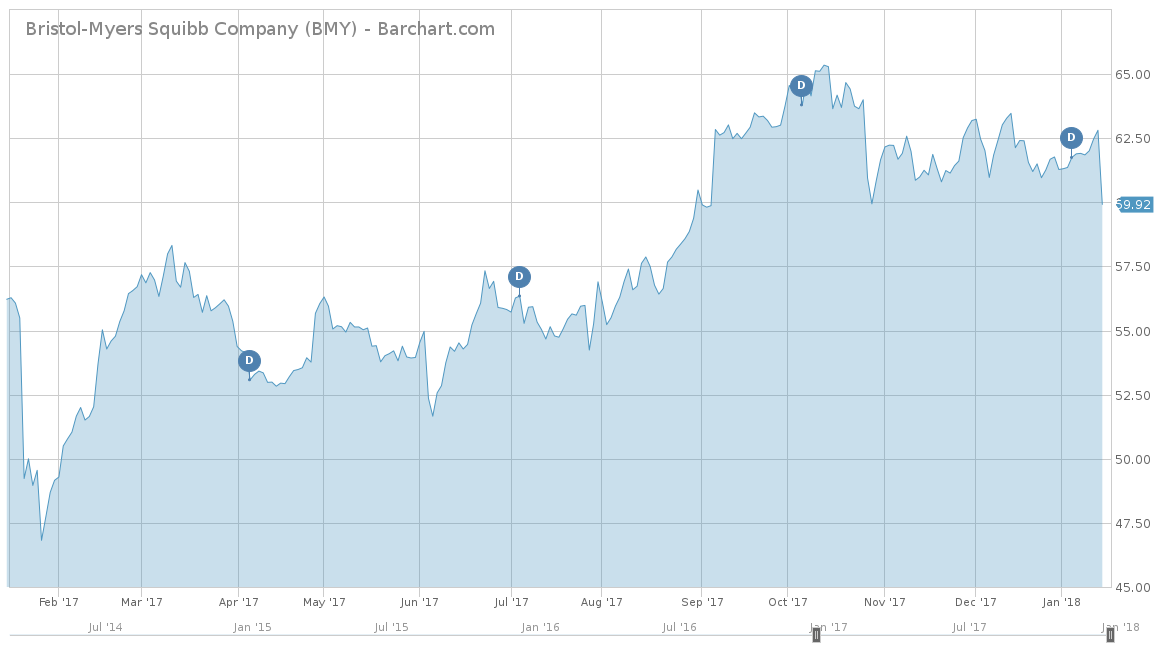

For 2017, Bristol-Meyers Squibb had a very lackluster year with a total return of 7.53%. This underperformed both the S&P 500 Index and the iShares Nasdaq Biotechnology ETF (IBB), which had returns of 19.42% and 21.08%, respectively, for the same time period. The same goes for BMY for the longer term, which has a five-year cumulative return of 76.33%, again underperforming the S&P 500’s 87.48% and IBB’s 130.00%.

Fundamentals

Over the last five years, Bristol-Meyers Squibb has had its struggles in maintaining positive revenue growth. Over the last five years, the company has a negative 1.8% average revenue growth. Revenues fell over three consecutive years from 2012 to 2014. However, since 2015, the company has been righting the ship by divesting some of its less profitable brands. Analysts expect 2017 revenues to come in at an estimated $20.64 billion, which would be a 6.24% increase from 2016. The same goes for 2018’s estimates, with analysts expecting $21.25 billion in revenues, which would be an increase of 2.96%. Although these estimates are not overly ambitious, it should bring the company’s five-year average back into the positive category.

From an earnings-per-share (EPS) perspective, BMY tells a different story. Over the last five years, the company has had an average EPS growth of 4.2%. However, this was mostly bolstered by a large boost in its 2016 earnings, which saw an increase of over 184% year-over-year. This increase was attributed to both a 17.3% increase in revenues as well as a 145.00% increase in operating income, thanks to management’s prudent ability to increase margins. Analysts are optimistic about both 2017 and 2018 earnings estimates, with $3.00/share and $3.22/share estimates, respectively. This would translate to an increase of 13.20% and 7.33% in 2017 and 2018, respectively.

From a price over earnings view, BMY comes in at 23.60. This is slightly lower than the 26.69 of the S&P 500 but higher than the average P/E ratio of IBB, which measures at 20.20.

Strengths

Bristol-Meyers Squibb has been aggressively repositioning itself to deal with its current challenging patent losses, and that it will face going forward. The company has trimmed its portfolio by selling off business lines that are not related to its core pharmaceutical strategy. For example, BMY has sold off its diabetes business, medical imaging, wound-care and nutritional business so that it can continue to focus on its more high-margin products and pipeline drugs. In return for its selloff, BMY has been acquiring companies and brands like Medarex, which helps to secure the company’s cancer immunotherapy line.

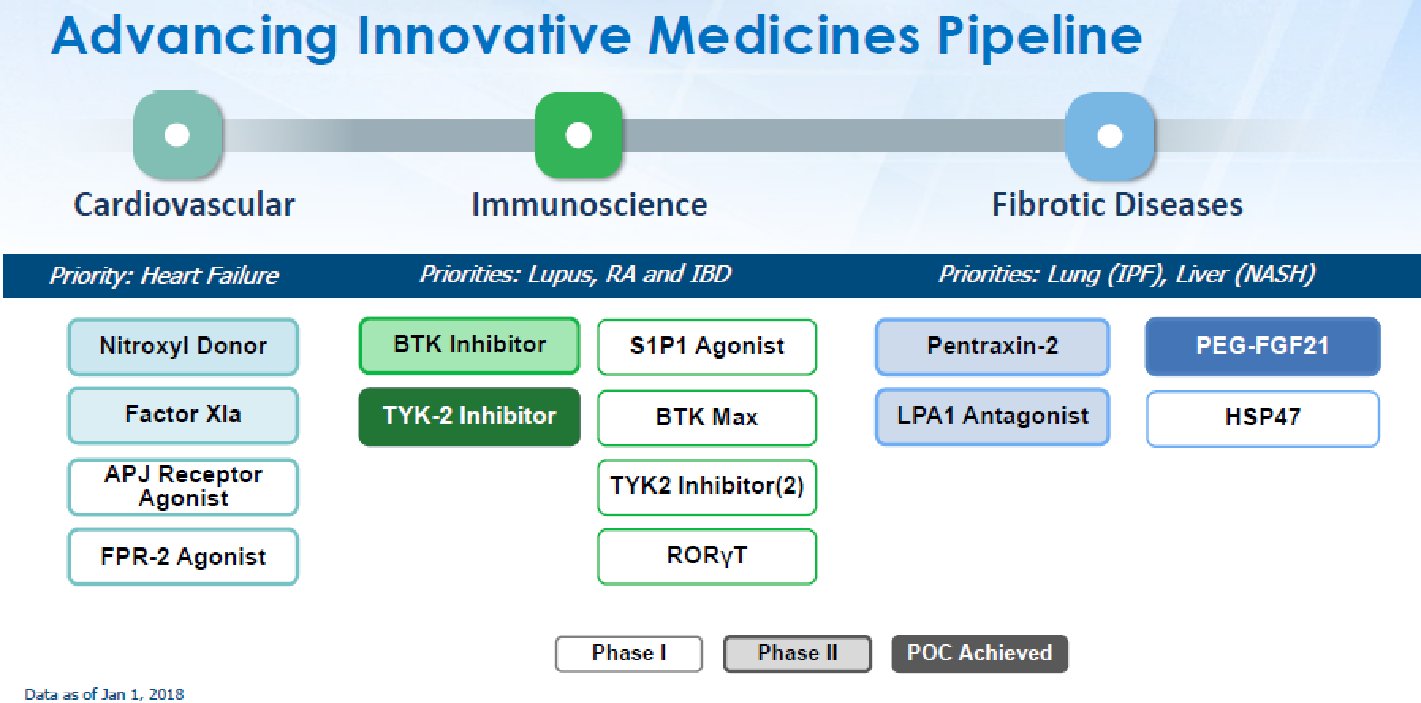

A major strength for the company has been the diversified pipeline of potential blockbuster opportunities that should offset the losses from any patent expiration. In 2016, Bristol-Meyers Squibb spent over $4.9 billion on research and development. As of October 13, 2017, the company had 35 compounds in development, 11 of which are currently in Phase 2 of the approval stage and that should be moving through the pipeline to Phase 3 for eventual approval. If BMY can find success with just a handful of these drugs, it should help the company to grow over the long term.

Growth Catalyst

A major growth catalyst for Bristol-Meyers Squibb remains its dominance in Opdivo, which should be able to produce peak sales of $9 billion. This would more than double its 2016 sales and give the company a hold on the advanced stage lung cancer treatment space. The Checkmate 227 study with Opvido is an important catalyst for BMY, which is expecting results in the first half of the year.

Another potential catalyst for growth is that management has done a great job of making BMY a potential acquisition target.

Dividend Analysis

Bristol-Meyers Squibb pays a dividend that is currently yielding 2.67%. This is equal to an annual payout of $1.60 per share. The company has also been building an excellent track record for raising its dividend, increasing it eight years in a row. This is considerably higher than IBB’s dividend yield of 0.45% and higher than the major drug manufacturers’ average yield of 1.94%.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to Bristol-Meyers Squibb stems from its strength of focusing its business on its core cancer treatments and major drug brands. This raises the company’s dependency on the success of these drugs and one setback could cause a major disruption in revenue and earnings growth. Also, if BMY sees little success with its pipeline, this could be a potentially disastrous outcome for the company’s long-term growth outlook.

The Bottom Line

Overall, the company has had very modest returns when compared to both its peers and the broad market. However, it looks to be righting the ship, thanks to stable cash inflows from Opdivo and Eliquis. So far, management has been proven right by shedding some of its non-cancer-focused businesses but if there are any holdups, it could all come crashing down.