Duke Energy Corp (DUK ) is a utilities company that currently distributes electricity to over 7.5 million customers and natural gas to over 1.6 million customers across the United States. Duke Energy can trace its history back to the Catawba Power Company in the early 1900s, which was founded by Dr. W. Gill Wylie, James Buchanan Duke and William States Lee who felt the South was too dependent on agriculture. Today, Duke Energy is a Fortune 125 company with over $22 billion in revenues as of the end of 2016.

Duke is one of the largest electric power holding companies in the U.S., delivering 52,700 megawatts of electric generating capacity in the Carolinas, the Midwest and Florida. In total, Duke services 95,000 square miles, with over 268,000 miles of distribution lines and over 32,000 of transmission lines. It also distributes its natural gas in Ohio, Kentucky, Tennessee and the Carolinas. It has over 32,000 miles of natural gas transmission and distribution lines, and over 26,000 miles of gas service pipelines.

Although most of Duke Energy’s revenues come from its electric and gas distribution, the company also has a segment that focuses on renewable energy. This area of the company acquires, develops, builds and operates wind and solar renewable generation assets. The segment is called Duke Energy Renewables, and it consists of 21 wind and 63 solar projects spanning 14 states.

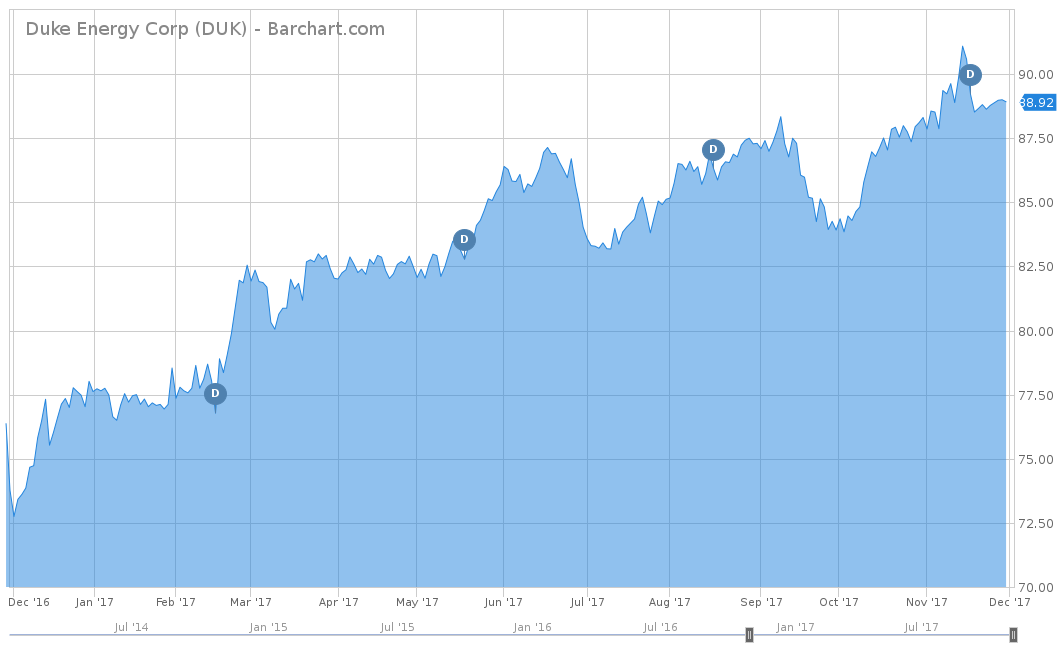

On a year-to-date basis, Duke Energy has performed fairly well, but it still underperformed the S&P 500 with a return of 14.44% versus the S&P 500’s 18.26% (as of December 13). When compared to its peers, Duke Energy has also slightly underperformed. The Utilities Select Sector SPDR Fund (XLU ) is the largest utilities ETF by assets under management. XLU is up 16.39% on a year-to-date basis, outperforming DUK by 1.95%. However, over the trailing five years, DUK has been sluggish and is up only 39.74%. This is weak when compared to the S&P 500’s return of 87.10% and XLU’s 60.14% for the same time period (as of December 13).

Fundamentals

Over the last five years, Duke Energy has had their revenues show steady declines since 2014, with a decline of 2.7% in 2014, 1.9% in 2015 and 3.1% in 2016. However, thanks to stellar growth in 2012 and 2013, the five-year revenue growth average is still 9.4%. Analysts finally see a turnaround in the company’s revenues, with 2017 growing 8.34%, at an estimate of $24.64 billion.

On an earnings-per-share basis, Duke has also been erratic, like its revenue streams. Over the trailing five years, Duke has had an average earnings growth of negative 0.6%. From 2015 to 2016, EPS fell 23.2% to $3.11 per share. However, this was most likely contributed to the $6.7 billion acquisition of Piedmont Natural Gas. This acquisition will give Duke significant growth potential, as evidenced by analysts’ more optimistic revenue outlook for 2017 and 2018. From an EPS view, analysts estimate the Piedmont acquisition to make an immediate impact, with an average EPS of $4.56, which is a 46.6% increase from 2016. They also predict earnings to further grow in 2018, with an estimate of $4.83, a 5.92% increase from 2017.

DUK currently has price-over-earnings multiple (P/E) of 26.32, which is slightly higher than the S&P 500’s 25.24. However, their P/E is much higher than the utility sector P/E average of 19.82. But this recent uptick in P/E is most likely contributed to the 46+% increase in this year’s expected earnings.

Strengths

The biggest strengths that Duke Energy has benefited from over the last few years are its regulatory relationships, especially in Florida and the Carolinas. Regulatory issues are always the main challenges that utility companies face, with holdups in distribution that tend to squeeze margins. Florida seems to be particularly constructive when it comes to regulations, which is allowing Duke Energy to recover costs in a more timely fashion than other states.

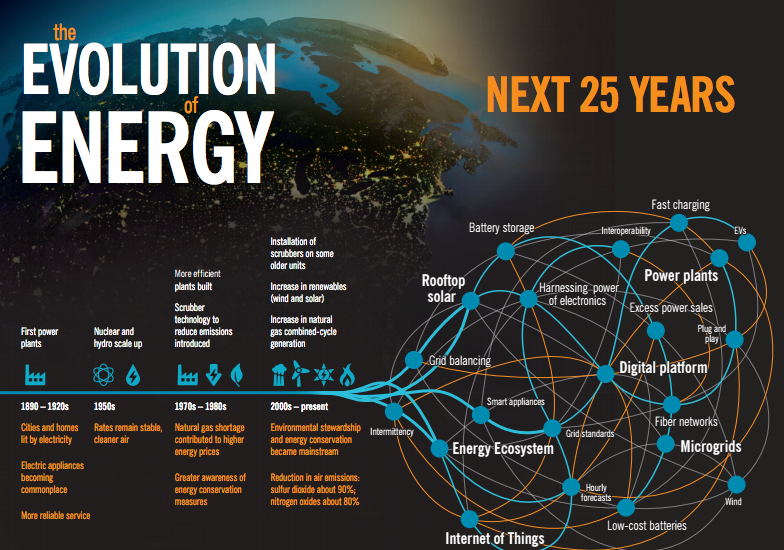

Another strong point for Duke Energy is the company’s focus to help modernize its business with its “Smart Grid” initiative. New technologies are being used to give Duke Energy’s customers more control, better communication, fewer outages and better service over the long run. With many homes focusing on becoming “smarter” thanks to wireless technology and home automation, Duke Energy would allow its customers the ability to see their home’s energy consumption on a daily basis. This would help customers to identify which appliances are inefficient and, thereby, increasing the house’s overall energy consumption.

Growth Catalyst

Most of the recent and future growth will be tied to its 2016 purchase of Piedmont Natural Gas. The deal was costly, but management believes it can double its earnings contribution from gas utilities and infrastructure over the next ten years. The purchase allowed Duke Energy to expand its investments in natural gas infrastructure, especially with pipelines and storage. It also added 1 million new natural gas customers that Piedmont already was servicing in North Carolina, South Carolina and Tennessee, with which Duke Energy had no previous affiliation.

Dividend Analysis

Like most utility companies, Duke Energy pays a sizeable dividend of 3.99% or $3.56 per share on an annual basis. Although not the highest yield in the sector, it is certainly well above the electric utility sector’s average of 2.36%. The company has also shown a nice trend of raising its dividend every year since 2007, for 10 consecutive years. Its most recent dividend hike was after the second-quarter earnings announcement, where management decided to raise its quarterly dividend by 4.1%. This is the 91st consecutive year that the company has paid a dividend, rewarding its shareholders with long-term consistency.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

Although Duke Energy has its regulatory relationships considered a strength at the moment, they are also a risk. The company has very aggressive investment plans over the next several years, which are dependent on these regulatory relationships. If they were to sour in any way, these expansion plans, and undoubtedly its margins, would drastically shrink.

Another risk that Duke faces is a raising interest-rate environment over the long term. With rates still near 30-year lows, utility companies have greatly benefited by borrowing with extremely low rates. If rates continue to creep up, with expected rate hikes in December and several in 2018, borrowing will be less appealing to Duke Energy. Raising rates also affect a utility company’s attractiveness to income-seeking investors. With rates continually on the rise, income-seeking investors will be looking toward fixed income again for similar rates with significantly less risk.

The Bottom Line

It looks as if management made the right call last year when acquiring Piedmont Natural Gas. Doing so added over 1 million customers as well as the ability to expand its natural gas infrastructure. Even though the deal added $1.8 billion of Piedmont’s debt to Duke Energy, management still believes its revenues will double over the next decade. If this is true, expect Duke Energy’s stock to continue to grow side by side with its growing revenues and earnings.

Check out our Best Dividend Stocks page by going Premium for free.