Chevron Corporation (CVX ) is one of the world’s largest integrated energy companies that specializes in the exploration, production, and refining of oil and natural gas. As of 2016, Chevron produced the daily net oil-equivalent of 2.6 million barrels per day, with a total of 11.1 billion barrels in proven reserves. The company had over $114 billion in revenues last year.

Chevron’s management team is led by CEO and chairman, John Watson, who has held the role since 2010 and has been with the company since 1980. Management has four financial priorities they try to abide by, year after year. The first is to maintain and grow the dividend, which is currently yielding 3.75%. The second priority is to fund capital programs for future earnings, which is expected to range in the $17-22 billion range over the next several years. Maintaining a strong balance sheet is another major priority, especially with an expected debt ratio range in the 20-25% area. Finally, Chevron’s final priority is to return surplus cash to its stockholders, as evidenced by its $45 billion in share repurchases from 2004 to 2014.

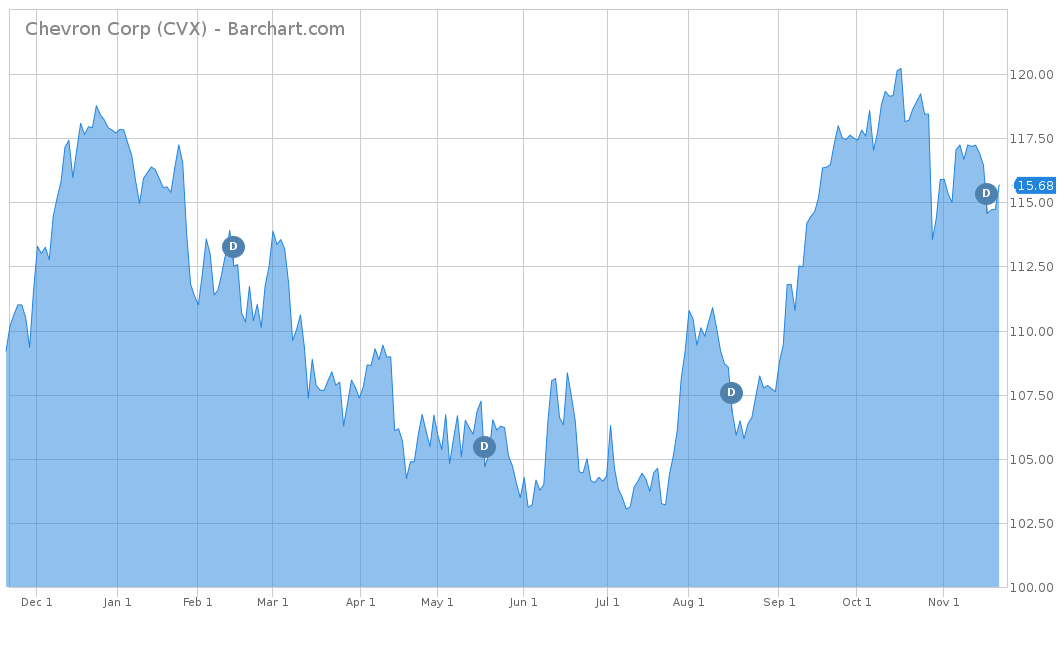

On a year-to-date basis, Chevron’s stock price is slightly down 2.13% and underperforming most of the major equity indices. Over the longer term, Chevron has produced modest returns and is up 12.49% for the trailing five years. However, when compared to the price of oil or even its largest competitor, Exxon Mobil Corporation (XOM ), Chevron has held up significantly better. The price of WTI Crude Oil has fallen 36.91% over the trailing five years and is up only 0.23% on a year-to-date basis. Exxon Mobil has shown a negative 6.42% return over the last five years and a 10.38% decline on a year-to-date basis.

Fundamentals

Like most companies in the energy business, Chevron has struggled in growing its revenues over the last five years. With oil dropping off nearly 50% off its once high point in the $110 per barrel range, oil companies have had a tough time staying profitable. As such, Chevron has seen a negative 14.7% change over the last five years in its revenues. However, it looks like 2017 will mark a turnaround for the company. Analysts expect Chevron to finish out the year with a total of $136 billion in revenues, an increase of over 19%. The same goes for 2018, where analysts estimate Chevron’s revenues to total north of $144 billion, an increase of over 5%. This turnaround is due to the stabilizing of oil prices paired with Chevron’s low cost upstream segment, which has already surpassed 2016’s total sales as of the third quarter of 2017.

Like revenues, earnings have not been doing well for Chevron. The company has posted negative earnings growth every year for the last five years, with the biggest dropoffs coming in 2015 and 2016, which fell 76% and 111%, respectively. In fact, in 2016 Chevron had a negative EPS of $0.27 per share. Both years were attributed to the substantial dropoff in revenues, tied to the declining price of oil. Going forward, analysts see a major turnaround as estimates are reporting at $4.02 per share, compared to -$0.27 reported in 2016. In 2018, analysts expect a sizeable increase of 28% to $5.15 per share. This stellar turnaround is attributed to the company’s increase in revenues along with management’s reduction in spending, as evidenced by its third quarter operating expense that was 22% lower than its 2014 averages.

On a price over earnings multiple, CVX currently has a 33.56, which is in line with the S&P 500’s 24.95. However, their P/E is higher than the measures of their competitors, like Exxon Mobil’s (XOM ) at 26.38 or Royal Dutch Shell plc (ADR) (RDS-A ) at 23.72.

Strengths

One of the major reasons Chevron has seen a turnaround is due to the across-the-board cost reduction efforts and new production volumes that have led to free cash flow generation. Chevron has introduced several strategies such as expanding cash and earnings margins, effectively allocating capital and high-grading the portfolio. In 2017, Chevron has seen a net production growth ranging from 6-8% from 2016 (excluding any asset sales that place this year), while also reducing the capital and exploratory budget at the same time. The company has established one of the lowest discovery costs when compared to its competitors, thanks to optimizing contracting strategy and improving quality management.

Finally, Chevron has reduced its high level of investments in several large long-term projects into better margined shorter-term cycle projects. In the first quarter of 2017, Chevron called an end to its mega LNG expansion project in an effort to focus boosting returns on its already developed $88 billion investment.

Growth Catalysts

The two biggest growth catalysts for Chevron going forward will come from the company’s current investments in Western Australia. The Gorgon and Wheatstone projects are centered on the discovery and production of liquefied natural gas (LNG). The Gorgon project is one of the largest natural gas projects in the world, with a total production capacity of 2.6 billion cubic feet per day. Its Wheatstone project currently has two LNG trains that have a combined capacity of 8.9 million metric tons per annum and a domestic gas plant. In conjunction with the Gorgon project, Chevron solidified itself as the leading natural gas supplier and LNG operator in the Asia-Pacific region.

Dividend Analysis

Even with oil prices falling over the last few years that have led the company to see a decline in revenues and earnings, Chevron has held true to its financial priorities by consistently paying and raising its dividends. In fact, with the price of oil going up, Chevron shareholders will most likely see a dividend hike going into 2018. Currently, the total annual amount equals $4.32 per share, for a yield of 3.71%.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

A major risk to Chevron’s recent profits would undoubtedly be a decline in the price of oil or natural gas. Falling commodity prices would lead to a narrowing of Chevron’s margins and cash flow, which would hinder the company’s ability to be both profitable as well as stand by its financial priorities. However, Morningstar research indicates that Chevron does have a modest reserve life of 12 years. With finding and development costs of $27/barrel over the past three years, there is still some room for oil prices to slide before the financials come under pressure.

The Bottom Line

Overall, it looks as if Chevron is on the rebound, seeing success in revenues and earnings growth in 2017. This is all due to a combination of increasing production and cost-saving initiatives that have caused the company to refocus its long-term outlook. Chevron’s stock will benefit if oil prices climb past $60/barrel or it continues its high output from its Western Australian LNG projects.

Check out our Best Dividend Stocks page by going Premium for free.