Originally founded by software pioneer Bill Gates, Microsoft Corporation (MSFT ) was one of the original leaders in the PC-era with its revolutionary MS-DOS and Windows-operating systems. After its quick rise to the top of the industry, Microsoft’s founder decided to relinquish CEO duties to Steve Ballmer in 2000.

Since then, the company and its stock price have been relatively stagnant due to Ballmer missing important technology trends, like the mobile market, and not transitioning legacy software platforms from on-premise installations. However, since the new CEO Satya Nadella took over in 2014, the company and its stock price have been rejuvenated. Nadella has focused on making Microsoft more operationally efficient while focusing on revenue-driving software and unloading failing businesses.

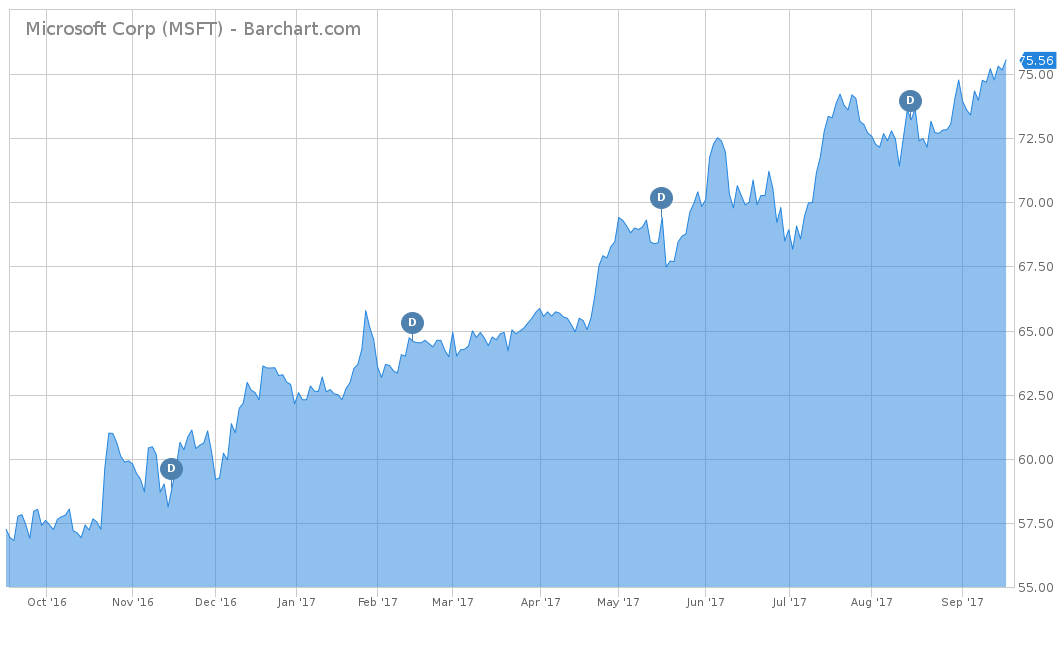

Since Nadella has taken over, the stock price has more than doubled from where it was trading in the mid-thirty range to its most recent closing price on September 18 at $75.16 per share, near its all-time high. On a year-to-date basis, MSFT has outperformed and is up over 21% versus the S&P 500’s 11%. Even more impressive is the fact that over the trailing one-year, MSFT almost doubled the performance of the S&P 500, up over 32% versus 17%.

Fundamentals

From a balance sheet perspective, Microsoft has been, and continues to be, rock solid, through and through. The company currently holds an AAA rating from Moody’s, with the only other AAA rating given to Johnson & Johnson (JNJ ). This top rating signifies the strong credit strength that Microsoft continues to maintain year after year.

Microsoft just finished its fiscal 2017 year with great success, thanks to its Azure cloud software and Office 365. Outside of an off year in 2016 due to the company refocusing its businesses, revenues have grown pretty significantly. The company has an average revenue increase of 4.1% over the last five years and a 5.8% average increase over the last ten. Earnings per share (EPS) has also steadily increased by an average of 6.3% over the last five years, with the most recent EPS coming in at $2.71 per share. Analysts have a 2018 expectation of $3.21 per share, which would be over an 18% increase. On top of increasing its revenues and EPS figures, Microsoft has a free cash flow of over $31 billion, adding to its total of over $133 billion in cash balance and short-term investments. This gives the company plenty of liquidity to face any troubled times going forward or to invest in its future through acquisitions.

According to Morningstar, from a price over earnings (P/E) multiple Microsoft is fairly high right now with 27.0, but still maintains a five-year average P/E of 20.5. The current P/E is higher than the S&P’s measure of 24.99 but lower than the information technology sector’s average of 29.68. However, forward P/E for Microsoft is estimated to be 22.5 and closer to its longer-term average. The current high P/E multiple is most likely attributed to the stock price’s quick appreciation this year and analysts expect earnings to increase in the near future. To see a list of the top 100 technology dividend stocks, click here.

Strengths

The biggest driver for Microsoft has been its Azure cloud infrastructure. The fourth-quarter results came with revenue growing 13% on a year-over-year basis, mostly thanks to Azure’s revenue growth increasing 97% year over year. Azure Premium Services revenue also grew in excess of 100%, for the twelfth quarter in a row.

Microsoft Office tools remain one of the most heavily used productivity program suites in the world, especially since it now integrates with Azure cloud technology. The company remains relatively unchallenged in this area, with more than one billion users worldwide. Office 365 increased by 43% in the fourth quarter by adding another 800,000 subscribers, bringing it to a total of 27 million worldwide.

Growth Catalyst

Microsoft’s management believes there are several catalysts in its future that could lead the company to new heights.

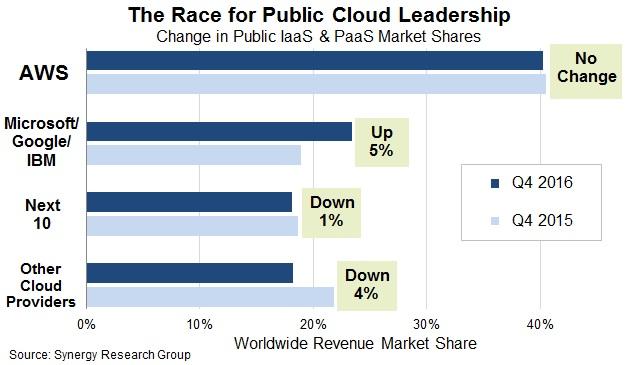

The biggest opportunity has to do with the further growth of Azure and the future of cloud technology. The current leader in the industry is Amazon Inc. (AMZN), which currently maintains 41% with its Web Services (AWS). Currently, Microsoft maintains only 14% of this total marketplace, which is expected to be over $383 billion by 2020. CEO Nadella has made it his company’s clear focus to become the dominant player in the cloud space, with Azure adapting new technology like speech recognition and other innovative tools.

Dividend Analysis

One clear advantage that Microsoft has maintained over its peers is its consistent dividend to investors. The stock is currently paying an annual amount of $1.68 per share, which is equal to a 2.26% dividend yield. This is significantly higher than the technology sector average, which currently yields 1.39%. Microsoft has also consistently raised its dividend every year since 2004. With a dividend payout ratio of 52% and over $130 billion of cash on its balance sheet, expect Microsoft to continue rewarding its investors with dividend hikes.

Risks

One of the biggest risks with investing in technology companies is their ability to continue to innovate with new products or software. During the Ballmer tenure, Microsoft was far too late entering into the mobile marketplace in which its main competitor, Apple Inc. (AAPL ), was able to capitalize with the Apple iPhone. Microsoft was also too slow to adapt its Windows software to become more user-friendly, which gave way to other competitors to eat up some of the operating software market. If Microsoft fails to further progress its winning Azure platform, Amazon and other competitors like Alphabet Inc. (GOOG) could take up its share of the cloud marketplace.

The Bottom Line

Even though Microsoft’s stock price has seen a run over the last few years, there should be more room for upside. The company continues to deliver on revenue expectations as well as an AAA-rated quality credit profile. If Microsoft’s new CEO can continue to make the company run as efficiently as possible, the stock growth could further skyrocket, thanks to Azure, and overtake some of the cloud technology market share.

Check out our Best Dividend Stocks page by going Premium for free.