The United States has taken a hard line on renegotiating the North American Free Trade Agreement (NAFTA), a sign that the Trump administration seeks a major overhaul of the trillion-dollar treaty. Naturally, equity investors are pondering the possible outcomes of the NAFTA renegotiation so that they can adjust their portfolios accordingly.

On August 16, representatives from the United States, Canada and Mexico descended on Washington, D.C. to begin redrawing the North American Free Trade Agreement. The first round of talks, which lasted for three days, began with each country tabling texts that will serve as the groundwork for a new treaty. Although NAFTA has facilitated economic and trade ties between the U.S., Canada and Mexico, each country has its own objectives when it comes to renegotiating the landmark treaty.

U.S. Looks to Rewrite NAFTA

As Trade Representative Robert Lighthizer clearly spelled out, the Trump administration isn’t looking for “a mere tweaking” of the 23-year-old NAFTA accord. Rather, Washington seeks a comprehensive review of the treaty itself with the aim of reducing its trade deficit with Canada and Mexico. On this particular issue, the U.S. stands alone, as neither Canada nor Mexico has prioritized their trade balance with the other two countries. Not completely unrelated, the United States is also looking to safeguard domestic manufacturing jobs, which is a highly contentious issue.

President Trump would also like to make it easier for U.S. banks and telecommunications companies to access the Canadian and Mexican markets – something the original NAFTA largely failed to accomplish. Increasing agricultural market access is also a key U.S. objective. Although NAFTA has generally been favorable to U.S. agricultural producers, greater regulatory harmonization and sanitary standards are required.

U.S. trade negotiators will also attempt to rewrite rules of origin, which could have a significant impact on the North American auto industry. They also seek to abolish the dispute-resolution mechanism, which prevents the U.S. from pursuing anti-dumping cases against its neighbors.

Updating NAFTA to account for the growth and widespread adoption of information technology is also a principal requirement of the upcoming negotiations. IT standards, like those that cover cloud computing and data storage, are expected to be less contentious.

The dairy and softwood lumber industries are also up for negotiation, especially as they pertain to Canada. Earlier this year, President Trump slapped heavy import duties on Canadian softwood lumber and announced plans to actively monitor the country’s dairy exports. To learn more about President Trump’s import tariffs on Canadian softwood lumber, click here. Also, learn why Canada’s dairy industry is on Donald Trump’s radar by reading the following article.

At the outset, it appears that equities tied to banking, telecom, IT and the automotive industry have the most to gain or lose from NAFTA renegotiations. Manufacturing stocks are also on high alert, given the politicization of factory jobs. The Trump administration has blamed NAFTA for a direct loss of 700,000 manufacturing positions.

Use the Dividend Screener to find high-quality dividend stocks based on 16 parameters. You can even screen stocks with DARS ratings above a certain threshold.

Canada’s NAFTA Demands

Canada’s goals for renegotiating NAFTA differ markedly from the Trump administration’s agenda. Foreign Affairs Minister Chrystia Freeland, who is negotiating on behalf of Canada, has released ten key demands for a new NAFTA accord. Among the more salient objectives include a new chapter on labor standards, rather than the addendum that was added to the original NAFTA deal.

The Canadians are also seeking to reform the investor-state dispute settlement process – in other words, Chapter 11 – to allow governments the “unassailable right to regulate in the public interest,” according to Freeland. Canada’s new trade treaty also expands procurements and allows for freer movement of professionals, expanding on the current list of jobs for which North Americans can easily obtain a visa to work across the border.

What Mexico Wants from Renegotiating NAFTA

As an emerging economy, Mexico’s development objectives differ in many important ways from its northern neighbors. This is reflected in the country’s top goals for renegotiating NAFTA, which include strengthening North American competitiveness, fostering more inclusive trade between the countries and updating energy, digital and telecommunications provisions. Given that the 80% of Mexican exports are U.S. bound, the country would like to retain access to the world’s largest economy. This is especially true of agriculture, which is an important export industry for Mexico.

Labor issues will likely be a major hurdle between the U.S. and Mexico. The Trump administration’s protectionist and nationalist policies are of no benefit to Mexico, which is looking to expand regional trade.

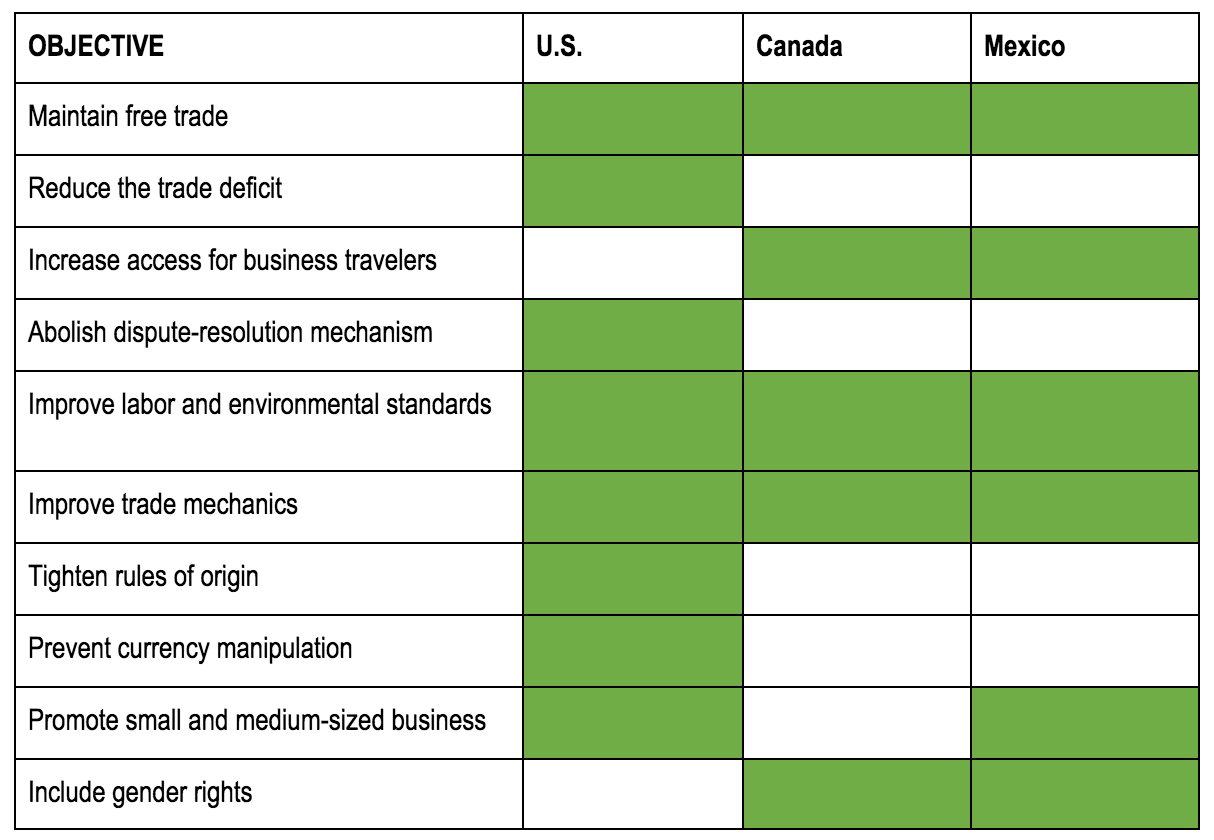

A detailed breakdown of each country’s trade goals is presented below:

Check out our Best Dividend Stocks page by going Premium for free.

The Bottom Line

Trade officials have set out an aggressive timeline for finalizing the new version of NAFTA. However, if history is any indication the talks will likely drag on indefinitely, perhaps even eclipsing the target deadline of Mexico’s election in July 2018. Investors should therefore adopt a proactive approach – one that includes monitoring the latest news developments and meeting schedules.

Stay up to date with next week’s major corporate changes regarding dividends in our News section on Dividend.com. As NAFTA negotiations continue, Dividend.com will provide the latest insights from the perspective of income investors.