United Parcel Service Inc. (UPS ) is more than 100 years old and is the world’s largest package delivery company, ahead of DHL and FedEx. 434,000 UPS employees help deliver more than 19 million packages every day and clocked in revenues of $61 billion last year.

It boasts a fleet of 237 UPS jet aircrafts and has services in “more than 220 countries and territories; every address in North America and Europe.” Should this giant of a company be part of your portfolio? Read on for some clues.

UPS and Its Competitive Landscape

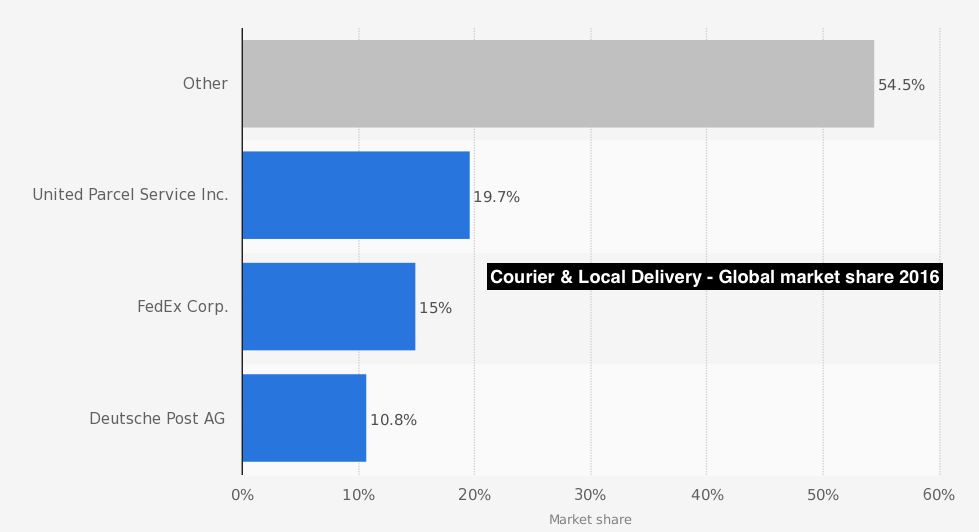

The sector comprises UPS, FedEx and other companies like DHL Express (a division of the German logistics company Deutsche Post DHL). While it may seem a straight comparison, there are some big differences. UPS is largely a ground shipping company whereas air shipments are the bread-and-butter of FedEx. While UPS manages all of its delivery divisions (ground, air, domestic, international, commercial, etc.) via a single network, FedEx has distinct objectives from each of its divisions (express, ground, freight, etc.). As a result, UPS has better gross and operating margins compared to FedEx.

Given that UPS is a company that specializes in domestic ground shipping, online commerce is better suited to UPS than FedEx. This will be an important factor in the coming years as more and more businesses will move their businesses online.

What’s All the Chatter About Amazon?

Amazon, the world’s biggest online marketplace, has been raising its delivery game in order to cut costs and delivery times for its customers. Amazon is a big customer and is now an increasingly big competitor to UPS. UPS CEO David Abney described UPS’ relationship with Amazon as “very comfortable” toward the end of 2016, but it is an obvious cause of concern.

While online commerce has been a revenue boon to delivery package service providers like UPS, FedEx & DHL, it has also resulted in some challenges. Speed to market has come to fruition as an increasingly valued differentiator in the online commerce world. Companies like Roadie, Grabr and Dolly utilized peer-to-peer capacity to get customers to help each other when it comes to shipping and package delivery. Folks logging into these services are both prospective customers and service providers. Like Uber, these companies have utilized existing capacity of vehicles, people and their existing travel commitments via road, rail or air.

Amazon has been adding scale to its speed delivery differentiators like ‘2 day’, ‘same day’ and even ‘2 hour’ delivery options. To meet its commitments, Amazon has not only started to lease its own air fleet but has also invested throughout the delivery lifecycle including programs like ‘Amazon Flex’ to manage the last mile portion of deliveries. These disruptive services can’t be delivered via “middlemen” and will need business model adjustments for companies like UPS.

Track Best Air Delivery & Freight Services Dividend Stocks here.

UPS as an Investment

UPS missed analysts’ revenue estimates in Q4 2016 by a small margin, bringing in $16.9 billion versus the expected $17 billion figure. UPS makes more than 70% of its revenue from the domestic segment that is comprised of ground, next day air, and deferred.

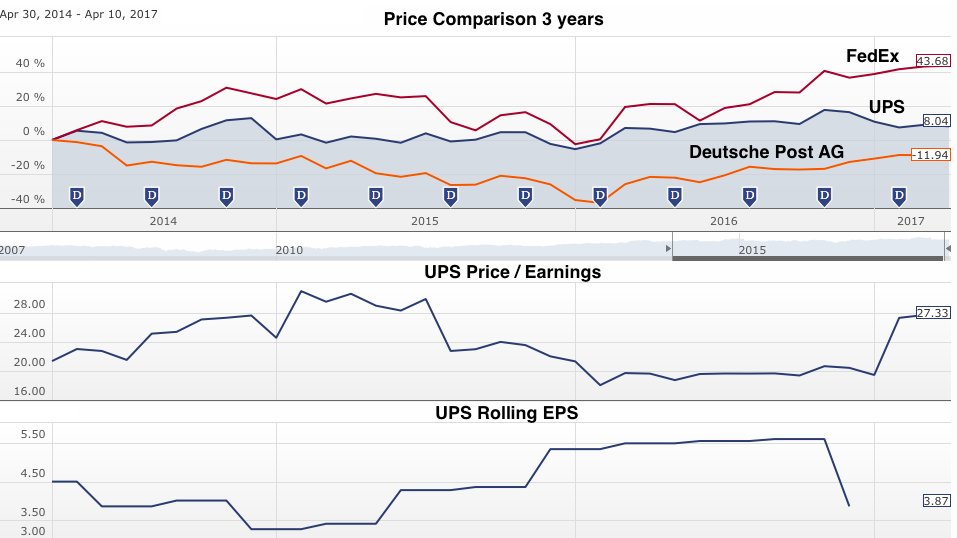

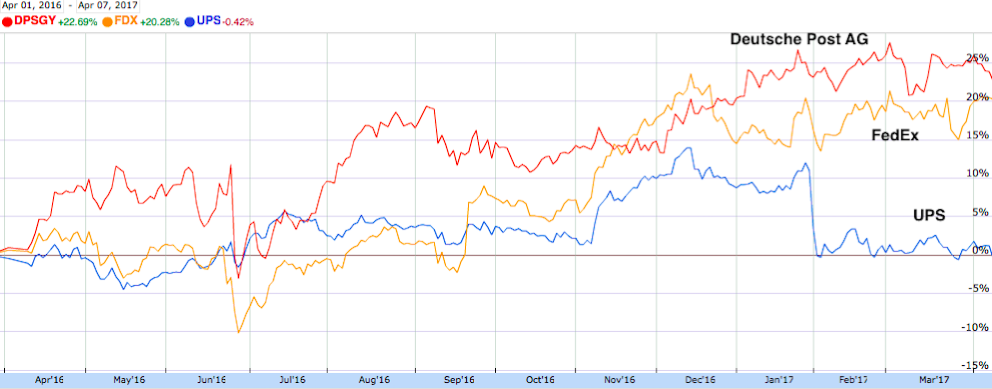

The ground business segment grew by 7.1%, whereas the Cargo business (part of its smaller international segment) fell 11.6% on a year-over-year basis in 4Q16. Revenue per piece also fell by a small margin (0.8%) despite a base rate increase. Management outlook for 2017 is 5-7%, which is high compared to historical trends. After a sharp fall at the start of the year (partly due to the strong dollar and increased capital investment), UPS is trading at a similar P/E ratio as compared to FedEx.

UPS has a good 3-year annualized growth of 8%, payout ratio of 55% and dividend yield of 3.16%. No wonder it features on the “Best Dividend Stocks” list on dividend.com: click here for the full list.

Check out how to Deliver Gains With UPS here.

Watch UPS Drops After Announcing Multibillion-Dollar Plane Purchase: click here

The Bottom Line

UPS has a massive infrastructure and more than 100 years of experience in delivery and shipping. While companies like Amazon are starting to cater to customers via their own delivery channels, it will be a long time before their 40 leased aircrafts catch up to UPS’ fleet strength of 240.

Even if Amazon continues to expand its premium shipping services (e.g. Prime), it’s unlikely to take on shipping responsibilities for all of its customers. As UPS continues to innovate to prepare itself for an increasingly online world, its ground shipping credentials will be the centerpiece of its future growth strategy.