The consumer staples and products sector is full of great dividend stocks. After all, you still need to wash your clothes or take a shower in all sorts of economic environments, which leads to a bout of cash flow and, ultimately, dividends. And one of the most consistent dividend payers in the sector has been The Clorox Company (CLX ).

The maker of salad dressing, lip balm and its namesake bleach has been as steadfast as they come with a long history of raising dividends and rising earnings. Even better for investors is the fact that CLX stock managed to double over the last five years and outperform rivals such as Procter & Gamble (PG ) and Colgate-Palmolive (CL ).

But things haven’t exactly been great for Clorox in recent months. Headwinds have caused it to perform less than admirably during recent trading sessions.

Nevertheless, Clorox is still as sturdy as they come and its issues are only skin deep. Any continued downturn could be used by investors to snap up shares of the dividend stalwart.

Find the best cleaning products dividend stocks here.

Plagued by Global Sales

When it was founded in 1913, CLX only sold one product: liquid chlorine bleach. Its best-selling bleach still exists but the firm has expanded outwards, and it’s now one of the largest manufacturers of consumer and professional products in the world. Its product portfolio includes such best-selling brands as Fresh Step cat litter, Burt’s Bees personal care products, Hidden Valley salad dressing and Glad trash bags. More than 80% of Clorox’s sales are generated from brands that hold either first- or second-place market share positions in their respective categories.

This broad sweeping brand portfolio and leadership have been some of the main driving forces behind CLX’s incredible run and long history of dividend growth. Clorox has managed to raise its dividend every year since 1977.

The problem is that outside of the U.S., no one really knows what Clorox is all about. The firm is very U.S.-centric with its sales. To that end, management has unveiled plans to boost its global presence and get Clorox wipes into the international marketplace. Following many of its rivals, an essential part of that strategy is Latin America.

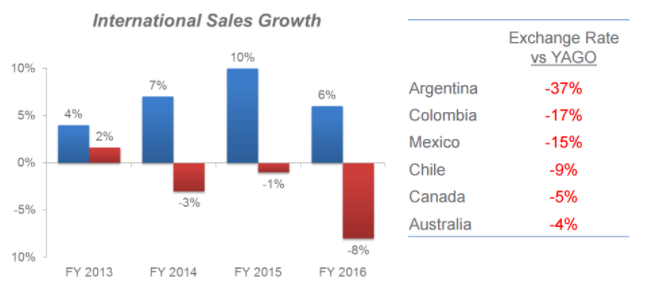

Which is great, except that Latin America hasn’t exactly been that pleasant of an investment destination in recent years. Economic downturns in places like Brazil and Mexico have caused lower sales, while currency headwinds – thanks to the strong dollar – have clipped profits in the region. While LatAm only makes up about 9% of CLX’s sales, it hurts its bottom line. CLX now expects its full-year sales growth in fiscal 2017 to be in the range of 2% to 4%. Without the currency impacts and issues facing Latin America that growth would be closer to 6%.

Just have a look at the chart below from Clorox’s most recent investor presentation. You can see just how significant the problems and currency issues in Latin America have become.

As a result of these issues, CLX has begun to underperform some of its rival in the sector in both share price gains and sales increases.

Clorox is a Dividend Aristocrat having raised its dividend for 39 consecutive years. You can get a complete list of all stocks that have crossed the magical 25 years of consecutive dividend increases here.

Find out which 10 companies are likely to be Dividend Aristocrats by 2050.

Still Plenty of Growth Left at CLX

But all of the negativity surrounding its sales declines and underperformance could just be hot air. Clorox is doing fine and has plenty of the same growth opportunities as its rivals, including a hefty dose of tech.

Clorox has managed to make bathroom cleaning supplies high tech, thanks to its partnership with Amazon (AMZN). CLX was one of the first firms to fully embrace Amazon’s Dash Button devices. These pods link to smartphones and allow for instant ordering of many products with just one click. Clorox and its brands are prominently featured in several of the buttons available from Amazon. Meanwhile, the firm has designed a new Brita water pitcher that will automatically order a new filter when the existing one starts to run low. These tech additions are just the beginning and they could create a major increase in sales for Clorox as they are adopted.

Secondly, Clorox has moved its products into non-traditional outlets such as moving Burt’s Bees products into Old Navy stores and Kingsford charcoal into Bass Pro shops and other grill retailers. Again, this gets their products in front of more consumers and could result in higher sales. These non-traditional channels have added $10 million in annual sales growth to the company over the last couple of years.

Finally, its continued focus on health and wellness seems to be working. High margin products such as vitamins and supplements continue to boost CLX’s bottom line. Its 2016 acquisition of Renew Life – a maker of probiotics, shakes and other nutritional products – is already paying benefits. As it uses its extensive distribution network, Clorox could strike gold with the division.

All of these efforts seem to be working. CLX managed to see its sales jump a total of 13% last year, despite the currency headwinds. Perhaps investors were too quick to cast away CLX stock on the back of the LatAm pressures.

Find out when Clorox will declare its next ex-dividend date in our Ex-Dividend Date calendar.

Buy CLX’s Leading Dividend

With shares trading about 10% below their 52-week high, investors might want to consider CLX stock. The firm’s issues exist, but it has managed to maneuver around them and it has the growth to keep its dividend going even with the pressures.

That dividend, by the way, has basically tripled over the last decade. CLX is now paying out nearly $3.20 per share annually. At current prices, that gives CLX stock a yield of 2.51%. While the firm’s payout ratio is a little high at 60%, the steadfastness of its sales and brand portfolio gives it the ability to hand out more cash than the average firm. And as long as the sales growth is there – which it is – Clorox should be able to grow its payout for another 39 years.

In the end, the market may be making a bigger deal out of Clorox’s issues than it should. For investors, that’s given them a chance to buy one of the best consumer products firms out there on the cheap.

Go Premium for free and get access to dividend data for over 6,500+ stocks that can help in your investment analysis.