Open your wallet or look inside your purse – there’s a good chance that there’s at least one card with that familiar red-orange logo. When it comes to global payments, there are only a few major players, and the sector represents one of the few legal oligopolies out there. As one of the two leaders of the group, MasterCard (MA ) is a powerful company.

It’s a pretty powerful stock, as well.

MA has been a dynamo in both stock returns and dividend growth since its IPO only a few years ago. Those hefty returns have been driven by its unique and lucrative business model, as well as the continued shift towards a cashless society. With plenty of growth left in the tank, MasterCard is poised to keep its dominant position in the global payments industry and keep its hefty pace of dividend growth going.

For dividend investors, MA represents one of the best and brightest plays out there.

A Cash-Flow-Intense Model for a Cashless Society

While you may know MasterCard from your credit or debit card, it doesn’t actually issue that card. That’s done by your bank, and as a result, MA has no credit risk. But what MasterCard does do is vital for that credit or debit card to work as we know it.

The real heart of MA’s business is that it facilitates the processing of payment transactions. That includes the authorization, clearing, and settlement of moving money between your bank account and the store’s, or another person’s. In essence, MasterCard is like a tollway for money. And those three steps – authorization, clearance, and settlement – are vital to ensuring that when we swipe or tap our cards, commerce actually functions as expected.

And just like a toll road, you need to pay to use that transaction network.

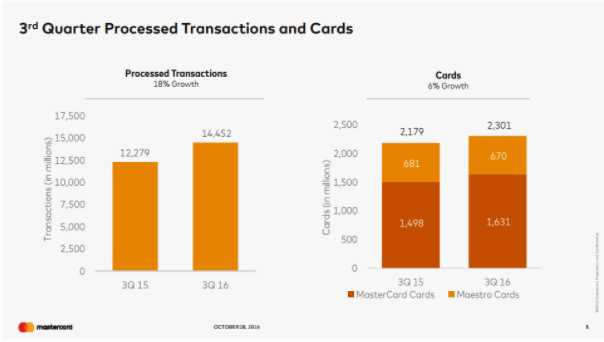

MasterCard clips a fee from issuing banks or credit card companies like Capital One (COF ) as well as the various merchants for providing access to that gateway. MA charges the fees based on the gross dollar volume of transactions. The more money heading over the tollway, the more revenue MasterCard makes. And we continue to swipe our cards at a rapid pace – check out the below chart. MA saw 18% growth in processed transactions in just a year, while total card growth increased 6%. That just highlights how quickly we are becoming cash-free.

As a result, MasterCard is a cash flow machine. Perhaps more importantly, it’s a free cash flow machine. Margins for the tollway are incredible high, as it’s already built. That allows MasterCard to generate hefty amounts of cash after expenses. And those free cash flows have continued to go up over the years as more merchants choose its system.

The real beauty is that there are only a handful of tollways merchants can use, and even then, in terms of size and payment volumes, it’s really just MasterCard and archrival Visa (V ). That gives MA a massive moat and a competitive advantage. You simply can’t replicate what MasterCard has built.

Track Dividend.com’s News section for the latest on dividend investing.

Growth Potential at MA

For MasterCard, the future looks rosy. In its core business, more and more people are swiping rather than using cash. That alone is enough to drive MA’s revenues and cash flows higher over the long term. Add trends like rising ecommerce adoption, and you begin to see how big MA’s potential is.

But MasterCard hasn’t rested on its core payment network; it’s expanded heavily into new markets like mobile transactions. That’s included partnering with PayPal (PYPL) and others on their mobile payment networks. MA has also recently unveiled and rolled out its MasterPass service. The one-touch access and payment network will allow faster checkouts for online purchases. That includes being integrated into various mobile websites and “wallets.”

Finally, growth in emerging markets will be a key win for MasterCard down the road. For example, India’s Prime Minister Narendra Modi has recently embarked on a crusade to turn the nation 100% “cashless.” Rising consumer demand in places like China and Brazil will send more revenue and payments down MA’s tollway, too.

Analyze over 10 ETFs that have exposure to MasterCard here.

It All Adds up to Amazing Dividend Growth

The real win for investors is dividend and buyback growth at MasterCard. With such ample free cash flows, MA can be pretty ample with its dividends, as well. Since its IPO just a few years ago, MasterCard has raised its payout by more than 900%. And that unstoppable dividend continues: the stock recently upped its payout by another 15%.

In addition to those hefty dividends, MasterCard has been a buyback champion and has recently announced another $4 billion program designed to reduce its share count. Last year, MA managed to reduce its share count by $3.84 billion.

And all of this should continue, as MasterCard’s payout ratio is a paltry 23%. That means it still has more than 70 cents out of every dollar it makes in profits to potentially spend on dividends. This is before any earnings growth occurs. This is very much a dividend growth story in its infancy.

Find out MasterCard’s complete dividend history here.

The Bottom Line

A wide moat, huge cash flows and rising demand are all the hallmarks of a great investment. And they all can be found at MasterCard. In the end, investors looking to cash in on an early dividend growth story should jump on MasterCard shares.

Find out MasterCard’s next ex-dividend date in our Ex-Dividend calendar. You can select the date range of your choice and click on search ex-dividend dates as you do your analysis.