Margin Expansion and New Restaurant Openings Fuel Growth

Yum! Brands, Inc. (YUM ) is a juggernaut in the fast food industry. The company’s aggressive expansion strategy has provided it with steady growth for several years. Yum! enjoys high restaurant-level profit margins thanks to a streamlined cost structure, which gives it enough growth to open new restaurants and return significant levels of cash to shareholders each year through dividends and share buybacks.

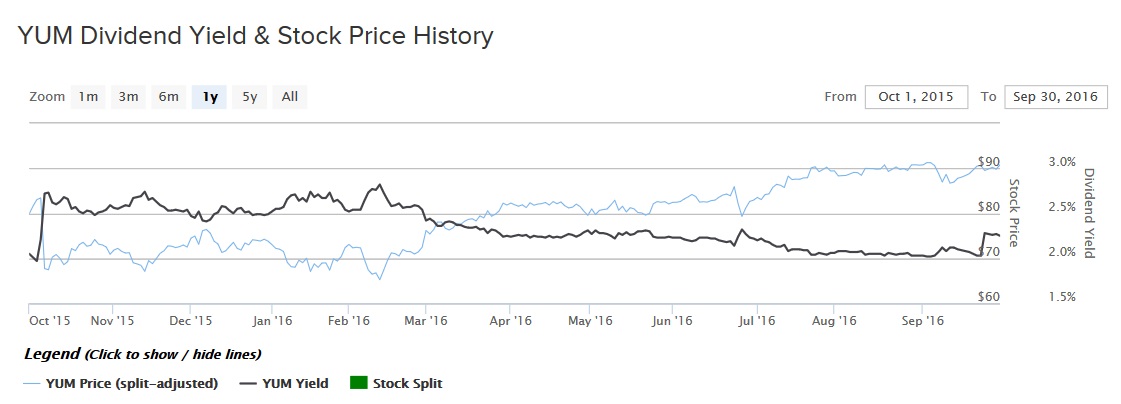

On Sep. 26, for example, Yum!’s Board of Directors approved a new quarterly dividend rate of $0.51 per share. This represents an 11% increase from the prior dividend. The next payout will be distributed on Nov. 4 to shareholders of record on Oct. 19. The new annualized forward dividend rate of $2.04 per share represents a 2.2% forward dividend yield. Since 2004, Yum! has increased its dividend by double-digit percentages each year, on average. Furthermore, the company expects to purchase $1.1 billion of its own stock by the end of the year.

Yum! stock has performed extremely well over the past year and has significantly outperformed the S&P 500 in that time.

Fundamentals

Yum! operates the Pizza Hut, KFC, and Taco Bell restaurant brands. In all, the company operates nearly 43,000 restaurants across more than 130 countries worldwide. On average, Yum! opens six new restaurants around the world each day. Yum! opened 2,365 restaurants globally last year and plans to open nearly 2,400 new locations this year.

Last year, Yum! delivered 5% sales growth and the company enjoyed broad-based success. Total sales grew 8% at Taco Bell, 7% at KFC, and 2% at Pizza Hut. Earnings, as adjusted for special one-time items, rose 4% last year to $3.18 per share. The company has followed up with a strong performance to start 2016. Adjusted earnings per share rose 30% through the first half of the year, compared to the same period in 2015. Yum! opened 373 restaurants worldwide just last quarter and 72% of its international restaurant openings were in the emerging markets.

Growth Catalysts

The most important growth catalyst for Yum! Brands is its growth in new geographies, particularly the emerging markets China and India. These two markets are critical to the company’s future growth, as growth in the U.S. has leveled off in recent years. As a much more mature market, U.S. consumers are taking an increasingly discerning view regarding food and beverage consumption, and as a result, are slowly turning away from fast food. At the same time, growth still remains compelling in the emerging markets. Over the past five years, Yum! has increased its restaurant count in China and India by 60% and 86%, respectively. This has exceeded its U.S. restaurant count growth by a wide margin.

Such a huge growth rate is why analysts are so bullish on Yum!’s future. Analysts on average expect the company will earn $3.67 per share in 2016 and $4.14 per share in 2017, which would represent earnings growth rates of 15% and 13%, respectively. A good portion of this growth will occur in the emerging markets. Last quarter, Yum!’s total sales in China rose 7%. Operating profit soared 26% year over year thanks to sales growth plus a 230 basis point improvement in restaurant operating margin.

Important Considerations

Yum! investors should know that the company will soon separate its China business into a new, independent entity that will trade on its own. The company expects Yum! China to begin trading on its own on Nov. 1, under the ticker symbol YUMC.

The rationale for the spin-off is that the Board of Directors believes it will allow each side of the company to be more focused on their own unique strategic initiatives. Since Yum!’s China business is growing at a much faster rate compared to the rest of the world, management believes the spin-off will create value for shareholders as it will allow Yum! China to earn a higher valuation than the company currently receives.

Dividend Growth

If Yum! meets forecasted earnings growth rates going forward, it will give the company plenty of room to continue growing its dividend at double-digit rates, as it has done since 2004. At the new annualized dividend rate of $2.04, Yum! is set to distribute 56% of its projected 2016 earnings per share. That is a fairly modest payout ratio. Along with organic growth, Yum! investors should expect 10% dividend growth each year moving forward.

The Bottom Line

Yum! has three strong brands, each commanding high market share in the fast food industry. It has a diversified business both in terms of geography as well as market category. While Yum! stock has performed extremely well over the past year, through its organic internal growth as well as the upcoming spin-off, there is plenty of room for even further value creation.