Shifting Consumer Preferences Makes for Clear Sailing

Over the past two years, one of the biggest beneficiaries from the decline in oil prices is the consumer discretionary sector. These companies depend heavily on consumer spending, and are therefore reliant on a financially healthy consumer. U.S. consumers have more disposable income now that they are spending less at the pump. For the most part, consumers are choosing to spend this extra money on experiences, rather than things.

As a result, the cruise line operators are among the major winners of the drop in oil prices. Royal Caribbean Cruises Ltd. (RCL) is growing sales and profit at a rapid pace, as consumers have embraced cruising like never before. The company has a compelling future growth catalyst now that cruise lines are allowed to travel to Cuba. In addition to the steady recovery in the U.S. economy – marked by significant recoveries in the labor and housing markets – there is a long runway of growth ahead for Royal Caribbean.

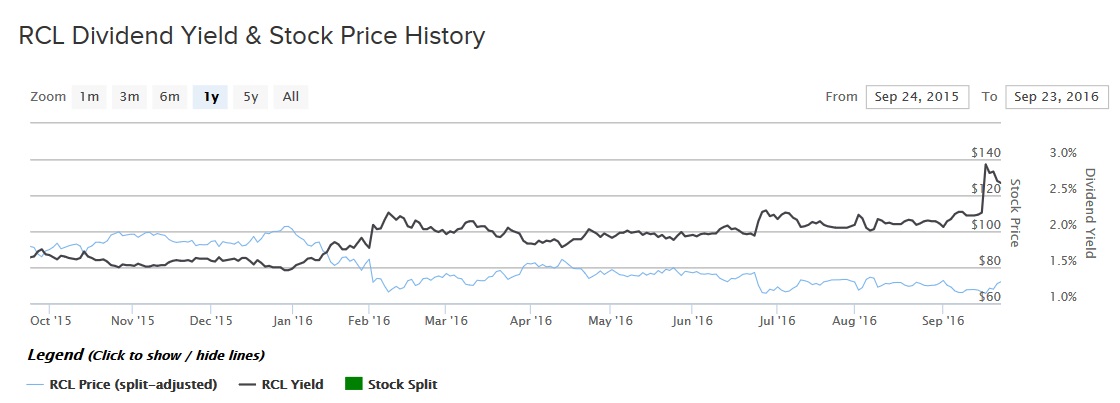

The stock has declined 22% over the past one year, and has badly lagged the S&P 500 Index. However, it is worth noting that the stock has more than tripled over the past five years. The decline over the past year could be a buying opportunity.

Record Profit in 2015

Last year, Royal Caribbean generated more than $1 billion of profit. That was a record for the company. Total revenue and adjusted earnings per share increased 2.7% and 42%, respectively, for the year, and the company expects even greater things this year. Earnings per share increased 25% last quarter, year-over-year, and management forecasts at least 25% earnings growth for the full year 2016.

Royal Caribbean’s main challenges right now are the strong U.S. dollar, which has reduced the value of sales generated from international operations. In addition, the company slightly cut its full-year earnings outlook, due in part to weakness in the British pound following the Brexit vote. However, favorable consumer economics continue to offset the negative effects of currency fluctuations. Royal Caribbean’s bookings for the remainder of this year remain strong and roughly on par with last year’s record results. Going forward, bookings over the next year are also strong, and are showing increases in both pricing and volumes, as compared with the same time last year.

A big reason for Royal Caribbean’s growth over the past several years has been increasing guest counts. Last year, the company serviced 5.4 million guests. This was up from 5.1 million guests the year before and 3.4 million guests ten years ago. Royal Caribbean has generated this growth from improvements to its fleet, and a strategic initiative to provide more trips to Asia and the Caribbean, two geographic regions seeing higher demand for cruises. In addition, Royal Caribbean has steadily increased prices. This has driven significant revenue growth for many years.

Revenue and Guest Count

Analysts agree that Royal Caribbean has even more growth in its future. On average, analysts expect Royal Caribbean to earn $7.17 per share in 2017, which would represent 15% earnings growth from 2016. The company plans to continue growing with a strategy called the ‘Double Double’, which means reaching double-digit return on invested capital, and doubling its earnings per share from 2014-2017.

Royal Caribbean’s earnings growth will be supplemented by a key catalyst going forward.

Future Growth Catalyst: Cuba

The U.S. and Cuba have worked to restore relations in recent years. Relations between the U.S. and Cuba are finally improving after decades of tension between the two nations. And now that the first regular cruise sailed from the U.S. to Cuba earlier this year, it will likely be a tailwind for Royal Caribbean in 2017 and beyond because Royal Caribbean is planning trips to Cuba soon. Management attributed last year’s record results in part to booming demand for trips to the Caribbean. Opening up Cuba could be a great way to capitalize on this demand.

Dividends

On Sep. 19, Royal Caribbean declared a 28% dividend increase. The new quarterly payout of $0.48 per share is increased from the previous rate of $0.375 per share, and is payable Oct. 13 to shareholders of record on Sep. 29. The company has demonstrated a clear commitment to returning cash to shareholders through dividends. Last year, Royal Caribbean delivered a 25% dividend increase.

Royal Caribbean’s forward annual dividend will rise to $1.92 per share. Based on its Sep. 26 closing price of $71.45 per share, the stock has a 2.7% forward dividend yield. This is an above-average dividend yield relative to the S&P 500 Index.

Even though Royal Caribbean has raised its dividend at very high rates recently, it still maintains a modest payout ratio. The new $1.92 per share annualized dividend rate represents 31% and 27% of projected 2016 and 2017 earnings per share, respectively. These ratios are still fairly low and there is room for the payout ratios to expand. In addition to earnings growth, this should easily result in double-digit dividend growth over the next several years.

The Bottom Line

Royal Caribbean stock has not performed well over the past year, even though the company itself is firing on all cylinders. The company is likely to continue growing earnings at high rates as it grows guest count and increases its trips to the Caribbean and Asia.

Investors could view the stock price decline as a buying opportunity, since the stock has an attractive valuation of 10 times earnings and an above-average dividend yield.