Tobacco stocks have performed extremely well for a prolonged period. The biggest U.S.-based tobacco company, Altria Group (MO ), has outperformed its industry peers, as well as the S&P 500, over the past year. The reason investors are so bullish on Altria right now is because companies generate strong profit margins and high levels of cash flow each year, which they use to pay their hefty shareholder dividends. This is why income investors commonly buy and hold Altria stock over long periods of time.

Plus, in an uncertain global economic backdrop marked by elevated geopolitical risk, Altria is even more attractive for investors because it operates entirely in the U.S. and, as a result, is insulated from international risk. Altria is also not affected by the strong U.S. dollar, because it generates 100% of its earnings from its U.S. operations.

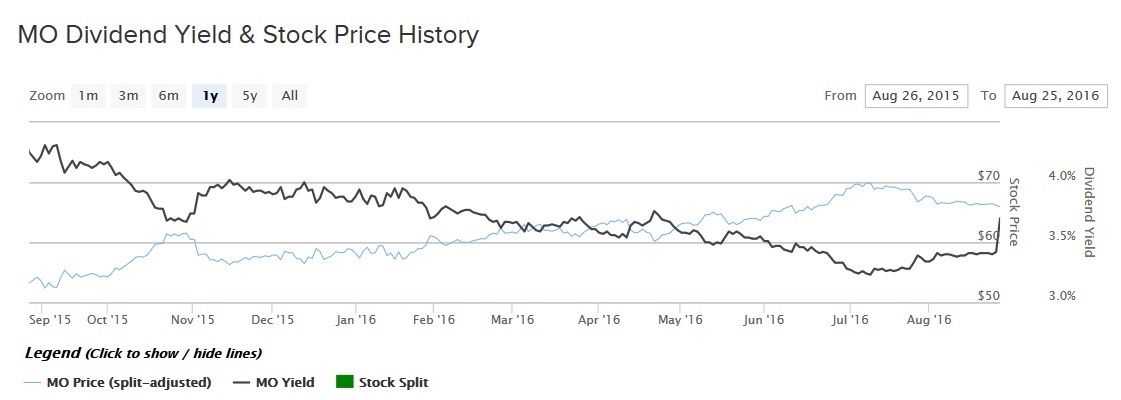

On Aug. 25, the Board of Directors of Altria approved a quarterly dividend rate of $0.61 per share. This represents an 8% increase from the prior dividend rate. The quarterly dividend is payable on Oct. 11 to shareholders of record as of Sep. 15. The new annualized dividend will rise to $2.44 per share.

Strong Brand and Strong Fundamentals

The economics of the tobacco industry are extremely favorable. Capital spending levels are low and large companies, like Altria, enjoy economies of scale in distribution. Altria’s flagship Marlboro brand held 44% retail market share last year. For context, consider that the next ten largest brands only had a cumulative market share of 43.3%. Another positive for tobacco companies is that their products are addictive, which almost guarantees repeat customers, and also provides significant pricing power. A key part of Altria’s revenue growth strategy is price increases. For example, last quarter, the profit margin in the core “smokeables” category expanded by 2.6 percentage points to over 50%, driven by price increases. Higher prices are necessary to help offset declining volumes. Altria’s cigarette business reported a 2.1% decline in shipment volumes, also in the last quarter. As fewer U.S. consumers are taking up smoking, Altria needs to raise prices on its remaining customers to keep revenue growth intact.

The other measure being deployed to offset declining smoking rates is cost cuts. Altria has a lean cost structure. At the beginning of 2016, Altria announced an aggressive cost-cutting program to help keep earnings growing at a healthy pace. It believes it will achieve $300 million in annualized cost savings by the end of next year.

This strategy has fueled steady earnings growth for many years.

Annual EPS & Dividends Declared Per Share

These initiatives result in very high levels of free cash flow. Over the first six months of the year, Altria generated $1.058 billion in operating cash flow and spent just $77 million in capital expenditures. Free cash flow over the first half of 2016 was $981 million, representing 15% of revenue in that period, which is a high rate of free cash flow generation as a percentage of sales.

Such strong free cash flow results in a very high dividend rate. Altria has a very clear dividend policy, which is to distribute 80% of its adjusted earnings per share each year to investors. This gives investors a high degree of certainty that as long as Altria’s earnings are growing, the dividend will grow as well. That sense of predictability is an attractive quality for investors who desire income from their equity holdings.

Going forward, Altria will also generate growth from its other product offerings. Many investors likely associate Altria with the Marlboro brand, but it operates a diversified business. Its other brands include Skoal and Copenhagen chewing tobacco, John Middleton cigars, the Ste. Michelle Wine Estates brand and, lastly, a significant equity stake in brewer SABMiller (SBMRY). These products contribute to Altria’s growth to offset declining smoking rates. A compelling growth catalyst for Altria is its NuMark subsidiary, which manufactures heated tobacco and other e-cigarette products. Last quarter, Altria expanded its MarkTen XL product to stores, which represent 50% of e-vapor volume in retail channels.

Over the first half of 2016, Altria grew adjusted earnings per share by 11%. Next year, analysts expect Altria to generate 9% earnings growth, which will likely give the company more than enough room to raise its dividend again in 2017. The stock has a modest valuation. Altria trades for 22 times its adjusted earnings per share. Since it generates above-average growth, Altria’s valuation is not unreasonable.

The Bottom Line

Consumer staples stocks are in favor, thanks to their steady business models and reliable dividend payouts. Within the consumer staples sector, Altria is one of the most highly regarded dividend stocks of all time. It has increased its dividend 50 times in the past 47 years.

Altria’s new annualized dividend rate represents a 3.7% current dividend yield, based on its recent closing share price. The S&P 500 Index has an average dividend yield of approximately 2.1%, which means Altria is an attractive stock for dividend investors.