Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, earnings of several iconic, dividend-paying companies have drawn scrutiny from our readers. Gilead Sciences (GILD ) has taken the first place on our list, as the company lowered its earnings outlook. Meanwhile, Apple (AAPL ) and Verizon (VZ ) released their earnings for the latest quarter, and the latter also made headlines with an important acquisition. Lastly, McDonald’s (MCD ) dropped after announcing a lousy earnings report.

Gilead Sciences

Biotechnology firm Gilead Sciences has seen its viewership rise exactly 100% in the past week compared to the same period a week ago, as the company’s stock and its business have continued to head down. This Monday, the company lowered its outlook for the full year and reported falling profits. The stock took a dive as a result, down nearly 7% over the past five days. Since the beginning of the year, shares have dropped nearly 20%.

Gilead, which currently yields 2.31% annually, said its profits for the second quarter fell 22% compared to the same period a year ago largely on the back of falling sales of its hepatitis C drugs Sovaldi and Harvoni. The healthcare firm was recently on the receiving end of criticism for charging as much as $84,000 for one Sovaldi treatment, making it harder for the company to increase the prices further. In addition, competitors AbbVie (ABBV ) and Merck (MRK ) have launched similar products over the past year, again putting pressure on the firm’s bottom line. Going forward, the company will definitely need to introduce new therapies to keep growing. It has a promising pipeline, with a hepatitis B drug close to commercialization.

Apple

Technology giant Apple (AAPL ) is always making headlines when it releases earnings. This time around was no exception. The company has seen its traffic rise 43% this week, as it released earnings that positively surprised analysts. As a result, shares have risen more than 5% over the past five days, trimming year-to-date losses to just above 1%.

Despite registering a slowdown in revenues and profits, the company’s net income beat analysts’ estimates largely due to selling more lower-cost iPhones. The firm’s recently launched iPhone SE was in high demand last quarter, exceeding management’s estimates. Demand for its flagship models, iPhone 6 and 6S, was rather subdued. This development prompted industry watchers to worry that SE may cannibalize the upcoming top-of-the-range version, which usually delivers Apple higher margins. In addition, it appears that cheaper alternatives running on Android are selling in increasingly higher numbers, particularly in China — an important region for the company’s growth strategy.

McDonald's

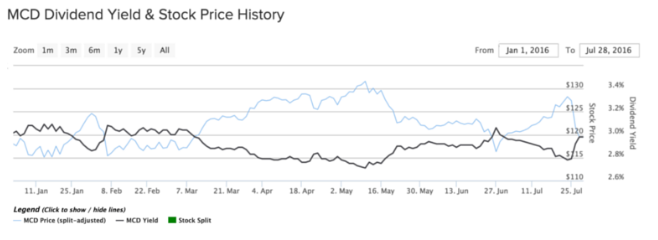

McDonald’s (MCD ) has taken the third spot in our weekly list with a 26% increase in viewership. Just like other firms on the list, the Golden Arches reported its earnings on Tuesday, which came in mixed. However, Wall Street judged the report as lousy and sent the stock down more than 7%. Year-to-date, shares are still slightly up.

The company’s second quarter net income of $1.45 per share was above estimates of $1.38, but sales of $6.26 billion lagged behind forecasts of $6.27 billion. It was the sales number that got investors worried and caused them to flee the stock. Stumbling sales put a big question mark on the company’s turnaround process in the U.S. The all-day breakfast menu initially proved a hit with customers, but concerns linger that the turnaround may flag in the face of increased competition. However, these disappointing numbers could be due to industry-specific factors and a slowdown across the fast-food industry. Yum Brands (YUM ), for instance, also reported weak earnings.

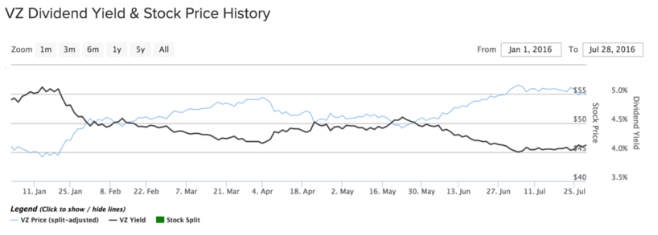

Verizon

Verizon has been in the spotlight recently not only for its earnings report, which was mixed, but also for its acquisition of Yahoo’s core business. The telecommunications company, which yields 4.2% per year just in dividends, has seen its traffic rise 15% this week compared to the week-ago period, largely because of these two events. Investors were somewhat undecided about what to make of all this, sending the stock slightly down over the past five days. Verizon’s shares are up nearly 19% since the beginning of the year.

The telecommunications firm has made the headlines with its buyout of the once high-flying tech company Yahoo. Verizon has paid $4.8 billion in cash — substantially less than initially estimated. The low figure was probably due to the uncovering of many weaknesses during the takeover contest between potential bidders. Verizon’s acquisition is not surprising; it had the upper hand on Yahoo’s business since the beginning of the bidding process largely because of synergies it could obtain from a combination with AOL — another former tech darling that was acquired last year.

The Bottom Line

This past week has been all about earnings and Yahoo’s acquisition of Verizon. Both Apple and Verizon have posted mixed performance for the second quarter, while Gilead and McDonald’s largely disappointed.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.