Master Limited Partnerships, or MLPs, are favored in the current investing climate. With interest rates near historic lows, and many economists doubting whether the U.S. Federal Reserve will increase rates this year, investors have flocked to MLPs in a massive search for yield. Investors looking for yield often turn to MLPs. But many MLPs have been slammed in the past two years due to the steep decline in oil and gas prices.

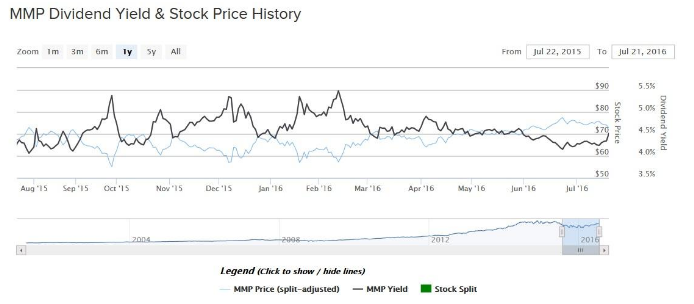

This year, the price of oil has recovered to $45 per barrel in the United States and has nearly doubled off the February low. The rally in commodity prices has caused a similar rally in many MLPs, including Magellan Midstream Partners (MMP ). Its huge yields are highly sought after by income investors, and many MLPs have seen their unit prices rally this year. Magellan has returned 9% over the past one year, not including dividends. This is far better performance than the S&P 500 Index in the same time. Magellan’s share price performance is even more impressive considering the broad sell-off in the energy sector over the past year.

Magellan has displayed excellent relative strength. The units are just 3% off the 52-week high. Such strong performance is a testament to Magellan’s effective management team and high-quality network of assets.

Stable Cash Flow Fuels Distribution Growth

Magellan is in the midstream segment of the energy sector. It owns and operates transportation and processing assets including pipelines and storage terminals. In fact, Magellan owns the longest refined petroleum products pipeline system in the U.S., and it has access to nearly half of the country’s refining capacity. It has storage capacity for 95 million barrels of petroleum products such as crude oil and gasoline. Magellan has a 9,600-mile refined products pipeline system with 53 connected terminals and an additional 27 non-connected terminals. It also owns approximately 1,700 miles of crude oil pipelines and storage facilities, as well as five marine terminals located along coastal waterways.

The best aspect of Magellan’s business model is its consistency. Midstream companies operate similarly to toll roads. Magellan collects fees based on the volumes of oil and gas it processes and transports. As a result, Magellan is not as vulnerable to volatile swings in commodity prices as companies in the upstream segment that are involved in exploration and production of oil and gas. Magellan’s operating structure is more stable. As long as demand remains steady, the company will continue to generate cash flow, experiencing a milder dip when commodity prices decline.

The value of MLPs is evident by their distributable cash flow, a non-GAAP metric that displays how much cash flow an MLP generates that is available to be distributed to unitholders. Last year, Magellan generated record distributable cash flow of $942.9 million, up 7% from the previous year. This growth was primarily due to higher refined products pipeline fees, increased shipments on the company’s Longhorn and BridgeTex crude oil pipeline systems, and growth resulting from the 2014 acquisition of the 40-mile Houston crude oil pipeline. This relative consistency allows midstream businesses like Magellan to generate significant cash flow each year, which the company returns to investors as high distribution payments.

One example of this is Magellan’s recent distribution increase. On July 21, the Board of Directors approved an 11% increase in the quarterly distribution, from $0.74 per unit to $0.82 per unit. The new annualized distribution will rise to $3.28 per unit and is payable Aug. 12 to unitholders of record on Aug. 1. Magellan has a long track record of steadily increasing its distribution. This raise represents the 57th distribution increase since the company went public in 2001. The company expects to raise its distribution by at least 8% next year, while maintaining a 1.2 distribution coverage ratio.

Magellan has increased distributable cash flow and distributions steadily over the past five years.

Magellan has experienced a slowdown to start 2016, as the decline in commodity prices has had a modest effect on the company’s refined products segment, which is somewhat affected by falling commodity prices. Every $1 per barrel change in the price of crude oil results in a roughly $3 million impact to distributable cash flow. Magellan’s distributable cash flow declined 12% last quarter, but despite this mild dip in performance, the company maintains an optimistic forecast. Management raised its full-year guidance for distributable cash flow by $10 million and now expects $910 million in distributable cash flow this year.

To drive future growth, Magellan intends to develop and complete new projects. For example, last year the company spent $666 million on organic growth capital expenditures. In addition, it recently announced plans to construct a new high-capacity marine terminal in Texas to handle refined petroleum products. The estimated cost of the project is $335 million, and it is projected to be operational in early 2019. The project is likely to contribute meaningfully to future cash flow, as Magellan has secured the project with a long-term customer commitment.

The Bottom Line

Magellan generates significant cash flow, even with commodity prices falling over the past two years. It is able to return a great deal of this cash flow to unitholders. Based on the July 22 closing price, the company has a 4.5% yield, which is more than twice the dividend yield of the S&P 500. As a result, Magellan is an attractive stock pick for income investors.