Utility stocks are very popular with income investors. Historically, utilities were often called “widow-and-orphan” stocks because they provide steady profits and dividends, thanks to their defensive and stable business models. The rationale for defensive investors buying utility stocks is that because every household needs to keep the lights on, even when the economy goes into recession, these stocks can pay dividends without interruption. Electricity is a necessity that no one can do without, and as a result, utilities generate highly predictable earnings and achieve modest growth each year through economic growth and rate increases. Utilities return a high amount of their earnings to investors as dividends and typically offer dividend yields above the market average.

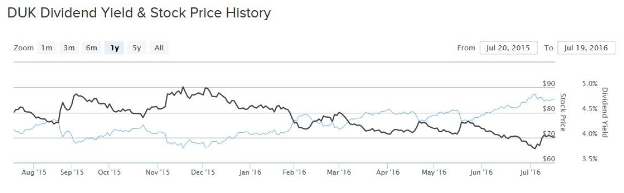

On July 11, utility giant Duke Energy (DUK ) declared a quarterly dividend of $0.855 per share. The dividend is payable Sep. 16, 2016, to shareholders of record on Aug. 12, 2016. This is a 3.6% dividend increase from the previous dividend rate. It has a long history of steady dividends: Duke has now paid a dividend to shareholders for 90 years. Its stock has enjoyed a significant rally over the past year, up 17% in the past one year through its July 19 closing price. That is a far greater return than the S&P 500, and it does not even include Duke’s dividend payments in that time. Duke is a strong stock pick for income.

Slow and Steady Wins the Race

Duke Energy is a regulated utility, meaning it has a large regulated business. This differs from a non-regulated business because regulated utilities must get rate cases approved each year before raising rates. Although this sounds like a headwind for growth, regulated utilities are actually strong performers because most rate cases receive favorable outcomes. This allows for a steady increase in profitability from year to year. Indeed, Duke Energy has been a model of consistency over the past five years.

Duke Energy exhibits the slow and steady growth in profits and dividends that investors have become accustomed to from utilities. Going forward, not only will the company grow earnings thanks to rate increases, but a separate growth catalyst could come in the form of renewable energy. Duke Energy’s generation assets still mostly comprise coal-fired plants, but it is steadily increasing its investment in renewables. For example, Duke Energy has invested $4 billion in wind and solar projects since 2007. Combined, Duke owns 2,500 megawatts of wind and solar assets. In addition, Duke is a major player in biopower — a renewable energy made from organic material. The advantage of biopower is that it provides electricity on demand with high capacity, much like fossil fuels but with the added benefit of being carbon-neutral. Duke has contracts to purchase more than 300 megawatts of electricity from biomass power plants in the Carolinas and Florida.

The greatest risk for utilities going forward is rising interest rates. Although interest rates remain historically low, the U.S. Federal Reserve could move to raise them again this year or in 2017. This matters for utilities because higher interest rates will raise their cost of capital. To finance their assets, utilities turn to the debt markets. When interest rates go up, it will be harder to raise capital at attractive rates. This could result in weaker earnings growth going forward, as companies have to spend more to finance.

Fortunately, Duke Energy is more than profitable enough to withstand a rise in interest costs. Last year, Duke earned an adjusted $4.54 per share in profit. Management expects earnings growth to pick up once again in fiscal 2016 due to favorable rate outcomes and steady economic growth in its key customer regions. This year, Duke projects $4.50-$4.70 per share in 2016 adjusted earnings. At the midpoint of that range, Duke Energy would increase earnings per share this year by 1%. Analysts expect Duke Energy to grow earnings per share by another 3% next year.

Future earnings growth should give the company enough flexibility to continue raising dividends each year, as Duke has a modest payout ratio. For example, Duke’s new $3.42 per share annualized dividend payout represents 75% of last year’s earnings per share and 73% of projected 2016 earnings. These payout ratios are somewhat high, but they are still manageable given that the earnings power of the utility business model is fairly easy to predict, with few surprises.

With its consistent profitability, Duke rewards shareholders with a high dividend payout. After the dividend raise, Duke now pays an annual dividend of $3.42 per share, which equates to a 4% yield based on its current share price.

The Bottom Line

As above-average dividend payers, utilities still have a valuable place in a retiree’s portfolio. Well-run utilities such as Duke Energy help to lower a portfolio’s volatility and increase its dividend income. Investors may want to monitor Duke’s valuation — the stock trades for a P/E multiple of 18, on par with the S&P 500 — and the company will need to continue growing earnings in order to justify this valuation. Higher interest rates are a potential concern, but Duke is a highly profitable company with strong management and an attractive dividend.