Kroger, Inc. (KR ), the largest supermarket chain in the U.S., has enjoyed a major resurgence over the past few years. It instituted a company-wide policy to more effectively respond to changes in consumer preferences, such as the desire for more natural products like organics.

In addition, earlier this year Kroger acquired supermarket chain Roundy’s – operator of the Pick ‘n Save brand as well as the popular Mariano’s banner – for $800 million including debt, to gain more exposure in the Midwest.

These initiatives resulted in significant earnings growth for Kroger’s. In turn, the stock has done very well. Based on its June 23 closing price, Kroger stock price returned 40% in the past two years, not including dividends. This performance significantly outperformed the S&P 500 in the same period.

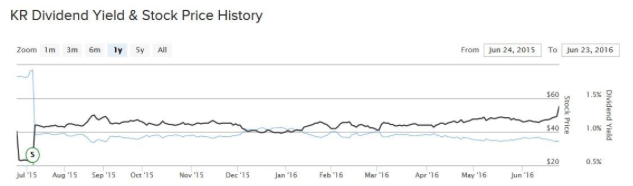

As a reflection of its success, Kroger can return more cash to shareholder. On June 23, Kroger raised its dividend by 14% and announced a new $500 million share repurchase authorization. Kroger’s new quarterly dividend will be $0.12 per share, up from $0.105 per share in the previous quarter. The new dividend will be payable Sept. 1 to holders as of record on Aug. 15. On an annualized basis, Kroger’s dividend rate will be $0.48 per share, which provides a 1.4% dividend yield.

Industry-Leading Growth

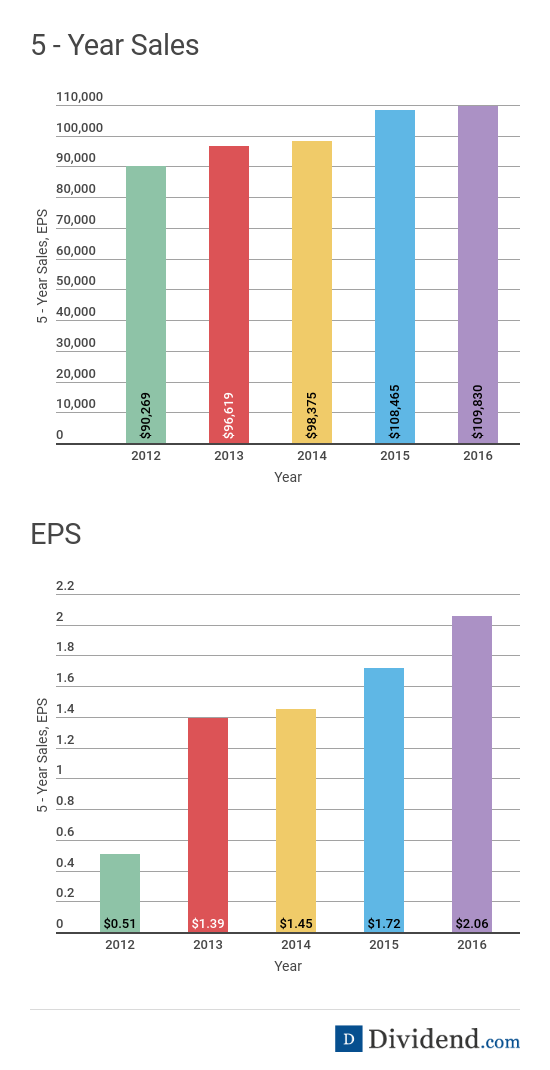

While many other supermarket chains are struggling, Kroger has taken share from its competitors and is enjoying significant growth because of it. Kroger owns and operates the Ralphs, Smith’s and Food-4-Less grocery chains, as well as its namesake Kroger supermarkets and, now, Mariano’s. Kroger has a proven track record of success, with an industry-leading 50 consecutive quarters of same-store sales growth. Same-store sales is a metric for retailers that measures sales at locations open at least one year, and is a critical sign of a retailer’s ongoing success. Kroger implemented several strategic initiatives, including acquisitions and investments in technology that have helped the company grow sales and earnings at high rates over the past five years.

Kroger has achieved this long streak of success due to management’s “Customer First” initiative, which called for a strict focus on low prices, store quality and customer service. Kroger has also invested in technology to capture a piece of the high-growth e-commerce segment. Kroger merged with Harris Tweeter two years ago, which has worked out well because the deal gave Kroger access to Harris Tweeter’s technological capabilities, particularly ClickList – which allows shoppers to order online and pick up items in-store. Since Kroger has a very large and efficient distribution network, it has successfully leveraged its e-commerce capabilities. Kroger has expanded ClickList and ExpressLane online ordering services to 25 markets.

Separately, Kroger has significantly boosted its natural and organic offerings. U.S. consumers are paying closer attention to what they are eating like never before. This is why Kroger has seen strong growth of its natural and organics products. In April, Kroger invested in Lucky’s Market – a specialty store focusing on natural and organics – which has 22 locations.

The results speak for themselves. Kroger is off to a good start in fiscal 2017. Last quarter, in its fiscal first quarter, Kroger increased its same-store sales by 2.4% compared to the same quarter last year. Kroger earned $0.70 per share last quarter, which was 13% year-over-year earnings growth. Kroger’s total sales rose 4.7%, and excluding the effects of gasoline price deflation, sales (excluding fuel) rose 7.8%. Kroger’s sales growth last quarter was boosted by its Roundy’s acquisition. Excluding fuel and Roundy’s, sales were up a more modest 3.5% year-over-year. In addition to sales growth, Kroger is growing earnings due to a strict focus on cost controls. Last quarter, Kroger’s total operating expenses excluding fuel and Roundy’s decreased four basis points as a percentage of sales.

From a valuation perspective, the stock appears modestly valued given its excellent growth. Kroger management expects the company to earn $2.23 per share at the midpoint of its 2016 guidance. Based on its June 16 closing price, the stock trades for approximately 16 times 2016 EPS estimates. This is about on par with the S&P 500, so the valuation still appears comfortable. Analysts expect Kroger’s growth to continue into 2017 as well. Analysts forecast the company will grow earnings per share by another 9% next year.

There is plenty of room for Kroger’s dividend growth to continue. The company maintains a trailing payout ratio of just 18%. Because of its earnings growth and extremely low payout ratio, Kroger should have no trouble raising its dividend at double-digit rates per year over the next several years.

The Bottom Line

Kroger is growing sales and profit at high rates, despite operating in a brutally competitive industry. It has shared its success with shareholders by raising its dividend and buying back its stock. Kroger has a low current dividend yield, but it compensates for this with high dividend growth.