Retail has endured significant difficulty over the past year. The sector has had to grapple with a number of challenges, including unseasonable weather conditions, the strong U.S. dollar, and slowing economic growth. But more so than anything, the toughest headwind has come from online competition. Internet retailers such as Amazon.com (AMZN) have taken significant market share from brick-and-mortar retailers. A wide variety of goods can be purchased on Amazon and other online retailers often for lower prices than physical retailers can offer.

However, one group of retailers has bucked the trend of broad weakness. These are the home improvement retailers, one of which is Lowe’s Companies (LOW ). Lowe’s is the second-largest home improvement retailer in the United States. It has a very strong position in its industry and is still growing sales and earnings thanks to its unique offerings.

In addition, Lowe’s offers something Amazon can’t; consumers are typically reluctant to purchase home improvement supplies on the Internet. Home improvement projects come in all shapes and sizes, meaning it is important to be able to inspect products in person and ask staff members questions to make better decisions. This has led to a great deal of success for Lowe’s, and it is sharing its success with investors through a growing dividend.

Lowe’s Fundamental Advantage

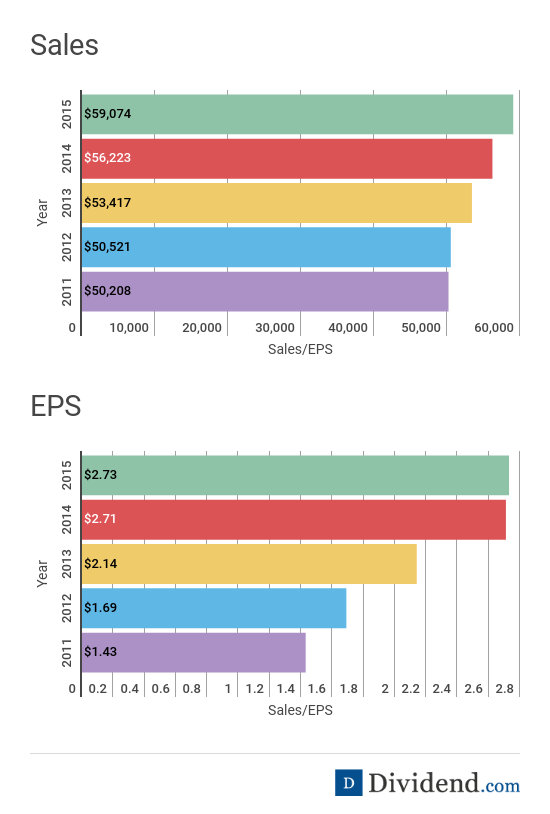

One of the only areas of brick-and-mortar retail that is still performing well is home improvement. Consumers are still spending on their homes thanks to a strong labor market and rising home prices. This has greatly helped Lowe’s over the past year. Comparable sales, a crucial metric for retailers that measures sales at locations open at least one year, increased 7% last quarter, year over year. Lowe’s repurchased shares and effectively managed costs, which led to 40% earnings growth in the first quarter. This comes on top of a very strong performance last year. Lowe’s grew earnings 21% in 2016. Moreover, the company has had a long history of sustainable growth.

Going forward, Lowe’s is projecting another successful year in 2016. Comparable sales and total sales are expected to rise by 4% and 6% this year, respectively. Future growth will be aided by continued improvement in the U.S. labor and housing markets as well as international expansion. Lowe’s is forecasting further growth in U.S. home prices and incomes, which should fuel greater discretionary spending by consumers. And, earlier this year, Lowe’s acquired Canadian home retail company Rona for $2.3 billion. Lowe’s expects the deal to close in May. This could be a very promising acquisition for Lowe’s because it does not yet have a meaningful presence outside the United States. Rona operates 700 stores across Canada, while Lowe’s only has around 40 stores in Canada, a tiny percentage of the more than 1,800 stores it operates in North America.

Another advantage for Lowe’s against Internet retail is that it has a focus on omni-channel fulfillment. Lowe’s recently opened a third contact center in Indianapolis along with two urban stores in Manhattan. The company has also relaunched LowesforPros.com to further leverage its digital channel capabilities.

Excellent Dividend Growth Prospects

Lowe’s is a tremendous dividend growth stock. The company has paid a cash dividend to shareholders each and every quarter since it first went public in 1961. Even better, it has raised its dividend for 54 years in a row. Lowe’s is certainly a Dividend Aristocrat, the name for the group of companies that have raised dividends for at least the past 25 consecutive years. Furthermore, Lowe’s is one of a select group of companies with 50 or more years of uninterrupted dividend growth.

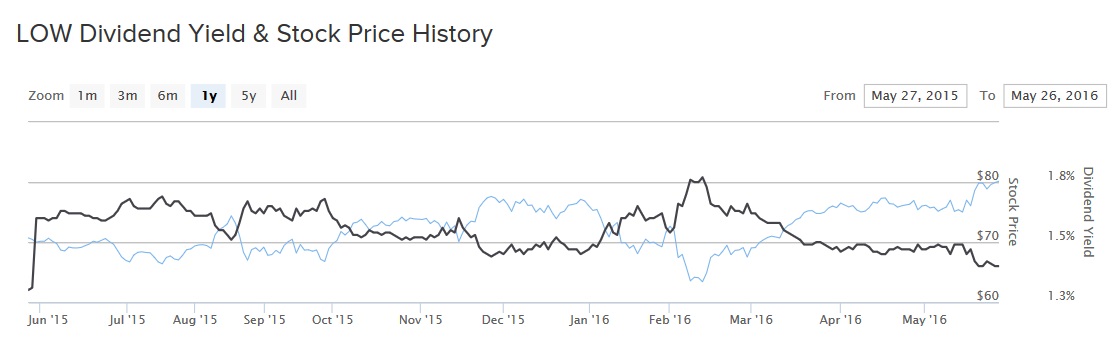

At its annual shareholder meeting on May 27, Lowe’s announced that it has approved a new quarterly dividend of 35 cents per share. This is a 25% increase from its prior dividend level. On an annualized basis the new dividend rate will be $1.40 per share. Based on its May 26 closing price, this results in a 1.7% dividend yield at the present time. The 1.7% dividend yield is below the S&P 500 average dividend yield of roughly 2%, but Lowe’s makes up for this with high dividend growth each year. The dividend will be payable August 3 to shareholders of record as of July 20.

Lowe’s should have no trouble increasing its dividend at high rates for many years to come due to its earnings growth and low payout ratio. Analysts expect Lowe’s to earn $4.61 per share next year, which would represent 16% year-over-year growth. Moreover, Lowe’s new dividend rate represents just 35% of its projected 2016 EPS. This should allow Lowe’s to continue raising its dividend in the high teens on a percentage basis going forward.

The Bottom Line

Lowe’s is a highly profitable company with an entrenched position near the top of the home improvement retail industry. It has proven to be somewhat Amazon-proof. While Amazon could someday render many more brick-and-mortar retailers obsolete, Lowe’s is significantly insulated from this risk because of its specialty. It should continue to grow sales, earnings, and dividends for many years to come. As a result, it is a very good stock pick for dividend growth.