It seems crazy to suggest that in this climate, investors can find dividend growth in the energy sector. With the price of oil collapsing from a high of $100 per barrel in 2014 to a low of $27 per barrel in February, dividend cuts are the norm in the oil and gas industry. Profits are drying up across the sector, which makes it very hard for companies reliant on a supportive commodity price to pay dividends to shareholders. But not every energy company is the same; there are some energy companies that actually benefit from lower oil prices. These are the refiners like Phillips 66 (PSX ).

Thanks to its strong business model and shareholder-friendly management team, Phillips 66 generates more than enough earnings to pay a substantial dividend to shareholders. It also returns cash through stock buybacks and is committed to raising its dividend over time. On May 4, Phillips 66 announced a 12.5% dividend increase. The new quarterly payout goes to 63 cents per share quarterly, or $2.52 per share annualized. The dividend is payable on June 1, 2016, to shareholders of record as of the close of business on May 18.

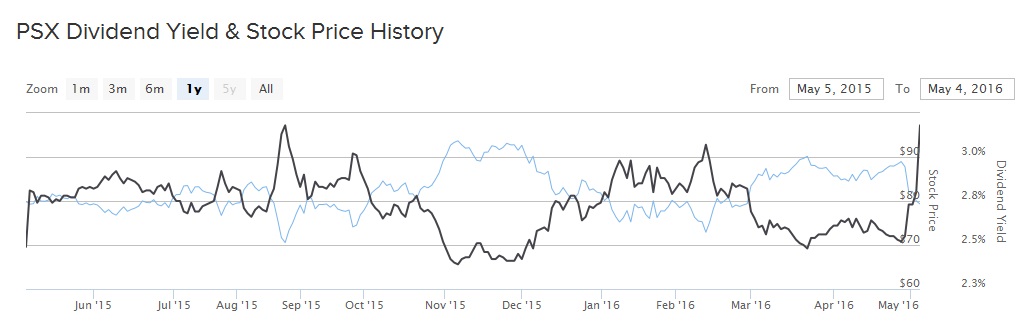

Based on its May 4 closing price of $79.52, Phillips 66 stock is down just 1% over the past year. The stock has performed admirably considering the huge damage across the energy sector as a whole. Phillips 66 has outperformed its industry peers by a wide margin and is one of the few energy stocks consistently increasing its dividend, even during the industry downturn.

Strong Business Model Fuels Dividends

Phillips 66 has the backing of legendary investor Warren Buffett. His firm Berkshire Hathaway has invested heavily in the company and is now one of its largest shareholders. Berkshire has taken a 10% stake in Phillips 66, equating to a nearly $5 billion investment. Buffett likes the company because of its strong business model and effective management team. Buffett also said he likes the fact that Phillips 66 isn’t a pure-play refining stock. Indeed, the company has a large midstream energy transportation business as well as a chemicals segment.

It may surprise investors to know that a certain corner of the energy market could actually perform better when oil prices decline, but it is indeed true. Over the past year, oil refiners have actually seen their profitability improve as the price of oil collapsed. The reason for this is because as oil falls, so do refining feedstock costs. This expands refiners’ spreads and margins and results in a huge boost to earnings.

Phillips 66’s adjusted earnings rose 10% in 2015 to $4.1 billion. Refining was the strongest performing group for the company. Adjusted profit in refining soared 60% for the year, which represents a significant tailwind for the company since refining makes up 60% of total earnings. Going forward, Phillips 66 has several projects in the works to keep profits growing. These include the Sweeny Fractionator One, with a capacity of 100,000 barrels per day, and the Freeport LPG Export Terminal, with capacity for 150,000 barrels per day. The Sweeny project announced first startup on December 8, and the Freeport project is on schedule to ramp up in the second half of 2016.

However, conditions deteriorated somewhat in the first quarter 2016. Last quarter, the company’s adjusted earnings declined 56% year over year due primarily to an 82% decline in refining profit. This was due to lower refining margins, driven by the recovery in oil prices. Still, its consistent profitability allows Phillips 66 to return lots of cash to shareholders. For the year, the company repurchased 19.3 million shares of common stock for $1.5 billion and paid $1.2 billion in dividends. Since July 2012, the company has repurchased 92.5 million shares for $6.4 billion.

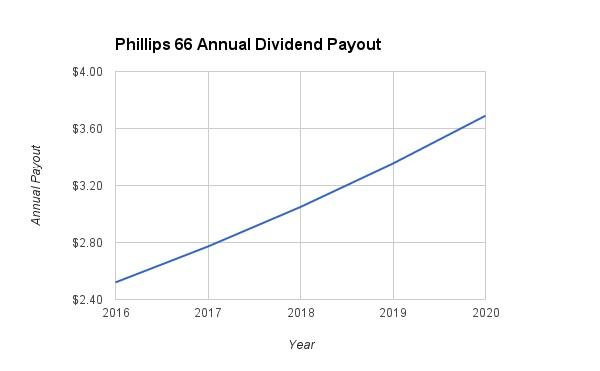

The recent dividend raise is the sixth dividend increase for Phillips 66 since its initial public offering in 2012. Over that time the company has increased its payout by 33% compounded annually. Going forward, investors should expect continued dividend growth based on its earnings growth prospects and low payout ratio. Earnings are expected to grow another 25% next year. Phillips 66 has a payout ratio of 36% based on its 2016 projected earnings. Therefore Dividend.com is forecasting 10% annual dividend growth for Phillips 66. Under this assumption, the payout will reach $3.69 per share in 2020.

The Bottom Line

Phillips 66 is one of the few energy stocks that actually benefited from falling oil prices. This has allowed its earnings and stock price to substantially outperform the broader energy sector over the past year. As its fundamentals improve, Phillips 66 is committed to enhancing shareholder value by providing a growing dividend. As a result, Phillips 66 is a strong dividend stock.