Biotechnology giant Gilead Sciences (GILD ) is a highly profitable company. It generates billions of dollars in cash flow each year and has tens of billions of cash on its balance sheet. The company is a relatively new dividend stock—it has only paid a dividend for one year—but management has demonstrated a commitment to a consistent dividend program by recently raising its dividend.

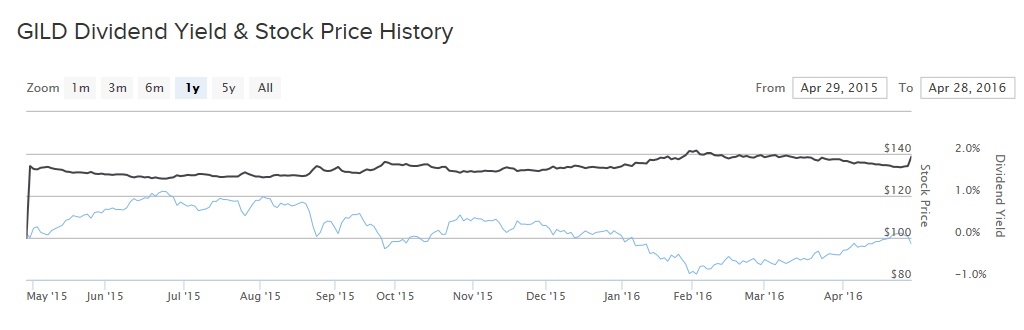

On April 28, Gilead declared its second-quarter dividend; the payout will be 47 cents per share, compared to the previous dividend level of 43 cents per share. The dividend raise comes out to a 9.3% increase. On an annualized basis, Gilead’s dividend rate increases to $1.88 per share, which is a 2.1% dividend yield based on the April 29 closing price of $88.21 per share.

Investors continue to be concerned regarding Gilead’s slowing growth and its future drug pipeline. It has two core properties which constitute a large portion of total sales, and since the market is a forward-looking mechanism, the stock is beginning to price in the effects of generic competition. This is why Gilead’s share price fell 9% on the day it reported earnings, even though it announced a solid dividend increase.

Gilead holds a very attractive valuation: the stock trades for just 8x 2016 earnings projections, and its dividend yield is competitive with the S&P 500. As a result, Gilead should be considered a top stock pick for investors interested in value and income.

Pipeline Concerns Are Overblown

Gilead generated revenue of $32.6 billion last year, which represented a 30% year-over-year increase. Its high revenue growth rate was due to its flagship hepatitis C drugs, Harvoni and Sovaldi. Such strong revenue growth translated into 62% earnings growth for the full year. In addition, Gilead generated $20 billion of operating cash flow last year. But the concern for investors, and the reason for Gilead’s extremely cheap valuation, is that growth is dramatically slowing down. Reflecting this, the stock has not performed well. It is down 12% year to date and 13% over the past one year and has underperformed the S&P 500 in both periods. Investors seem worried that the high growth rates seen in recent years will not last. Indeed, the high growth seen in 2015 and in prior years was due largely to the huge success of Harvoni and Sovaldi. These two drugs, which collectively generated $4.2 billion of sales in the first quarter, now represent approximately 55% of Gilead’s total revenue.

It is true that growth in these two product categories is beginning to slow down. Worldwide sales of Harvoni declined 15% last quarter compared to the same quarter last year. This is a particularly big concern because Harvoni itself is a $3 billion drug by revenue each quarter. Because of this, Gilead’s total sales were $7.8 billion in the first quarter, up 2% from the same quarter last year. The company still achieved growth but at a far lower rate than previous periods. Consider that Gilead’s total sales grew 16% in the fourth quarter of 2015. Furthermore, sales could even begin to decline—Gilead management forecasts $30-$31 billion in total sales this year, which would represent a decline from last year’s $32.2 billion in total sales. Gilead’s earnings are expected to increase just 1% in 2017.

But whatever growth the company cannot generate organically, it can easily pursue through aggressive mergers and acquisitions. Gilead ended the first quarter with $21 billion in cash, equivalents, and marketable securities on its balance sheet, compared to just $10 billion in current liabilities. It could easily make a significant acquisition or several, which could replenish its future pipeline and add to revenue and earnings growth going forward.

Dividend Growth Expectations

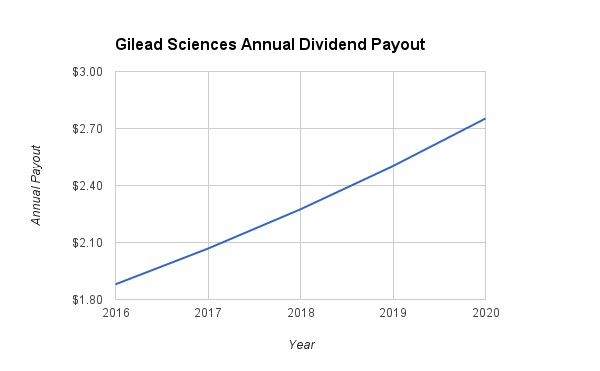

Gilead generates high levels of free cash flow, has a strong balance sheet, and also has a low payout ratio. It is a tremendous cash flow generator and uses a large amount of cash flow to reward shareholders with buybacks and dividends. Not only has Gilead increased its dividend, but the company is also in the process of a $12 billion share repurchase program. The payout ratio is just 13% based on projected 2016 earnings estimates.

As a result, investors should expect dividend growth to continue, even if sales and earnings remain flat this year and next year or decline slightly. In addition, there is even the potential for double-digit dividend increases on a percentage basis because of its extremely low payout ratio. Gilead has the necessary metrics to be a high dividend growth stock. Consequently, Dividend.com is modeling 10% annual dividend growth over the next several years. Under this assumption, Gilead’s annual payout would reach $2.75 per share by 2020.

The Bottom Line

Investors are highly concerned about the threat of generic competition facing Harvoni and Sovaldi. It is possible that Gilead’s flagship drug products could see intense competition going forward, and the company may lose market share. But investors are missing the fact that with such high levels of profitability and so much cash on the balance sheet, Gilead can simply buy growth through mergers and acquisitions.

Gilead stock is extremely cheap and appears undervalued right now. The market is pessimistic, but this could be a very good buying opportunity. Gilead remains a top dividend stock.