On April 6, retailer Bed Bath & Beyond Inc. (BBBY ) initiated a dividend for the first time when it reported fiscal fourth-quarter and 2015 full-year financial results. The initial dividend level will be 12.5 cents per share paid quarterly, or 50 cents per share on an annual basis. While this does not seem like a huge move—the current yield is just 1.1%, almost half the level of the S&P 500 average yield—it represents a major change to the company’s capital allocation program.

Previously, Bed Bath & Beyond did not pay a dividend at all. Instead, it chose to return cash to shareholders through a significant stock repurchase program. But these buybacks did not effectively create value. For example, based on its April 11 closing price, the stock has lost 36% of its value over the past one year. This is despite the company spending billions of dollars to buy back its stock in recent years.

Investors should view this decision as a positive catalyst. Bed Bath & Beyond is now a dividend stock, which it was not prior to the dividend initiation. While the current yield is low, the company has strong underlying fundamentals, which should allow it to raise its dividend at high rates each year going forward.

Get all the latest dividend increases in our payout tool available for premium members.

Why This Is a Positive Catalyst

Bed Bath & Beyond’s decision to start paying a dividend should be a positive catalyst for the stock. Now that it is officially a dividend stock, institutional investors that only invest in dividend stocks, such as various dividend mutual funds, can now buy the stock. Moreover, individual investors at the retail level who do not invest in stocks that do not pay dividends, will perhaps consider buying the stock as well. This means Bed Bath & Beyond stock will likely see higher demand, which could help support a higher share price.

It is clear that now is the right time for Bed Bath & Beyond to start paying a dividend. Fundamentally, there is little reason not to. In fiscal 2015, the company earned $5.10 per share, up 0.6% year over year. The company is highly profitable, generates significant cash flow and is still growing, meaning earnings per share should only rise going forward. Bed Bath & Beyond’s comparable-store sales, a key metric for retailers that shows sales growth at locations open at least one year, rose 1.4% last year excluding foreign exchange fluctuations. Total sales increased 2.3% in constant-currency in fiscal 2015 to $12.1 billion.

Prior to the dividend announcement, Bed Bath & Beyond only returned cash to shareholders via stock buybacks. The company generated at least $1 billion in operating cash flow in each of the past two years, which allowed it to buy back a lot of stock. It spent $1.1 billion repurchasing its own stock last year, and $2.25 billion on buybacks in fiscal 2014. It bought back so much of its own stock that it had to take out debt to finance the repurchases since its buybacks exceeded free cash flow. Bed Bath & Beyond issued $1.5 billion in long-term debt in fiscal 2014.

Normally, stock repurchases help to increase the share price. When a company buys back its own stock, it reduces the number of shares outstanding. This helps boost earnings growth since each remaining share captures a greater percentage of a company’s earnings. In theory, higher earnings typically lead to higher share prices over time. But this was not the case here; Bed Bath & Beyond’s stock price has performed very poorly over the past year. The company will continue to repurchase shares going forward, but it is a good sign that management is willing to take a more balanced approach. As a result, it is an appropriate time to change course and devote less money to share repurchases, and instead pay shareholders a dividend.

Expect High Dividend Growth

All signs indicate Bed Bath & Beyond should have no trouble increasing its dividend each year going forward by a high rate of growth. Its current dividend represents just 10% of its trailing earnings. That is a very low payout ratio. Further, the company is growing sales and earnings at a satisfactory pace, which should give plenty of room for rapid increases to the dividend.

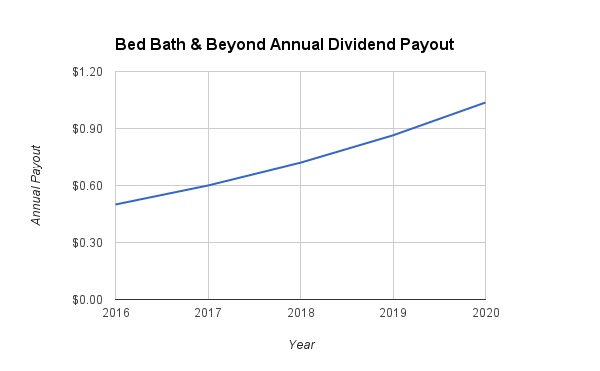

Based on this, Dividend.com is forecasting 20% annualized dividend growth each year going forward. The company’s dividend would grow to $1.04 per share by 2020 under this scenario.

The Bottom Line

Bed Bath & Beyond is highly profitable, generates a lot of cash flow, and recently decided to return a portion of that cash to investors via a dividend. While the initial dividend provides a 1.1% dividend yield, which is fairly low in relation to the S&P 500 Index, income investors can expect a high level of future dividend growth. By 2020, the company’s dividend could be more than double the current level. As such, investors should consider Bed Bath & Beyond stock as part of an income-focused portfolio.