The utility sector is a haven for income investors. Utilities have all the qualities of strong dividend stocks: recession-resistant business models, steady profits, wide economic moats, and manageable debt levels. In January, utility company Consolidated Edison (ED ) raised its dividend. ConEd stock is up 1% in the past year. It has outperformed the S&P 500 Index in that time, which is down 5%.

ConEd is a regulated gas and electric utility provider in the northeastern United States. It services more than 3 million customers, primarily in New York City. Consolidated Edison increased its annualized dividend to $2.68 per share, up from the previous $2.60 per share annualized payout. This is a 3% dividend increase and represents ConEd’s 42nd year in a row of consecutive dividend increases.

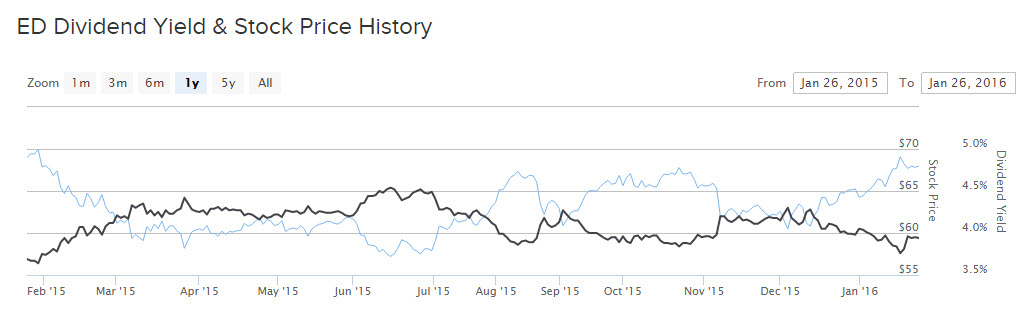

ConEd is a Dividend Aristocrat and its current dividend yields 3.8%. ConEd has a long track record of dividend growth, a sustainable payout ratio, and a high yield. As a result, it is a valuable holding for income investors.

Steady Profits Fuel Dividend Growth

Utilities like ConEd are not high dividend growth stocks. Dividend increases across the utility sector typically mimic inflation—but in exchange, utilities offer high dividend sustainability. Electricity is a basic need for society to function. It is essentially a matter of national defense. That places a great deal of stability underneath utility stocks. Consumers need to keep the lights on, even when the economy enters a downturn. That means utility profits are highly stable from year to year, even during a recession.

Plus, regulated utilities are allowed to pass through modest rate increases each year. Along with population growth, this keeps revenue and earnings growth intact for utility companies like ConEd. Indeed, over the first nine months of 2015, net income rose 1%, year over year. Excluding one-time gains and charges, earnings grew 4%. This is more than enough growth to sustain ConEd’s current dividend and to also provide the flexibility to raise dividends each year.

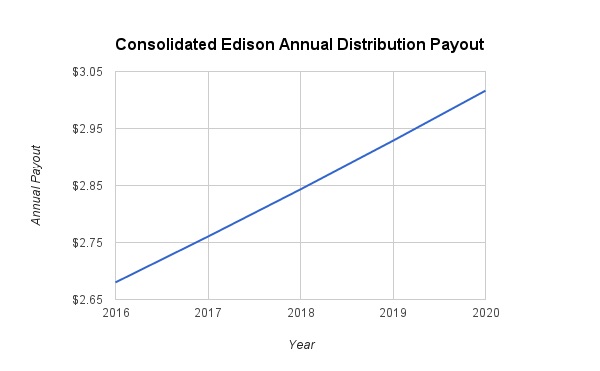

Going forward, investors should expect dividend growth in-line, or slightly below, annual earnings growth. This is how ConEd has managed its dividend increases over the past several years. The company maintains a consistent policy, which is to keep the dividend payout ratio between 60% and 70% of its adjusted earnings. ConEd’s current payout ratio is approximately 66%, so it is well within that range. As a result, I model 3% annual dividend growth through 2020, which should keep its payout ratio within the specified targets. The following chart depicts ConEd’s future dividends over the next several years.

ConEd’s dividend reaches $3.02 per share by 2020. Assuming earnings grow at historical averages, approximately 4%-6% per year, the dividend will still be sufficiently covered by earnings. This will allow the company to stay within its stated payout ratio target. In addition, modest dividend growth will allow ConEd to utilize a portion of earnings to improve its balance sheet.

The biggest risk for utilities like ConEd is interest rate risk. Utilities are vulnerable to higher interest rates because they typically carry high levels of debt to finance their long-term assets. Refinancing debt becomes more expensive when rates rise. As a result, it is appropriate to examine utility balance sheets before investing. Fortunately, ConEd has a manageable level of debt on its balance sheet.

ConEd’s future debt payments are spread out over the next several years. At the end of the third quarter, the company had $761 million of long-term debt due within the next year, and debt payments remain below $1 billion per year over the next several years. The company earned nearly $1.2 billion in net profit in the past four quarters, so it should easily service its debt, and also continue to raise its dividend each year going forward.

The Bottom Line

Utilities have long been known as “widow-and-orphan” stocks, because of their ability to pay quarterly dividends like clockwork, year after year. Many utilities have increased their dividends with regularity. ConEd is a great example of a steady utility with a long track record of dividend growth.

Income investors primarily own utilities for their stable earnings and dividends. Utility stocks are ideal choices for risk-averse income investors, such as retirees, because of their defensive qualities and secure business models. After all, people will always need electricity, even when the economy goes into a deep recession. This provides a great deal of certainty that the profits generated by a utility, and consequently their dividend payments, will stay intact each year. With a 3.8% yield and 42 consecutive years of dividend growth, ConEd is a top income stock in the utility sector.