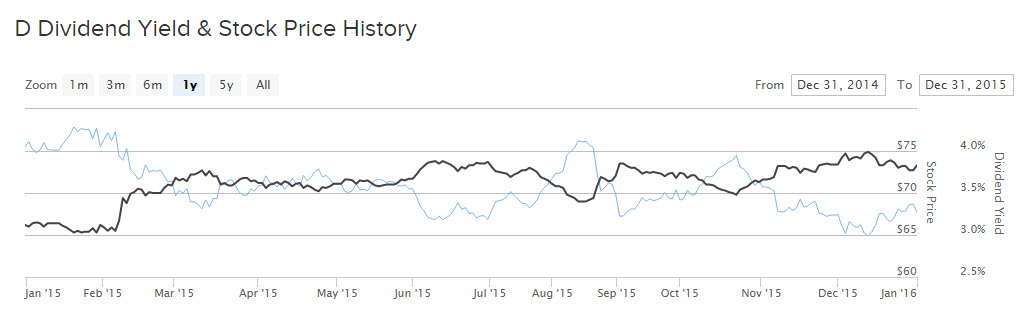

The utility sector is known for being a haven for income investors. Across the board, the vast majority of utility stocks pay dividends to shareholders. Some utility stocks provide yields that are double the average stock in the S&P 500, and many have maintained decades of uninterrupted quarterly dividends and annual dividend increases. In December, Dominion Resources (D ) raised its dividend by 8%. This brought the new annualized dividend to $2.80 per share. At its current $66 stock price, that results in a 4.2% current dividend yield. Dominion stock did not perform well in 2015. Shares declined 12% last year—a worse performance than the S&P 500 Index, which was flat in that time.

The stock performed poorly due to investor uncertainty and concern over rising interest rates, which can affect utilities disproportionately. However, investors should feel confident about Dominion because of its strong underlying fundamentals and future growth initiatives. Dominion generates enough profits to sustain its dividend, and handle higher costs from rising interest rates. The stock should remain a top dividend pick for income investors.

Dominion's Plan for Growth

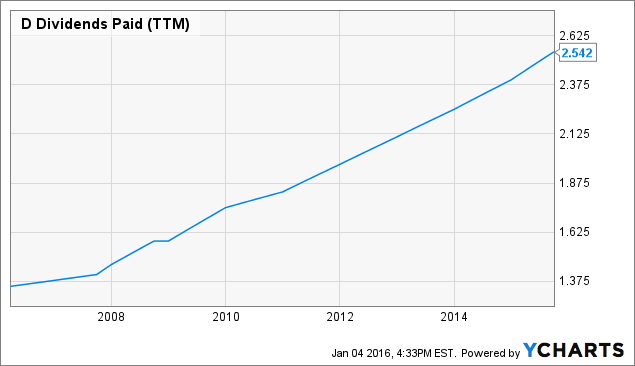

Dominion Resources management previously guided investors to expect 8% dividend growth each year through the end of the decade. The reason the company is projecting such a strong dividend growth rate over the next several years is because of its energy infrastructure growth plan.

The company’s strategic goal is to acquire modest gains in customers, which will boost revenue. Another way in which revenue can grow is through higher average bills. As a utility, Dominion can pass through regular rate increases. These factors helped the company produce steady earnings in 2015. For example, customer additions and higher average bills resulted in 10% earnings growth last quarter. Continued gains in these areas should fuel future earnings growth.

In the first nine months of 2015, Dominion’s operating earnings rose 7% year over year. This was a very satisfactory growth rate for a utility and speaks to the benefits of Dominion’s growth strategy. The company has invested in building midstream and other energy assets and is nearing completion on some key projects. Construction on the Brunswick County project, a 1,358-megawatt natural gas combined-cycle facility, is about 89% complete and is set to ramp up commercial operation in the middle of 2016. Furthermore, construction on the Cove Point liquefaction project is also progressing on time and on budget. The project overall is almost half complete.

Once these projects are complete, they should meaningfully add to Dominion, which already produces steady earnings growth from its core electricity operations. The one concern going forward is rising interest rates. As a utility, Dominion needs to utilize debt heavily within its capital structure to finance its long-lived fixed assets. Indeed, Dominion has a significant amount of debt. The company has just $250 million in cash on its balance sheet and $27 billion in total debt—but it is important to keep in mind that Dominion’s earnings are highly stable. Its product, electricity, is virtually a matter of national security. That places a great margin of safety underneath the stock and its dividend, which is why Dominion’s dividend has grown for many years in a row.

Dominion Remains a Top Income Stock

Dominion investors punished the stock last year on concerns over rising interest rates, but this concern appears overblown. Dominion has a long history of raising its dividend, even during years in which interest rates were relatively high. The expected 2016 dividend increase would mark the 13th consecutive year in which the annual dividend rate rose from the previous year’s rate. Dominion management has set a benchmark payout ratio of 70%-75% of earnings per share. This will leave enough financial flexibility for the company to continue paying its current dividend, raise the dividend modestly each year, and navigate a higher-rate environment. As a result, income investors should continue to view Dominion as a top dividend stock.