Income investors typically hold real estate investment trusts, commonly referred to as REITs, in high regard. There is a good reason for this since REITs are excellent income producing securities. As an asset class, REITs typically provide twice as much income as the S&P 500 (or even more in some cases) in dividend yield terms.

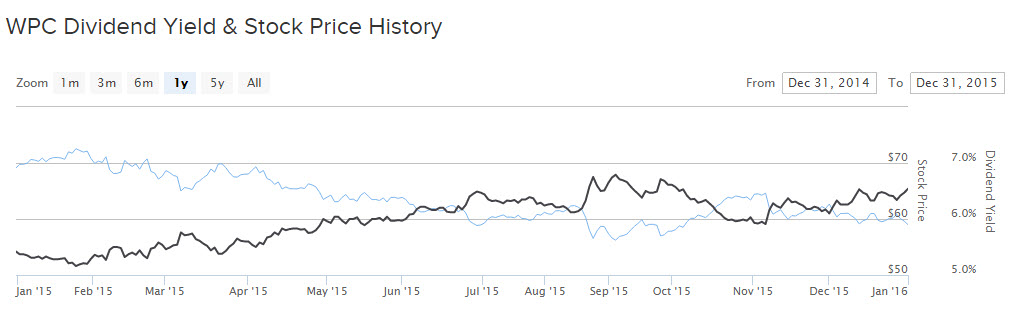

W.P. Carey (WPC ) is a REIT and the company recently raised its dividend to $0.9646 per share. The stock did not perform well in 2015, losing 17% of its value while the S&P 500 was flat at the same time.

This was based on escalating fears of higher interest rates in 2016 and beyond. While rising interest rates would be a negative headwind for W.P. Carey, it is a high-quality REIT with a solid tenant portfolio. The dividend increase is a sign of management’s confidence in the health of the underlying business. For these reasons, investors should continue to view W.P. Carey favorably.

W.P. Carey Is a Strong Income Selection

As previously alluded to, income investors flock to REITs because REITs enjoy a favorable tax structure. In return, they are required to hold the bulk of their assets in real estate investment, and then distribute 90% of their income to shareholders. This results in high yields across the REIT asset class, and the likelihood of dividend growth from year to year.

W.P. Carey’s dividend increase is a prime example of the income that well run REITs can provide—a 1.5% increase from the same quarterly dividend last year. W.P. Carey’s new annualized $3.86 per share dividend represents a very strong 6.5% yield. It is clear that W.P. Carey has a historical track record of delivering gradual dividend increases over many years. It has navigated periods of much higher interest rates and still managed to increase its dividend.

Most importantly, W.P. Carey has the fundamental strength to support its dividend growth. Over the first three fiscal quarters of 2015, revenue increased 2% year-over-year, driven by additional lease revenues from properties acquired and higher asset management revenue from growth in assets under management. In the same 9 month period, adjusted funds from operation (AFFO) rose 2.4%. The company expects to generate between $4.83 and $4.97 per diluted share in AFFO for the full year. That will easily cover the company’s $3.86 per share dividend. W.P. Carey’s 2015 projected dividend payout ratio is a comfortable 78% of AFFO, based on the midpoint of management’s guidance.

Forward Risks to Consider

However, investors should keep in mind that no stock is completely without risk—therefore, the biggest future risk that investors should be mindful of is the threat of rising interest rates. As a REIT, W.P. Carey is particularly vulnerable to higher interest rates, because the REIT capital structure is debt reliant. REITs typically carry higher levels of debt than the average company because they need to borrow in order to purchase properties, which then generate cash flow.

In December, the U.S. Federal Reserve finally raised the Fed Funds rate, which is the rate that determines bank-to-bank loans. It is widely viewed as a benchmark for many other types of loans. It is expected that the Federal Reserve will continue to raise rates in 2016 if the U.S. economy continues to gradually grow. Higher interest rates will make it costlier for companies to borrow and finance their capital structures with new debt. This could be a drag on earnings growth, and in turn, dividend growth.

This could negatively affect W.P. Carey because it carries significant debt. Currently, its market capitalization is $6.1 billion and it has a $10.2 billion enterprise value. Consequently, it has a net debt position of approximately $4.1 billion. The company has $264 million in variable rate debt due next year and $954 million due in 2018. Financing that level of debt is a concern moving forward.

Why W.P. Carey’s Dividend Remains Attractive

Still, W.P. Carey should generate enough cash flow to maintain a strong balance sheet and grow the dividend as well, even if interest rates continue to climb. The business is sound and remains healthy.

Another sign of strength is its strong tenant portfolio: W.P. Carey operates a diversified portfolio across a number of industries including retail, transportation, health care, and automotive. Its $8.9 billion of assets are spread across 854 separate properties. In addition, the company holds long-term leases which lock in steady revenue growth for many years. The average lease term is 8.9 years, with a 98.8% occupancy rate. This provides it with a great deal of long-term stability.

W.P. Carey stock may not appeal to dividend growth investors. The company will likely raise its dividend at low single-digit rates due to its debt financing needs and high payout ratio. But for income investors who desire current yield, W.P. Carey and its 6.5% dividend yield should be attractive.

Click here for 2016’s Best Dividend Stocks.