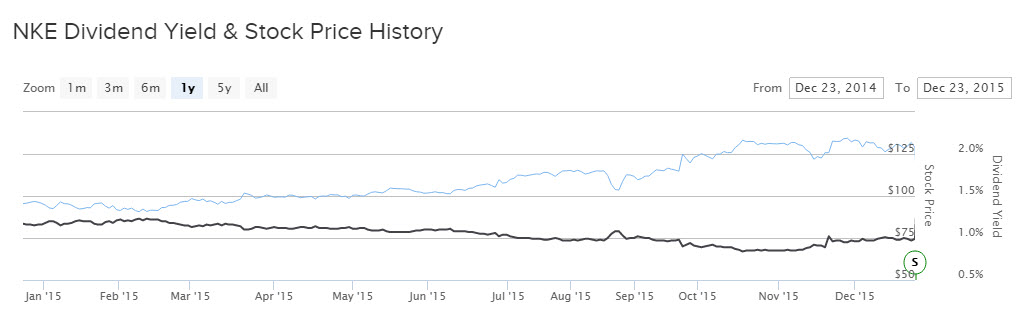

Athletic apparel giant Nike, Inc. (NKE ) is having a banner year. Thanks to its world-class brand and global reach, Nike is enjoying rapid growth. In turn, the stock has rewarded investors handsomely over the past year. The stock is up 36% since the start of the year, and recently rose to an all-time high of $133 per share when the company significantly boosted its capital return program, including its dividend and share repurchases.

Nike announced a 14% dividend increase, a new $12 billion stock buyback authorization and a two-for-one stock split. Investors cheered the move, and sent the stock up 5% on the day of the announcement. Nike has a number of growth catalysts that are providing for its significant capital returns. Nike is a premier dividend growth stock, although investors looking for significant income now may be disappointed.

Nike and Growth: “Just Do It”

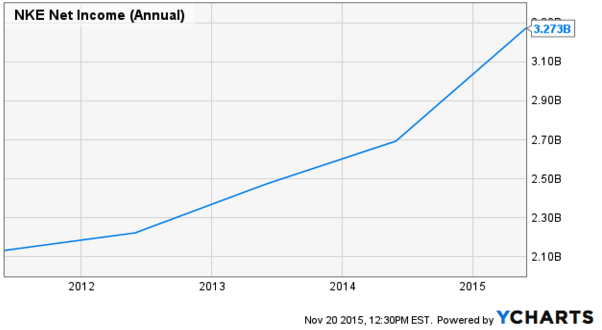

In the fiscal first quarter, Nike grew revenue and earnings per share by 5% and 23% respectively, year-over-year. The core results were even more impressive, since Nike’s growth was significantly weighed down by foreign exchange fluctuations. On a currency-neutral basis, revenue would have increased 14%. Other key metrics were very strong—worldwide futures orders (a gauge of future demand) rose 17% excluding foreign exchange. This successful first quarter came after a very good fiscal 2015. Last fiscal year, Nike grew revenue 10% to $30 billion and earnings per share by 25%.

Nike has experienced a prolonged period of outsized earnings growth.

Two of the biggest factors for Nike’s rapid growth are its e-commerce and women’s businesses. Nike’s e-commerce business grew constant-currency revenue by 46% last quarter. An increasing share of consumer shopping is being conducted online for its convenience, and Nike is reaping the benefits. Nike saw robust e-commerce growth across all of its geographic markets, with strong conversion and increased mobile traffic.

Another major business Nike has built up is its women’s line. Nike’s women’s business is rapidly becoming every bit as important as its men’s line. In fact, the women’s business grew by double-digits last quarter, and is now a more than $5 billion business by annual revenue. Nike offers some popular women’s products, including apparel styles such as the Dri-FIT knit bras and NIKE pro tights; both of which are selling well.

Because of these tailwinds, Nike expects strong revenue growth for many years ahead. Nike has some important events coming up over the next several months, including the Super Bowl, the NBA All-Star weekend, the Euro Champs and the Rio Olympics. Any or all of these events could be a catalyst for Nike’s strong revenue and earnings growth to continue in fiscal 2016.

Looking at the long-term, management recently released an updated forecast which calls for $50 billion in annual revenue generation by 2020. That would represent 66% revenue growth from its current annual levels. Along with continued margin expansion, this would result in high double-digit earnings growth per year over the forecast period.

The Bottom Line

There is little doubt that Nike is a tremendous business, backed by a strong brand and excellent growth of earnings and cash flow. Over the past five years, Nike has grown its dividend by 15% compounded annually. Strong dividend growth can continue, as Nike maintains a 30% dividend payout ratio as a percentage of earnings per share. This makes Nike an ideal holding for dividend growth investors. However, the stock may not be a great selection for investors who desire current income, such as retirees, because of its very low yield.

Even when including the recent dividend increase, Nike stock yields just 0.9%. That is a very low yield, which is less than half the S&P 500 Index average yield of 2%. Nike would have to double its dividend from here just to be on par with the overall market average. Nike will very likely continue to increase its dividend by double-digit rates each year going forward, but investors will have to settle for relatively low income. As a result, Nike is a strong pick for dividend growth investors, but investors who want current income should look elsewhere.