International Business Machines (IBM ) is a company in transition. Formerly known as a dominant industry player in technology hardware, in the past several years the company has repositioned itself into new areas like the cloud, data, and software. The reason it has done this is because as technology hardware has become a commoditized industry, margins are very low. Shrinking profitability has caused the stock to decline for an extended period of time.

In response, IBM has divested itself of several hardware-oriented businesses in the last few years, and has reinvested aggressively in its strategic imperatives. The company hopes that over time, the high growth being realized in the higher-margin strategic imperatives could eventually become the majority of the company.

Still, IBM is a highly regarded dividend stock. It has paid uninterrupted dividends since 1916, and it has increased its dividend for 20 consecutive years. Even though IBM’s revenue and earnings are declining during its turnaround phase, IBM still generates healthy free cash flow, which is critical to the dividend.

IBM Is in a Prolonged Revenue Decline

IBM recently reported quarterly earnings in which its revenue fell for the fourteenth consecutive quarter. The company generated $19.28 billion of revenue, representing a 13% year-over-year decline. This failed to meet analyst expectations of $19.6 billion of revenue. Meanwhile, IBM’s earnings fell 12% year over year, to $3.02 per share.

One thing investors should note is that foreign exchange and divestitures accounted for most of IBM’s revenue decline. As previously mentioned, the company has divested several businesses over the past year. In addition, the rising U.S. dollar has weighed on IBM since the company derives a large amount of its revenue from international markets. Excluding currency fluctuations and divestitures, IBM’s revenue would have declined just 1%.

In addition, IBM is realizing very high growth in its strategic imperatives. These are the higher-margin areas that are the foundation of IBM’s turnaround, including cloud and mobile computing, data analytics, and social and security software. Overall, revenue in IBM’s strategic imperatives increased by 17% last quarter, year over year. Adjusting for currency and divestitures, strategic imperatives grew revenue by 27% year over year. Cloud revenue has now reached $9.4 billion in the trailing 12 months.

Cash Flow Continues to Support the Dividend

Fortunately, even though IBM’s revenue and earnings have been stuck in a prolonged decline, the company continues to generate high levels of free cash flow. That is directly a result of the company’s shift to higher-value businesses like the cloud, data, and security. As IBM stated in its 2014 annual report, in 2009, its strategic imperatives represented just 13% of IBM’s total revenue. Last year, these businesses accounted for 27% of total revenue. The percentage of total revenue from the strategic imperatives more than doubled in that time. If growth continues at a similar rate this year and beyond, the percentage will be even higher, eventually becoming the majority of the overall business.

Consequently, even though revenue and earnings are declining, free cash flow has remained strong because the strategic imperatives carry much higher margins than IBM’s legacy hardware businesses. As a result, IBM still expects free cash flow in 2015 to mimic last year’s free cash flow. That would leave more than enough room for IBM to continue paying its current dividend, and even raise the dividend each year going forward.

IBM Offers Impressive Cash Returns

In the trailing 12 months, IBM generated $13.6 billion of free cash flow. This allowed IBM to return $8.7 billion to shareholders in that time, consisting of $4.7 billion of dividend payments and $4 billion in share repurchases. IBM still generates much more in free cash flow than it returns to investors. IBM’s dividend represented just 34% of free cash flow over the past one year. This indicates a very healthy free cash flow dividend payout ratio.

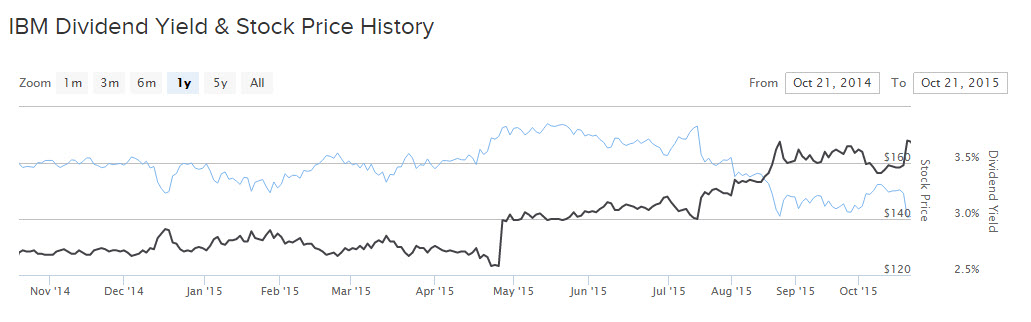

Such strong free cash flow generation has allowed IBM to raise its dividend at high rates for many years. It increased its quarterly dividend by 14% compounded annually over the past five years, including a solid 18% raise earlier this year. IBM stock now provides a 3.6% dividend yield, which is much higher than the stock market average of about 2%.

To conclude, while IBM has struggled with falling revenue and earnings for many quarters in a row, the company still generates high free cash flow. Free cash flow is the more important metric than earnings for IBM’s dividend. As a result, IBM remains a strong dividend growth stock.

Disclosure: The author is long IBM.