There are certain rivalries that will remain timeless and everlasting: cats vs. dogs; Chicago deep-dish vs. New York floppy pizza; the Sens vs. Leafs. And in the case of investing, the biggest rivalry is probably “growth” vs. “value” stocks.

While straight index investors could care less about the last battle, those looking for dividends certainly have a dog in the fight. On the surface, it seems that dividends and value go hand in hand and looking deeper, the two are very much intertwined. So much so that they almost can’t exist without each other. Numerous academic studies have shown that for longer-term outperformance investor focus on value with a hefty side of dividends is key.

The real question is do we even need to have growth stocks in our portfolios at all?

"Value" Beats

The biggest battle comes down to a difference of definition. Textbooks define growth stocks as those firms whose earnings are expected to continue growing at an above-average rate relative to the broad market or sector. Usually, investors are willing to pay up for earnings growth, and growth stocks, for the most part, have price-earnings metrics in the double digits. The name of the game for growth stock investors is capital gains. Most growth firms plow their cash flows back into retained earnings to fund future growth to justify their potentially sky high P/Es.

Value stocks, on the other hand, are those that tend to trade at a lower price relative to their fundamentals. Those fundamentals can be anything from earnings, sales, and book value, or some combination of metrics. Value stocks for the most part have good fundamentals. However, they may have fallen out of favor in the market and are considered bargain priced compared to their competitors.

And while it seems like there are plenty of periods when growth is king — say in a five-year-old bull market after one of the worst recessions of all time — it’s actually a terrible system for stock investors. Truth be told, boring value trumps sexier growth over the long haul.

According studies conducted by Research Affiliates, since the 1930s value has outperformed growth in four out of five decades. The only time this wasn’t true was during the go-go 1990s and the Internet/tech boom. And we all know how that turned out for JDSU or Nortel and their triple digit P/Es. This echoes the 1992 publication The Cross-Section of Expected Stock Returns by economists Fama and French.

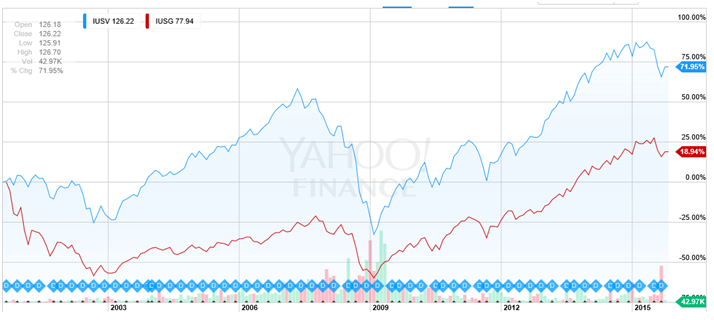

The outperformance can be staggering. The chart below is a look at the iShares Core U.S. Value ETF (IUSV) and iShares Core U.S. Growth ETF (IUSG). Each tracks the value or growth stocks of the broad Russell 3000 Index, respectively.

But Why?

The value premium is explained by analysts and researchers in a number of ways. The simplest explanation is that investors are an overzealous bunch and we all think we know who the next Google (GOOG) or Apple (AAPL ) is going to be. We tend to overpay for that belief early on in a stock’s growth story, and when we realize that Dr.KOOP.com isn’t going be it, we run for the hills as fast as we can.

Another explanation for the value premium is dividends.

Research Affiliates estimates that once enthusiasm for a growth story is lost and the market bails, most growth stocks are ready to begin handing out their cash as dividends. Value investors basically step in at just the right time to snag these future cash payouts. That’s because P/Es, price-book ratios, price-sales, and other metrics have fallen back to earth enough for value investors and value indexes to consider them.

Work by RA’s commander in chief Rob Arnott showed that dividends are the key driver for stock market returns. Looking at 200-year total return from 1802 to 2002, Arnott found that U.S. stocks would have returned an average of 7.9% a year, of which 5% came from dividends. The vast bulk of returns over the long haul has come from redistributed cash.

The Key for You and Me

So value and dividends are almost one and the same. They have a unique relationship in which one leads to the other’s outperformance. The key for income seekers and their portfolios is simply to focus on the one metric, value. The dividends will follow.

Perhaps more importantly, over the longer haul the combo of the two will crush growth stocks and will lead to higher total returns. It’s the secret to investing success that we should all follow.

Image courtesy of adamr at FreeDigitalPhotos.net