The analysts here at Dividend.com analyzed the search patterns of visitors to our site during the past week ending September 25. Below we give an analysis of how intelligently users used Dividend.com to help them in their investment decision-making process.

SPDR S&P Biotech ETF

Hillary Clinton’s tweet on September 22 sent biotech stocks spiralling to a loss of $40 billion of market cap in a matter of hours.

The XBI ETF was one of the hardest hit, falling from $80 to $70. Other biotech stocks hammered by the tweet were JUNO, LXRX and RARE.

To take advantage of such situations, investors may want to consider inverse leveraged ETFs such as LABD and ZBIO, both of which rose after the tweet. Inverse ETFs move in the opposite direction of the sector, theme or country that they’re tracking.

SPDR S&P 500

A top trender from last week, the SPDR S&P 500 ETF (SPY) features again this week as investors viewed it as a potential “Buy on the Dip” prospect and were hoping for market rallies post-Fed announcement. However, quadruple witching kicked in post-announcement instead. This, coupled with poor Chinese data, and the markets were not happy.

McDonald’s

McDonald’s (MCD ) is a stellar dividend-paying stock and has increased its dividend for 38 straight years. The company has been one of the most resilient stocks in this downfall. From August 21, 2015, to date the stock has only fallen 3%. The stock has the highest top line and bottom line in the quick service restaurant industry.

Find a complete list of restaurant stocks here.

Best Drug Manufacturers

As we know, health care acts as a perfect hedge in a falling market. So it was no surprise that when investors wanted to hedge themselves they looked up all the stocks they could find classified as health care and good dividend-payers. The hedge is much stronger when the stocks are high dividend-paying stocks as that signifies they have a much stronger balance sheet than others.

This list provides an entire list of dividend-paying drug stocks as well as S&P 500 stocks that aren’t dividend paying.

Nike

Nike (NKE ) announced its dividend payment date will be on October 5, 2015. Currently yielding 1%, the company’s annual payout is $1.12. Nike’s stock has given a stunning performance this year. Investors may have viewed this as another hedging opportunity in the current volatile conditions. YTD the stock has returned 18.75%, excluding dividends. Despite its heavy Chinese exposure, the stock has simply refused to fall in the current market conditions and has been going from strength to strength.

Who Owns Apple?

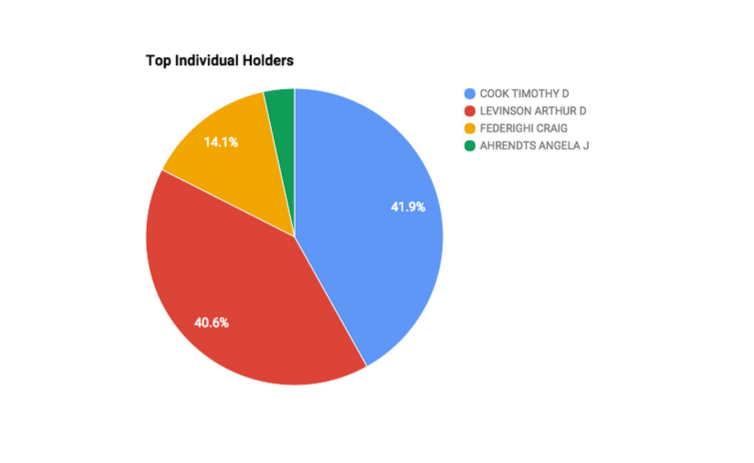

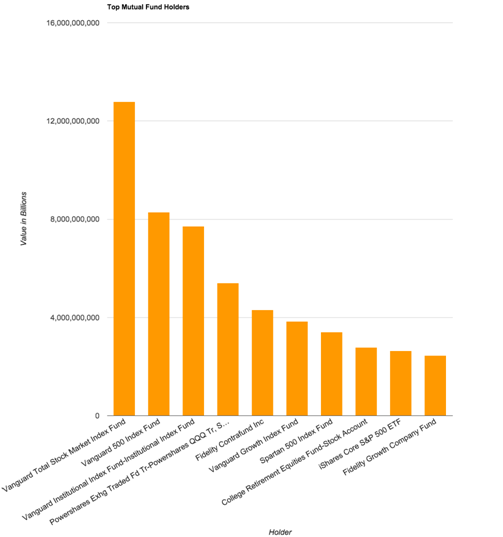

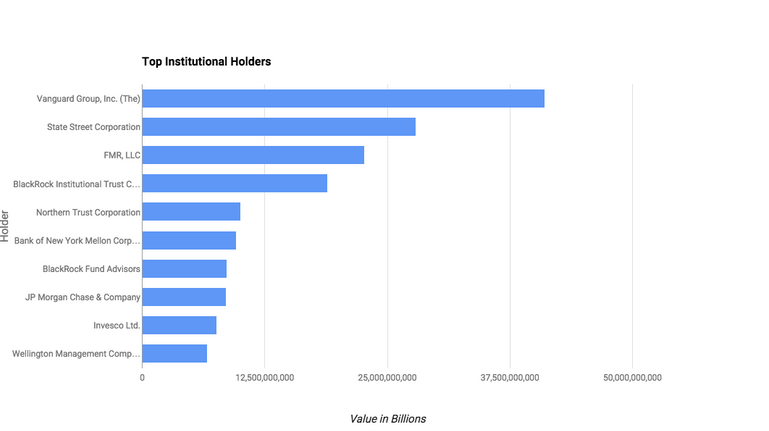

On November 5, 2014, we analyzed Apple’s (AAPL ) top five individual shareholders here. Now, we go a step further and analyze Apple’s top individual holders, top institutional holders as well as its top mutual fund holders.

Timothy Cook and Arthur Levinson own 1,170,191 and 1,133,283 shares, respectively, as of August 24, 2015 and May 28, 2015.

Vanguard mutual funds occupy the top three spots as the largest shareholders of Apple in the mutual fund category.

Vanguard Group again occupies the top spot as an institutional investor, with 327,508,974 shares, representing a value of $41 billion as of June 30, 2015.

Apple has been trending recently after they launched two new products: the iPhone 6s and the iPhone 6S+, along with the iPad Mini 4.

Royal Dutch Shell

Traffic to Royal Dutch Shell’s (RDS-A ) ticker page recorded a 30% increase last week. From 2005 to 2015, Royal Dutch Shell has stayed in an upper range of $87 to a lower range of $41. The company currently has a solid dividend yield of 8%, but almost halved after the oil price decline. Due to its low volatility over a ten-year period, and oil declining to record lows, contrarians might be keeping a close eye on this one.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.