Earlier this week, we highlighted some of the key themes and takeaways from this earnings season.

In today’s piece, we’d like to take a deeper dive into one of these topics – the dollar.

Dollar Strength and Revenue Headwinds

At Dividend.com we’ve talked about the impacts of a rising dollar for some time now, and this past earnings season illustrated just how much of an impact currency fluctuations can have.

What many investors fail to realize is that while a portfolio can completely comprise U.S.-domiciled securities, these companies (particularly the large- and mega-cap ones) are often closely tied to foreign markets. Firms that derive a significant portion of revenues from foreign sales have been hurt tremendously by the stronger dollar as the products and services they sell abroad have become much more expensive for foreign buyers.

In its most recent Monthly Outlook, Wells Fargo touched on this topic:

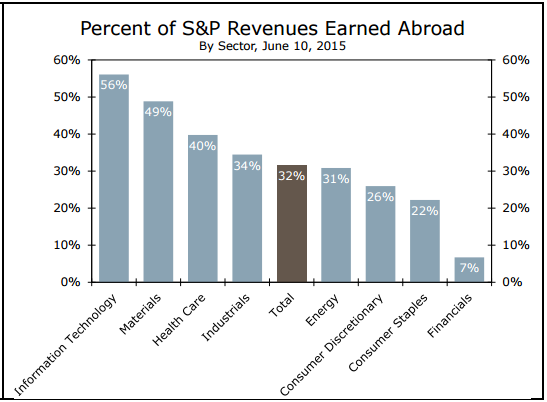

Of all the S&P 500 companies, the sectors most affected by the dollar have been information technology, materials, and health care – each of which derive over 40% of revenues from abroad. In total, S&P 500 firms rake in roughly one-third of their revenues from foreign markets. The sector that has been least impacted by the dollar has been financials, which has only about 7% of revenues coming from abroad.

Wells Fargo analysts believe the dollar will continue to appreciate for the rest of the year, which will ultimately diminish the value of foreign earnings in U.S. businesses – particularly in the sectors mentioned above.

A Dividend Investor's Takeaway

For us dividend investors, we will have to closely monitor and account for the dollar’s future movements, as more than likely our portfolios will be affected. As such, we encourage you to take a deep dive into each of your investments to determine just how much of each company’s revenue relies on foreign consumers.

If the dollar’s strength persists, be prepared to see tighter profit margins, lower revenues, and worse-than-expected earnings results from multi-national corporations. What is important to realize, however, is that the dollar’s impact will be short-term, and that eventually such drastic currency fluctuations will wane as the U.S. and global economies continue to stabilize. If a pullback occurs due to such fluctuations in the coming months – don’t panic – instead consider buying on the dip, scaling into positions that are fundamentally sound for the long term.

Be sure to follow us on Twitter @Dividenddotcom.