Bond yields all over the globe have spiked considerably in recent weeks for a number of reasons. First and foremost, improving growth prospects in the Eurozone coupled with looming rate hike fears in the U.S. have prompted traders and investors alike to start jumping away from rate-sensitive, safe-haven fixed income securities.

Every pundit out there has an opinion as to why and how this yield-spike “tantrum” will play out. We’re not ashamed to admit that we don’t have a crystal ball, so don’t expect us to sell you on what is going to happen on Wall Street in the coming weeks.

Are Yield-Spikes Bad News for Stocks?

With that being said, we fall under the camp of using historical data to give us a perspective as to what may happen; more specifically, we’re taking a look at some very insightful quantitative research compiled by Dana Lyons, a seasoned portfolio manager and well-respected financial blogger, aimed to answer the question – What really happens to stocks after yields spike?

What exactly constitutes a yield spike? For Lyons, this means looking at prior occurrences when the 10-year Treasury yield has moved from a 52-week low to a 5-month high within roughly a 4-month period. In other words, the research is limited to identifying periods when the rise in yields has closely resembled the current environment, rather than looking at every single instance of rising yields. Going back to 1962, Lyons found 15 occurrences in total, with the two most recent ones taking place in June, 2008 and December, 2010.

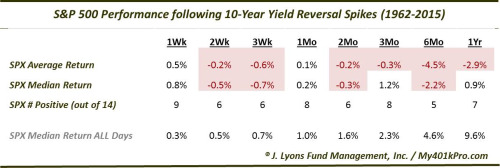

The table below summarizes how equities, as tracked by the S&P 500 index, have performed in the weeks following a yield spike similar to the one we’re seeing now:

There’s a number of key takeaways here. First and most obvious, it’s quite clear that as a whole yield spikes have translated into lackluster returns for stocks in the weeks following; note the overwhelmingly negative “average returns” in the S&P 500 for the various time periods following a yield spike. Second, there’s several occurrences where the above takeaway doesn’t hold true; note that there were instances of positive returns following the yield spike as well, specifically during the periods in 1996, 2003, and 2010.

The Bottom Line

Remember that there’s always exceptions even when the evidence is seemingly overwhelming, which brings up a key point with regards to this research specifically. The sample size is fairly limited, with only 15 historical occurrences being analyzed here. Nonetheless, Lyons does come to an insightful conclusion, which is that, based on the historical analysis of similar environments, a spike in yields has more often than not had a negative impact on future stock returns. As always, we advise that conservative, income-minded investors take advantage of selloffs over time rather than join the herd and rush for the exit.

Be sure to follow us on Twitter @Dividenddotcom