Earnings season is well underway and right around half of the S&P 500 constituents have posted their 1Q 2015 operating results thus far.

While we are by no means out of the woods just yet, with regards to the number of companies that have yet to report results, there are a number of key themes that are likely to persist through the end of this earnings season. Let’s dive in.

1Q 2015 Earnings Review Thus Far

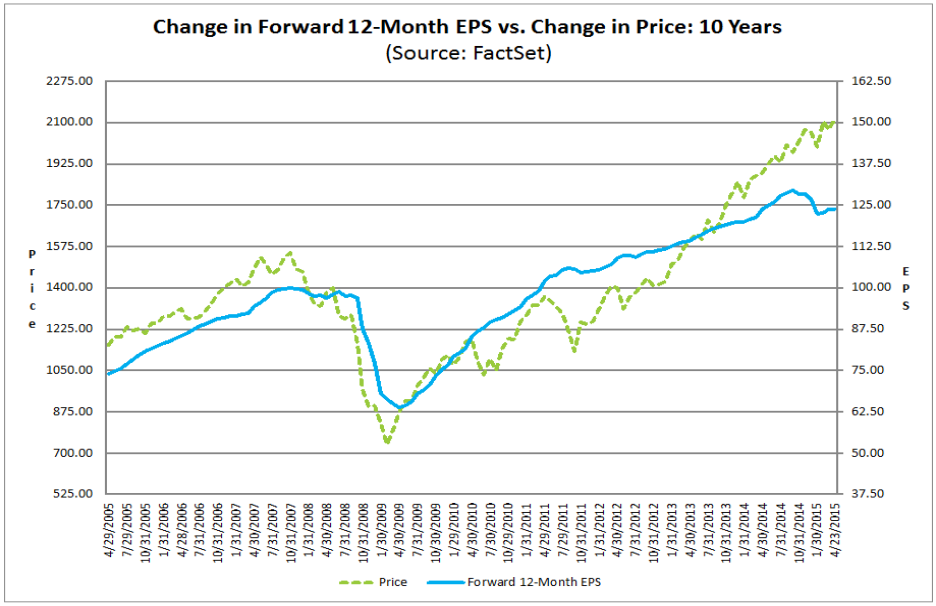

Below, we’ll take a look at FactSet’s (FDS ) most recent earnings season update, summarizing key takeaways that are more than likely to resonate through the end of the reporting period. For starters, let’s consider the broad market and how the overall change in forward EPS (blue line) among companies has behaved with respect to the performance of the S&P 500 Index (green line):

Right off the bat, it’s quite clear that there is a divergence between forward EPS estimates and the performance of the broad equity market; more specifically, earnings expectations are quite muted and stagnating whereas the S&P 500 remains in a steep, upward-slopping trajectory. This is worrisome because it suggests there is a fundamental disconnect between where earnings growth expectations stand and how investors are positioning themselves for the future. Simply put, it appears that despite the lackluster EPS outlook, investors are still willing to buy into the market as evidenced by its continued ascent higher.

This development can progress in one of three ways; first and foremost, it can persist for a while, meaning that EPS estimates can get even worse while the market continues to rally. Remember the old saying, “markets can remain irrational longer than you can remain solvent”. Second, EPS estimates can continue to deteriorate and the market may finally stage a steeper pullback to compensate for the worsened outlook. Lastly, the market may stagnate until EPS estimates finally start to turn the corner for the better before resuming its ascent.

Some other noteworthy takeaways from the earnings reports seen thus far include:

- The blended earnings growth currently stands at a negative 2.8%, which is actually above the projected figure of -4.6%

- 73% of the companies have reported actual EPS above the mean EPS estimate

- In terms of revenues however, only 47% of the companies have reported actual sales above the mean sales estimate

- Healthcare stocks are reporting the highest earnings growth rate at 14.8%, while the financials sector is reporting the second highest growth rate at 12.5%

- Not surprisingly, energy stocks are reporting the largest decline with -65.2% in year-over-year earnings

- The stubbornly strong U.S. dollar continues to eat away at revenues for multinational corporations

We’ll be keeping you updated with the latest earnings news as it comes in.

Be sure to follow us on Twitter @Dividenddotcom