On Tuesday April 21st, Bill Gross tweeted from Janus’ account that shorting the German Bund was the “short of a lifetime”. See full tweet:

There are so many interesting angles to this 117 character assertion. Let’s look at a few.

The Crux of the Trade

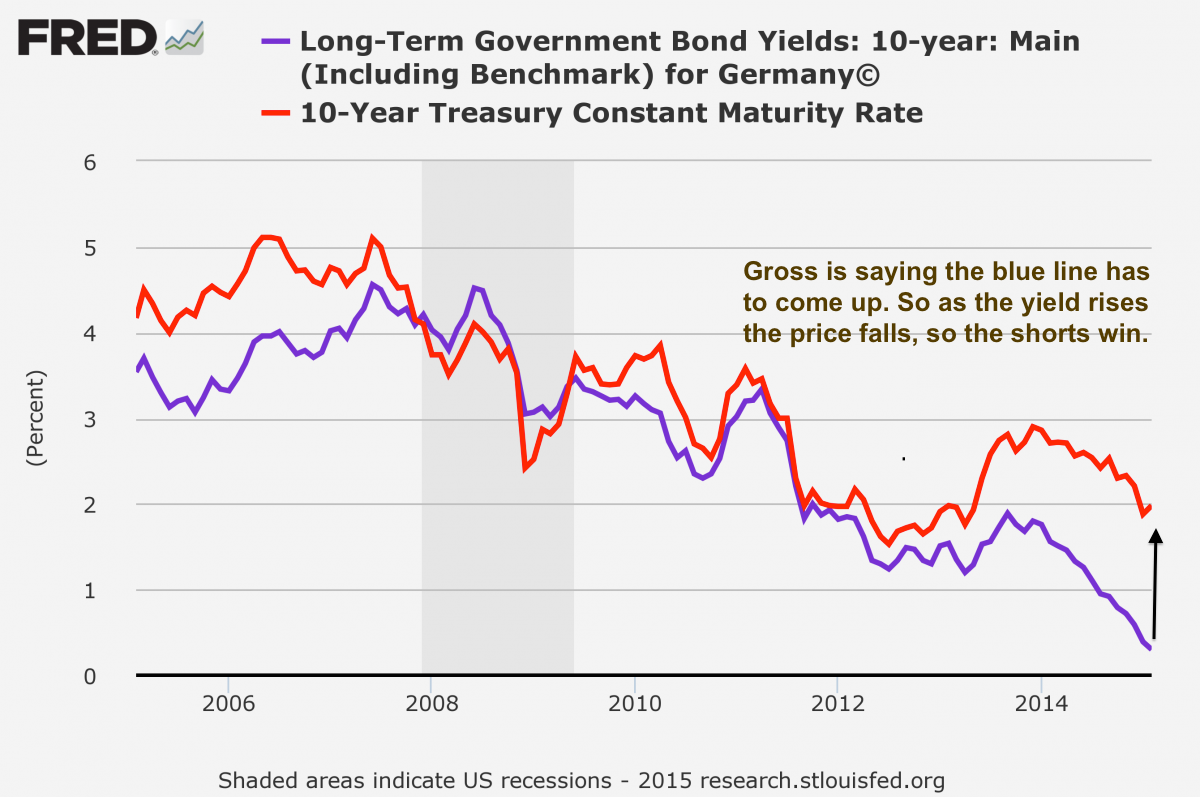

Before diving into the layers of depth that are interesting, let’s quickly recap what Gross is saying. The crux of the trade he’s proposing is a classic convergence to the mean-style thesis. The mean being that history shows that when US 10-year treasury rates and German rates diverge as much as they have recently, they’ll revert to a state of closer correlation. See chart below:

The Massive Caveat

While it only took 117 characters for Bill Gross to propose to the world a seemingly huge golden nugget of potential, that’s very misleading. The reason why is because of the elephant sized caveat, “Only question is Timing / ECB QE”.

I’ve written about this in the past, but there’s an old trader’s axiom, “when your timing is wrong, you’re wrong”.

So while Gross’ proposition seems scintillatingly easy to execute, the whole crux is the timing. Which leads to the next layer of why this is so interesting.

The Limbo: How Low Can You Go?

The question regarding timing begs the deeper question, when does the bell ring at the bottom of the Bund yields? Currently, at approximately 0.16% vs. a 10-year US treasury yield of approximately 1.9%. However, given how aggressive the dovish stance has been of ECB president Mario Draghi, there’s no reason to believe this isn’t the bottom. If yields go lower, price goes up and shorts lose in that environment, so in order to time the trade you need to ‘call the bottom’ on Bund yields.

How low will they go? We’ll leave that prognostication to others, but directionally speaking, we don’t see this as the bottom.

The Great Paradox

A final and interesting paradox of this potential trade, is what does “winning” look like? In a world where the Bund rates shoot up from at, or near 0% return for a 10-year period, what else has to happen in the world for that to occur? While we’ll agree to disagree with a lot of things our friends at ZeroHedge.com purport, Tyler Durden (a pseudonym for the site’s founder) puts one possible ‘world’ in which that occurs eloquently, “paradoxically, for that to happen, central banks have to finally lose all credibility”.

A world in which all central banks lose credibility, is not one of a healthy, functioning financial system and one where fiat currencies value would be increasingly questioned.

So the paradox of this trade is two fold; you need to A) time it well and; B) if you “win”, you likely “lose”.

While Gross has an excellent track record, we’ll definitely stay on the sidelines for this type of macro-bet and continue with our fundamentally driven analysis of dividend producing stocks. That said, quite the firestorm that can be created these days in 140 characters, or less.

Have a great weekend and talk to you on Monday.