There’s a saying in the game of golf that “every putt makes someone happy”. Either the putter, if he makes it, or his opponent, if he misses it. It’s golf’s way of describing the concept of zero sum.

I couldn’t help but include a golf related quote given Jordan Spieth’s recent triumph at one of golf’s most prestigious tournaments — the Masters. What an amazing performance by a 21 year old star on the PGA tour!

Today, we’ll cover the concept of zero sum game as it applies to the world’s energy markets.

Zero Sum Refresher

Not to be confused by our friends at the investment idea website, Sum Zero, let’s quickly brush up on the concept of zero sum. In a zero sum environment, for every loser, there is an equal and opposite winner. Wikipedia describes it this way, “(a game or situation) in which whatever is gained by one side is lost by the other.”

We’ve written in these pages about the massive ripple effects of plummeting oil prices has had across all facets of the economy. Nothing is unaffected when the price of such an important input to the economy changes so drastically. That said, in the short term, it’s a zero sum situation.

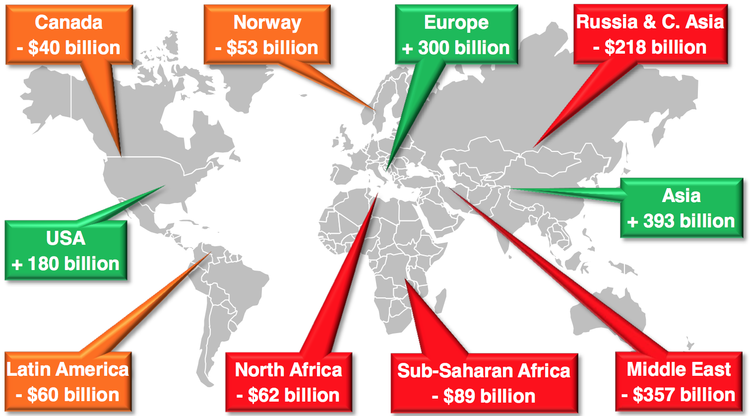

A Great Visualization of Oil's Immediate Impact On Economic Output

Hat tip to Bloomberg’s Tom Randall (follow him on Twitter: @tsrandall) for aggregating the data from a number of sources and visualizing it simply, yet effectively. As you think about the image, it makes sense that the ‘Middle East’ is the biggest loser, as is Russia. It also makes sense that the regions you had a sense were net importers, will benefit. It’s often been referred to a tax cut for these regions, enabling consumers to spend more.

That said, I bet it wasn’t on top of peoples’ mind just how much the drop in oil’s price impacts Africa, or just how big a player Norway is in the energy markets. Norway’s 5M people, comprise 0.07% of the world’s population. Not even a tenth of one percent, yet the ~$50 drop in oil results in a negative $50B+ impact on that economy.

Short Term vs. Long Term Impact

While the numbers quickly shift to benefit certain regions, they in turn negatively impact others — thereby, resulting in a zero sum game. The more intriguing question is that IF we’re in an age of reduced energy costs and given which regions that helps and hurts, how does that impact the world’s economy longer term. Does it remain zero sum?

Almost certainly not. The fact that the US, Asia and Europe gain from the shift, the compounding effect of their economies, ability to allocate capital more efficiently than others, will result in a net positive for the global economy.

Only time will prove this, although the fickle oil market may not let this hypothesis play out. If prices continue to creep up on a recent upward trajectory, with WTI finding it’s bottom in the low $40’s, we won’t get to see the longer-term results of how re-allocating energy wealth and costs plays out.

At least not this time.

Have a great weekend and talk to you on Monday.