Apache Corporation (APA ) reported its fourth quarter results before the opening bell on Thursday morning, posting a net loss and lower revenues compared to last year’s Q4.

APA's Earnings in Brief

- Apache Corp reported fourth quarter revenues of $2.95 billion, down significantly from last year’s Q4 revenues of $3.45 billion.

- APA reported a net loss of $4.8 billion, or $12.78 per share, compared to last year’s income of $174 million, or 43 cents per share.

- Adjusted earnings for the quarter came in at $404 million, or $1.07 per share.

- APA beat analysts’ expectations of 76 cents EPS, but missed revenue expectations of $3.09 billion.

CEO Commentary

APA CEO and president John J. Christmann IV had the following comments: “Onshore North American liquids production growth exceeded our guidance for 2014, and we exited the year with strong operational momentum. Since our Nov. 20th North American Update, oil and gas prices have decreased substantially, prompting us to act quickly and decisively to reduce activity levels and reset our well cost structure. We have reduced our rig count from an average of 91 rigs in the third quarter of 2014 to an estimated 27 rigs by the end of this month. We have also reduced our frac crews by approximately 50 percent during the same time period and are delaying some well completions until service costs decrease materially. In 2015, Apache will run a streamlined capital program that focuses on efficiency improvements, downspacing and other strategic tests to further delineate our extensive inventory of locations within the Permian, Eagle Ford, Canyon Lime, Duvernay and Montney. While we are fortunate to have a substantial inventory of projects that can make economics at these oil prices, we believe it more prudent to curtail our activity until costs are lower and prices recover. This strategy will enable us to further strengthen our balance sheet and preserve the financial flexibility to capitalize on industry opportunities during the downturn.”

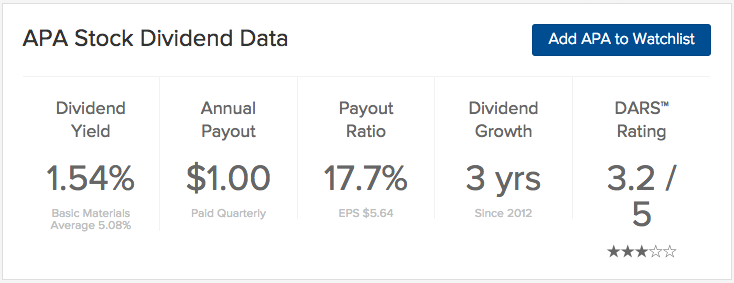

APA's Dividend

Apache will pay its next quarterly dividend of 25 cents on February 22. The stock went ex-dividend on January 20. We expect the company to announce its next dividend in the coming days.

Stock Performance

APA stock was inactive in pre-market trading. YTD, the stock is up 1.44%.

The Bottom Line

Apache Corp (APA ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.2 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.