If it’s not worries stemming from the eurozone, or persistent volatility in the crude oil market, investors are more than likely to bring up the impending interest rate hike as a reason to take profits in today’s environment.

But does the inevitable rate hike justify all of the fear-induced selling it has inspired thus far on Wall Street? And perhaps more importantly: are investors better off selling out of the market entirely before the rate hike does come to fruition? The short answer is No – but we’ll let the numbers speak for themselves.

Why You Shouldn't Fear the Upcoming Rate Hike

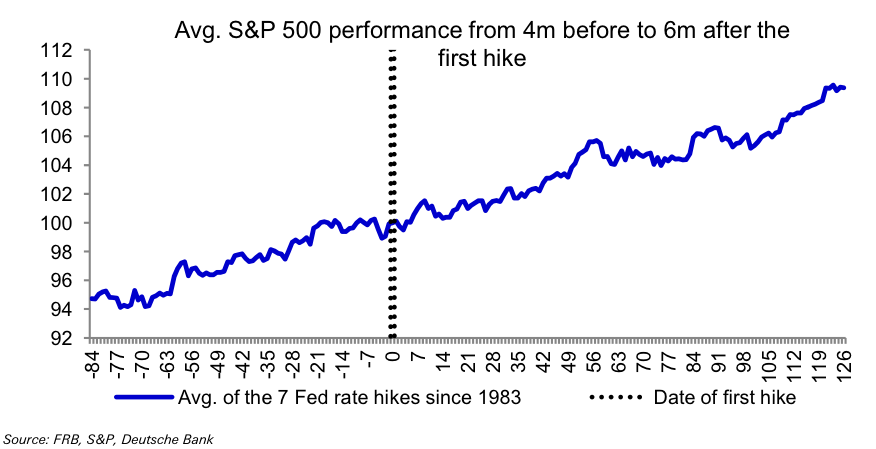

We stumbled across an incredibly insightful chart compiled by Deutsche Bank that offers a visual representation of how the S&P 500 Index behaved before and after the first rate hike during the last seven tightening cycles, dating all the way back to 1983. The blue line in the chart below, left of the dotted line, is the average performance of the broad U.S. equity market during the four months leading up to the first rate hike, and right of the dotted line is the performance during the six months following the rate hike:

Though the chart above is an average performance of the market over the last seven rate tightening cycles, the “big picture” takeaway is quite clear: from a long-term perspective, rate hikes simply don’t matter that much. That is to say, the long-term, upward trajectory of the stock market has previously managed to remain in-tact in the months before, and after, the Fed has raised interest rates.

We’re not saying there’s not going to be a correction this time. There very well might be a major sell-off before, or perhaps after, the first rate hike. The truth is, we don’t really know, but even more importantly, we’re not too concerned.

Why? It’s not because we’re indifferent to what happens in the market, it’s because our investing philosophy doesn’t revolve around accurately predicting all the ups and downs on Wall Street. We’re more concerned about identifying high-quality, dividend-paying stocks that have demonstrated the ability the weather all sorts of economic environments. Our philosophy is inherently long-term minded, so the occasional sell-off doesn’t really scare us as much as it does others; in fact, we’re big proponents of embracing pullbacks – if you need a reminder, here’s 3 Reasons Not to Get Rattled by Any Correction.

The Bottom Line

It’s difficult, if not altogether impossible, to predict which way the markets will swing before and after the inevitable rate hike that is on everyone’s mind; however, If history offers any clues, the chart above clearly showcases the notion that previous rate hikes have not had a major impact on the market’s long-term, upward-sloping trajectory.

We’d prefer not to burden ourselves with predicting the implications of the rate hike at all; that’s why we focus our efforts on scaling into fundamentally-sound, dividend-paying stocks that are more than capable of weathering any sort of market environment over the long-haul, and you should too.

Be sure to follow us on Twitter @Dividenddotcom