Apple Inc. (AAPL ) has long been a leader in the technology world, but now it has announced that it’s making its first major step into the energy world. Earlier today it was announced that the firm will purchase $848 million worth of clean energy from First Solar, Inc and its California Flats Solar Project.

Major Solar Purchase

The deal will see Apple receive solar power from First Solar in a 25-year deal. First Solar’s CCO, Joe Kishkill, noted that “Apple is leading the way in addressing climate change by showing how large companies can serve their operations with 100 percent clean, renewable energy.”

The project will begin construction in mid-2015 and the project will account for 2,900 acres of land. It is expected to be completed by the end of 2016. Apple will receive 130 megawatts from the project while the remaining 150 megawatts will be sold to Pacific Gas & Electric in a separate deal.

Future Implications

The move could be a big spark for the clean energy industry, which has lacked big-time backing in the past. The issue is that fossil fuels are cheaper when it comes to providing energy, so many companies choose to save as much as possible. Apple, with its massive cash pile, has decided that it is worth spending the extra money to ensure that it is consuming clean energy that is safe for the environment.

It may be that Apple is the only major company to construct a deal like this, but it could influence others. If big business begins to turn to solar power and other forms of renewables, the energy sector could look very different in a decade’s time.

Stock Performance

Apple stock was up 16 cents, or 0.13%, in after hours trading. YTD, the stock is up 9.5%.

The Bottom Line

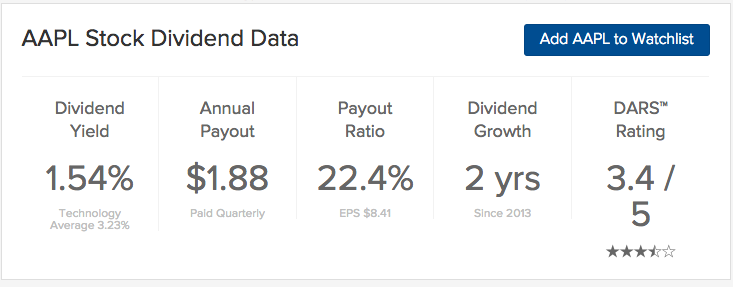

Apple Inc. (AAPL ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.