Before the opening bell on Thursday morning, Dunkin Brands (DNKN ) reported its fourth quarter results, posting higher revenues and earnings compared to last year’s Q4.

DNKN's Earnings in Brief

- Dunkin Brands reported fourth quarter revenues of $193.2 million, up 5.5% from last year’s Q4 revenues of $183.2 million.

- Net income for the quarter came in at $52.5 million, or 50 cents per diluted share, up from last year’s $42.1 million, or 39 cents per diluted share.

- DNKN beat analysts’ estimates of 47 cents EPS on revenues of $191.37 million.

- For FY2015, DNKN sees EPS in the range of $1.83-$1.87, which is below analysts’ expectations of $1.89.

CEO Commentary

DNKN chairman and CEO Nigel Travis had the following comments: “Highlights from our performance in 2014 included: strong domestic restaurant level unit economics; robust U.S. restaurant development for both brands, including the opening of our first traditional Dunkin’ Donuts restaurants in California; growing transactions in the Dunkin’ Donuts U.S. business in the face of macroeconomic and competitive headwinds; the launch of both the DD Perks loyalty program, which now has more than 2.5 million members, and Baskin-Robbins online cake ordering; and progress with the retooling of our international businesses as demonstrated by the signing of significant international development agreements in Sweden, Austria, and China. Our nearly 100-percent franchised business model delivered another year of double-digit adjusted earnings per share growth, and most notably, more than 50 percent free cash flow growth. While our earnings growth expectations for 2015 are below our longer-term targets, we are committed to returning to double-digit growth in subsequent years.”

DNKN Raises Dividend

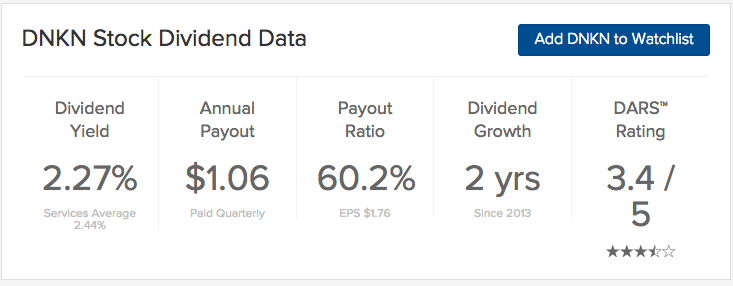

Dunkin Brands announced a dividend raise along with its quarterly earnings, boosting its quarterly payout to 26.5 cents from 23 cents. The dividend is payable on March 18 to all shareholders on record as of March 9. The stock goes ex-dividend on March 5.

Stock Performance

DNKN stock was up 60 cents, or 1.29%, in pre-market trading. YTD, the stock is up 9.06%.

The Bottom Line

Dunkin Brands (DNKN ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.