Eli Lilly (LLY ) reported its fourth quarter earnings before the opening bell on Friday morning, posting lower revenues and higher adjusted EPS than last year’s same period.

LLY's Earnings in Brief

- Eli Lilly reported fourth quarter revenues of $5.12 billion, which are down 12% compared to last year’s Q4 revenues of $5.81 billion.

- Reported net income came in at $428.5 million, or 40 cents per share, down from last year’s Q4 figures of $727.5 million, or 67 cents per share.

- On an adjusted basis, LLY reported EPS of 75 cents, which is slightly higher than last year’s adjusted EPS of 74 cents.

- LLY beat analysts’ EPS estimates of 74 cents, while revenues were just shy of the $5.21 billion expectation.

CEO Commentary

LLY chairman, president and CEO John C. Lechleiter, Ph.D. had the following comments: “While Lilly’s fourth-quarter 2014 results continue to reflect the impact of patent expirations, we are moving to a period of growth led by diabetes, oncology and animal health. Despite the loss of significant revenue for Cymbalta and Evista following the expiration of our U.S. patents, we saw strong performance from many other products. At the same time, we made excellent progress with our innovation-based strategy, and we continue to advance our pipeline. Throughout the balance of this decade, we aim to drive revenue growth and expand margins as we offer new medicines to the people who need them.”

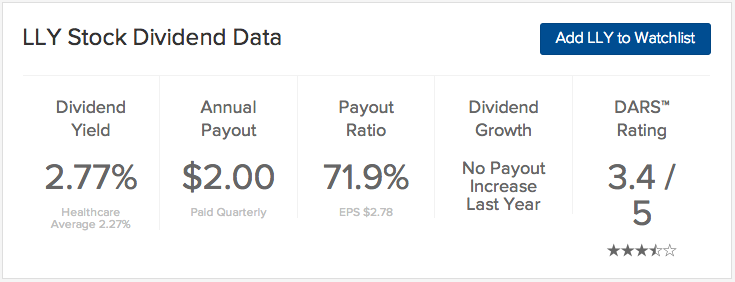

LLY's Dividend

Eli Lilly will pay its next quarterly dividend of 50 cents on March 10. The stock goes ex-dividend on February 11.

Stock Performance

Eli Lilly stock was inactive in pre-market trading. YTD, the stock is up 4.52%.

The Bottom Line

Eli Lilly (LLY ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.