Earnings season is well underway, although as we pointed out earlier, the action on the reporting front doesn’t pick up steam until the last week of January and first week on February

Nonetheless, there are a number of common themes that have already emerged, and they are more than likely to persist through the rest of earnings season.

So Far, Not Too Impressive

If you’re not familiar with FactSet Research Systems (FDS ), the company provides financial information of all sorts and boasts a fairly impressive dividend-growth track record spanning nine years; but perhaps more importantly in this context, FactSet is among the leading authorities on delivering valuable insights each and every earnings season, so be sure to add their Earnings Insight publications to your reading list.

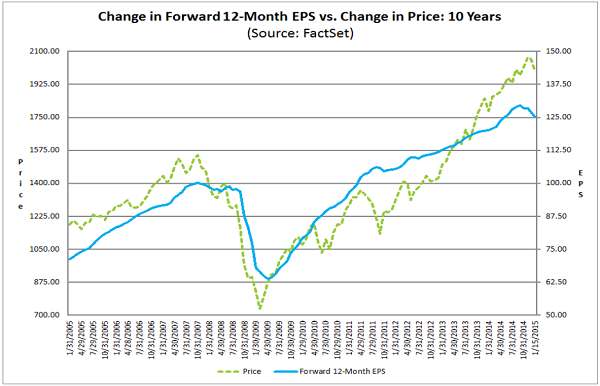

Below, we’ll take a look at FactSet’s most recent earnings season update, summarizing key takeaways and themes that are likely to resonate through the end of the reporting period. For starters, let’s consider the broad market and how the overall change in forward EPS (blue line) among companies has behaved with respect to the performance of the S&P 500 Index (green line):

It’s quite clear there is a bit of a divergence taking place; forward EPS estimates have been declining whereas the S&P 500 has managed to stay afloat and even climb higher. What’s noteworthy here is that the last time forward EPS deviated from its uptrend, the broad market followed suit lower; for example, notice the dip in the S&P 500 during the second half of 2011. Simply put, until earnings growth expectations improve, the broad market may stagnate or perhaps endure a pullback.

Some other noteworthy takeaways from the earnings reports seen thus far include:

- The big 3 banks,(BAC ), (C ), and (JPM ) all reported results that fell short of analyst estimates for the first time since Q4 2011.

- In aggregate, companies are reporting dollar-level earnings below estimates; the blended earnings growth currently stands at a paltry 0.6%.

- Companies are embracing the stronger economic environment in the U.S. and noting the persistent weakness across European markets.

- The rise of the U.S. dollar has negatively impacted those firms with more exposure to foreign markets.

- The longer-term impact of depressed energy prices has yet to be determined, although more companies are responding with upbeat commentary regarding this ongoing development.

We’ll be keeping you updated with the latest earnings news as it comes in.

Be sure to check us out on Twitter @dividenddotcom.