After the closing bell on Tuesday, IBM Corp (IBM ) reported its fourth quarter results, posting lower revenues and earnings compared to last year’s Q4.

IBM's Earnings in Brief

- IBM reported fourth quarter revenues of $24.11 billion, down from last year’s Q4 revenues of $27.39 billion.

- Net income for the quarter came in at $5.48 billion, or $5.54 per share, which is significantly lower than last year’s Q4 figures of $6.19 billion, or $5.77 per share.

- On a non-GAAP basis, IBM’s EPS came in at $5.81, compared to last year’s $6.16.

- IBM’s Q4 EPS beat analysts’ estimates of $5.41, while revenue missed the $24.77 billion expectation.

CEO Commentary

IBM chairman, president and CEO Ginni Rometty had the following comments: “We are making significant progress in our transformation, continuing to shift IBM’s business to higher value, and investing and positioning ourselves for the longer term. In 2014, we repositioned our hardware portfolio for higher value, maintained a services backlog of $128 billion and achieved strong revenue growth across cloud, analytics, mobile, social and security. Together these strategic imperatives grew 16 percent in 2014 and now represent $25 billion and 27 percent of our revenue.”

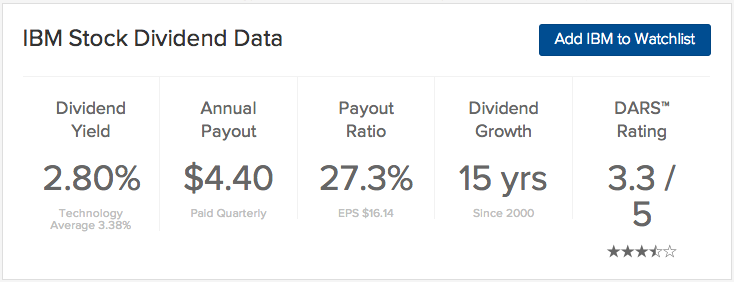

IBM's Dividend

IBM paid its most recent quarterly dividend of $1.10 on December 10, 2014. We expect the company to announce a raise to its dividend in the coming weeks.

Stock Performance

After ending the trading day mostly flat, IBM stock was down $1.24, or 0.79%, in after hours trading.

The Bottom Line

IBM Corp (IBM ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.3 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.