Before the opening bell on Tuesday, KB Home (KBH ) reported its fourth quarter results, posting higher revenues and net income compared to last year’s Q1 figures.

KBH's Earnings in Brief

- KB Home reported first quarter revenues of $796 million, up from last year’s Q1 revenues of $618.5 million.

- Net income for the quarter came in at $852.8 million, or $8.36 per diluted share, up significantly from last year’s Q1 figures of $28.1 million, or 31 cents per diluted share. The company’s net income includes an $824.2 million income tax benefit.

- KBH beat analysts’ revenue estimates of $778.5 million, while EPS estimates of 56 cents do not compared to KBH’s released EPS figures.

- KB Home’s backlog for the quarter was up 14% from last year’s Q1.

CEO Commentary

KBH president and CEO Jeffrey Mezger had the following comments: “The commitment and focus of our team throughout 2014 produced significant improvements in our financial and operational results. A particularly notable accomplishment in the fourth quarter was the reversal of nearly all of our deferred tax asset valuation allowance. This reversal, grounded in our consistent profitability in recent quarters, as well as our positive outlook for our business, the housing market and the broader economy, had a measurable impact on our financial position. Among other things, it nearly tripled our stockholders’ equity from a year ago, significantly reduced our debt leverage ratio, and, going forward, is expected to shelter, on a cash basis, more than two billion dollars of future earnings from income taxes. All of this will meaningfully support our ability to advance our business goals.”

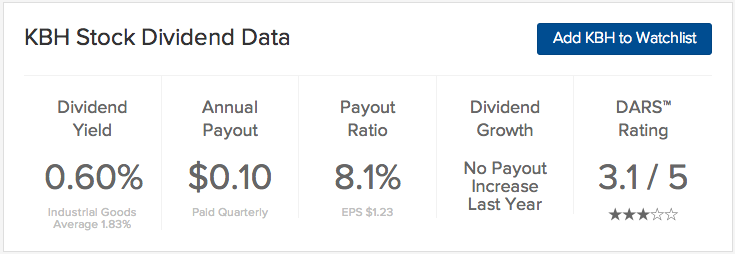

KBH's Dividend

KBH paid its most recent dividend of 3 cents on November 20. We expect the company to declare its next dividend in the coming days.

Stock Performance

KBH stock was up 87 cents, or 5.25%, in pre-market trading.

The Bottom Line

KB Home (KBH ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.1 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.