Municipal bonds are typically seen as a boring fixed income sector. Volatility and defaults are both low. So, when any type of risk begins to grow, it tends to make investors nervous. And right now, a major risk is starting to brew.

The cash that helps pay for muni bond coupons—state and local revenues/taxes—is starting to slip.

But should investors actually be concerned or is this just a case of the boy who cried wolf? Is the recent dip in state revenues the start of a worrisome trend? The data suggests that it may not be a real concern.

Trending Lower

Taxes. They are the lifeblood of state and local governments. States rely on income taxes for about 40% of revenues and sales taxes for more than 35% of total revenues. Without this cash flowing in, they can’t pay for essential services and expansion plans. They also can’t pay their debts. Normally, this isn’t a worry and muni bonds feature some of the lowest default rates of any bond type. But when something upends the apple cart of taxes, investors start to take notice. And that’s just what is happening today.

State and local governments’ revenues are starting to slide.

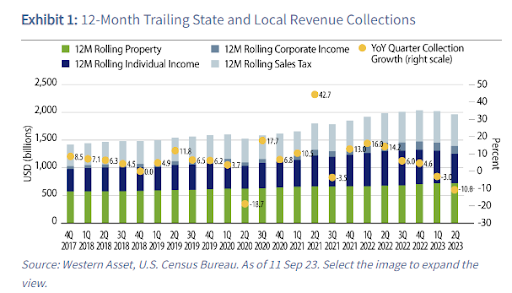

The latest data from the Census Bureau shows that state and local tax collections for the second quarter of 2023 declined 10.8% from the second quarter of 2002 levels to $487 billion. The declines were across the broad when it comes to type, with individual income tax, corporate income tax, and sales tax collections declining by 12%, 7%, and 1%, respectively. 1

This chart from Western Asset shows the declines and downtrend.

Source: Nuveen

What’s troubling is that this is the second year-over-year quarterly decline since the start of the pandemic.

So naturally, changes to the states’ finances has muni investors on edge. Without this vital cash, the risk of default grows for municipal bonds. Since the summer, muni bonds were in a downturn and produced negative returns. It wasn’t until the latest Fed decision meeting that the sector turned positive for the year.

Investors in municipal bonds are scared.

More Bark Than Bite

The question is: Should they be scared? Not if you consider the actual financial health of many state and local governments.

For starters, while tax collections have started to decline, they are only 1% below record levels. That’s not even close to putting states at default risks. Second, 2022’s tax collection figures could be considered an outlier. Thanks to hefty stimulus efforts, federal aid, strong capital gains taxes, and sales taxes boosted by strong consumer spending and higher inflation figures, the amount of tax collected in 2022 was not perhaps normal.

Comparing 2023 to earlier years, a different picture emerges. Total tax revenues for the first half of 2023 were up nearly 24% when compared to 2019, and almost 31% higher than in 2020. 2

The outlier year of 2022 did have a positive effect, however. State and local governments’ rainy day funds have surged to record amounts. Thanks to a great year, states are flush with cash and many are finishing this year with budget surpluses. Moreover, analysts are predicting that full-year 2024 will have states in a similar position. This should help limit default risks.

At the same time, states have started to spend less. Many state and local governments were proactive and reduced budgets by an average of 3.1% to reflect declining cash flows, lower economic growth, and reduced tax collection. This has states needing less to run their governments and services. This means more money can go toward paying and servicing debt. Again, this reduces default risks.

Finally, the reasons behind the lower tax collection in the first place may be abating. The Fed’s recent decision to pause rate hikes has already started to light a fire under growth once again. States may see higher consumer spending, taxes due to market gains, and a return to labor health. All of this would reverse the declines to tax collections pretty fast.

In the end, investors may be getting worried over the slight dip in tax collections. The longer-term picture and backdrop for municipal credit is a supportive one.

Municipal Bonds Are Still a Buy

While it may be worrisome to see the source of muni bond repayment starting to dip a bit, the reality is that state and various local governments are still in good shape. The combination of strong cash flows and rainy-day funds will protect investors, while the reversal of lower-tax trends will spur growth forward.

With that in mind, investors may want to still consider munis for their portfolios. Currently, they still offer high tax-advantaged yields, good credit quality, and attractive valuations.

Municipal Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ORANX | Invesco Rochester Municipal Opportunities Fund | $8B | 8.4% | 5.1% | 1.30% | MF | Yes |

| MINO | PIMCO Municipal Income Opportunities Active ETF | $78M | 7.7% | 3.8% | 0.49% | ETF | Yes |

| OPTAX | Invesco AMT-Free Municipal Income Fund - A | $2.28B | 7.1% | 3.7% | 0.88% | MF | Yes |

| PRFHX | T Rowe Price Tax-Free High Yield Fund | $3.25B | 6.5% | 3.7% | 0.77% | MF | Yes |

| HYMB | SPDR Nuveen Bloomberg High Yield Municipal Bond ETF | $1.9B | 6.5% | 4.2% | 0.35% | ETF | No |

| PRTAX | T Rowe Price Tax-Free Income Fund | $2.19B | 6.4% | 3.2% | 0.59% | MF | Yes |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 5.4% | 3.1% | 0.05% | ETF | No |

| JMUB | JPMorgan Municipal ETF | $669M | 5.2% | 3.2% | 0.18% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34.2B | 4.6% | 2.8% | 0.05% | ETF | No |

The Bottom Line

Tax collections for states have trended lower the last two quarters, causing investors to worry about municipal bonds and default risk. However, investors shouldn’t be worried. States’ coffers are flush with cash and are still bringing in plenty of revenues. With that, munis are still a big time buy.

1 Western Asset (September 2023). Weekly Municipal Monitor—State and Local Revenues Slide

2 Nuveen (November 2023). States’ surplus revenues: handled with care