While the economy seems to be moving right along, there’s no doubt that it is slowing. The combined effect of high interest rates, dwindling consumer budgets, and tough housing market has finally started to take its toll. A variety of data is starting to show signs of duress. Uncertainty, and the chance for recession, is growing.

This leaves many investors in a pickle.

However, municipal bonds could be their ticket out. Munis have traditionally performed well in times of duress; with their high institutional ownership structures, selling activity during recession tends to be muted. Thanks to their tax advantages and high yields, they could offer portfolios the best chance for good gains in the year ahead.

Dwindling Data

Truth be told, investors have no idea what’s going on. So far, the Fed seems to be getting it right with their monetary tightening policies. Inflation has been broken and many issues around those high prices have ceded. However, no good deed goes unpunished.

Economic data across a variety of metrics has started to slip. Consumers have largely spent their pandemic savings and have started to clamp back on discretionary items. The labor market, while still healthy, has started to show signs of increased layoff activity. Higher mortgage rates and home prices have crimped housing activity, both in terms of new and existing home sales/construction. Perhaps more importantly, measures of business activity and manufacturing have started to slip as well.

The problem is that things aren’t necessarily bad.

While data has slipped, the economy is still humming along. The U.S. economy managed to expand by an annualized 4.9% in the third quarter of 2023. While that’s below previous numbers, it’s still a very robust economic environment by any measure. The issue is when or if the recession will come. And that has investors on edge, as they are reacting to every data point and creating plenty of volatility among asset classes.

Municipal Bonds to the Rescue

The question for portfolios is how to get strong, stable returns amid the volatility and uncertainty of recession. The answer, according to life insurer and asset manager Manulife, could be bread & butter municipal bonds.

Issued by state and local governments, municipal bonds are considered some of the safest bonds around. Much of the municipal debt market carries investment-grade ratings and is backed by the taxing authority of local/state governments. However, because of the slight default risks versus Treasury debt, munis often feature higher yields. Better still, munis feature tax advantages in which their coupon payments are free from federal taxes and, in some instances, state taxes as well.

These factors notwithstanding, Manulife suggests that munis could be a great play for the uncertainty.

For starters, municipal bonds are mostly purchased by large institutions such as banks, insurance funds, and pension plans. For example, banks hold more than 15% of the market, with the 10 largest banks holding the bulk of that. The key is that the vast bulk of muni debt across all major holders is designated as ‘held to maturity’ on their balance sheets. These munis form the basis for reserves, tier 1 ratios, and claims paying abilities. The sell-off of 2022 was an atypical year, with many yield tourists exiting the sector. Many institutional investors held firm and even purchased muni debt. 1

So, we have the major holders standing firm on these bonds. This works well to help reduce drawdowns during periods of duress. Munis typically see lower losses, if any at all, during recessions.

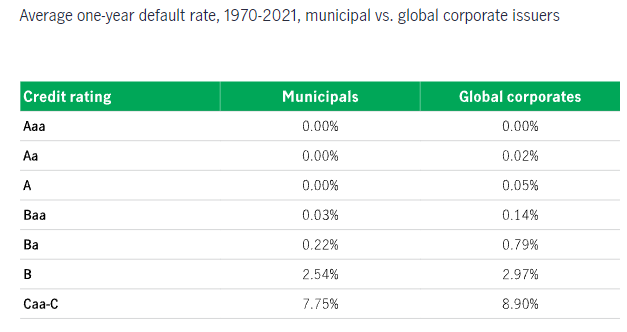

Another factor remains defaults, which are far and few between. This chart from Manulife sums up munis’ advantage over investment-grade corporate bonds. All in all, corporate bonds have a higher percentage of defaults relative to muni bonds across all credit ratings ranging from AA to Caa-C.

Source: Manulife

Finally, muni issuance is down. States and local governments have put the brakes on issuing new debt amid the higher rate environment. As of the third quarter, supplies of new muni debt are down roughly 23% year over year. With many larger investors gobbling up these supplies when issued, it’s creating a floor for the sector.

The combination of these factors—historical low defaults, lower volatility, and rising demand amid lower supplies—continues to boost municipal bonds as a go-to asset class for the mixed environment. Investors have the chance to score high-tax free yields, while seeing reduced and lower volatility versus other asset classes, all while getting a margin of safety from a high credit rating.

A Strong Portfolio Contender

Given all the uncertainty and mixed economic picture before investors, munis could offer a great deal to get through the malaise. The sector has rebounded since the 2022 meltdown. However, they still offer plenty of strong yield and potential for portfolios.

As we said, pensions, insurance funds, and endowments tend to snap-up munis quickly. This could make purchasing them difficult on an individual basis. As such, the real game in town for regular investors is via funds. But luckily, there are plenty of muni bond ETFs that offer exposure to the asset class.

Investors may also want to go active with their municipal bonds. Thanks to credit research and the ability to buy bonds at a discount, active management may have the advantage in the sector.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their one-year total return, which ranges from 2.3% to 5%. They have expense ratios between 0.05% to 0.65% and have assets under management between $930M to $34B. They are currently offering yields between 1.5% and 4.1%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.8B | 5% | 2.98% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 4.9% | 3.4% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34B | 4.3% | 2.64% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | 4.4% | 2.79% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $933M | 3.1% | 4.1% | 0.19% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 2.4% | 1.5% | 0.20% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 2.3% | 1.74% | 0.07% | ETF | No |

In the end, several important factors have made municipal bonds wonderful portfolio additions during times of duress. From high ownership structures to low default rates, munis could be exactly what portfolios need to get through the current uncertainty and mixed economic environment.

The Bottom Line

Economic data is pointing to a mixed environment, with rising recession risks amid tepid growth. That uncertainty is throwing investors for a loop. But municipal bonds could be the answer. Thanks to low default rates, low volatility, and high buy & hold investor bases, munis could be a wonderful play in the new year.

1 Manulife (June 2023). Municipal bonds could provide stability in an uncertain market