When it comes to safety, municipal bonds have long been a go-to investment for income seekers. After all, in theory, a state or a local town has the ability to raise taxes to help pay for coupon payments – and history suggests just that. However, some investors have begun to worry about municipality and state revenues in the face of the dwindling economy.

The truth is, those worries may be all in investors’ heads. Municipal credit continues to improve. Upgrades have far outweighed downgrades, while defaults remain low and concentrated in a few high-risk sectors. The reality is that munis are still offering very advantageous high yields at great credit quality.

Worries Mount

It’s all about taxes, and that’s the cause of the worries currently affecting municipal bonds. Munis are issued by state and local governments to fund their operations, launch special projects and provide their citizens with various programs. In order to pay for those bonds, it’s often taxes – payroll, sales and property – that help pay the interest and pay off debt. And while states and towns have the ability to raise taxes, there is a limit to what they can collect. A family or a business can easily move to a lower tax state. Because of this, analysts and investors watch state revenues like a hawk to determine municipal bond health.

And right now, many have postulated that trouble is brewing.

The higher interest rate environment is starting to impact economic growth, which is not a great thing for taxes. States originally budgeted for a 3.1% decline in 2023, and many have shifted budget surplus predictions for 2024 into budget deficits.

For municipal bonds, this is a big deal, as it – at least in theory – reduces the amount of money collected that can be used to pay back bonds and interest. With rates still high, investors have been cautiously thinking about their muni bond purchases, potentially crimping some of their returns at the start of the year.

Still Plenty of Positives

However, investors may not want to write off municipal bonds just yet. In fact, it could be quite the opposite. Municipal bonds credit quality is actually getting better.

While states planned for lower tax revenues last year, the reality is they didn’t see them. In fact, total tax collections remain above pre-pandemic nominal levels. According to Nuveen, total revenues for the first half of 2023 were nearly 24% higher than 2019 and 31% higher than 2020’s figures. Meanwhile, income taxes are also strong when compared to pre-pandemic levels. 1

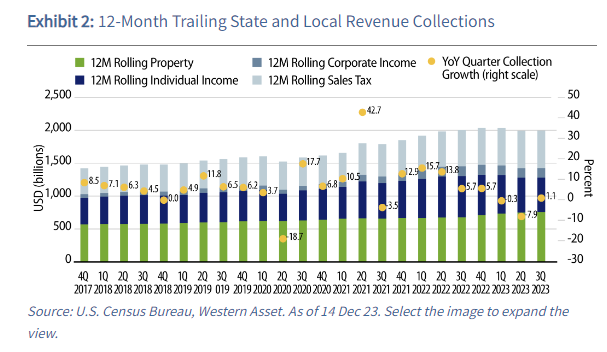

This chart from Western Asset shows the breakdown of state and local revenue collections.

Source: Western Asset

In addition to their cash flows, many states’ rainy-day funds are quite fat. An influx of pandemic-issued cash has helped many states grow their rainy-day balances to levels not seen before. Today, those balances relative to spending are higher than any point in the last 15 years. This highlights that states have plenty of wiggle room with regards to their budgets and paying off their debts.

And speaking of budgets, many states have already begun to trim and cut costs as they already predicted lower tax receipts. Because of this, budget deficits were small and many aren’t realizing the declines they expected.

As for the debts themselves, defaults for munis still remain very low. Only 53 municipal bonds realized a default event in 2023. And when it comes to those defaults, the vast bulk of them came from Continuing Care and Retirement Community (CCRC), Assisted Living, and Health Care municipal sectors – already a high-risk segment of the staid muni market.

The real win is that all of these continue to support a strong credit environment for muni bonds. Looking at data through the end of 2023 from the three major ratings agencies – Moody’s, S&P and Fitch – credit upgrades outnumbered downgrades 7 to 1. This indicates that states and local governments’ ability to pay back their bonds has gotten even better. 2

Adding Muni Debt

So, the real driver behind making sure they can pay their debts has gotten even better over the last year. That’s reason enough to add muni debt to a portfolio. Another incentive could be their high tax-free yields.

Because they are designed to help states fund their operations, Uncle Sam will cut investors a break on muni bond interest. Today, investors can score an after-tax yield on muni debt north of 7% for investors in the highest tax brackets. However, even those in lower tax brackets will still score yields above Treasury bonds for top-notch and improving credit quality.

As a sector, municipal bonds remain notoriously hard for investors to purchase individually. Supplies of bonds are often quickly scooped up via large institutional investors like pensions and insurance funds. Secondary trading comes with large bid/ask spreads and significant initial investments.

This means ETFs and funds are one of the best ways to get your municipal bond fix. Both passive and active options abound. Active may have a slight edge, as managers can exploit inefficiencies in the market. Either way, investors can score high after-tax yields and the potential for some capital appreciation.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their 1-year total return, which ranges from 3.3% to 5.6%. They have expense ratios between 0.05% to 0.65% and assets under management between $930M to $34B. They are yielding between 1.7% and 3.4%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | 5.6% | 3.1% | 0.05% | ETF | No |

| FMB | First Trust Managed Municipal ETF | $1.8B | 5.6% | 3.2% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 5.6% | 3.4% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34B | 5.2% | 3% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $933M | 4% | 2.9% | 0.19% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 3.4% | 1.7% | 0.20% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 3.3% | 2.1% | 0.07% | ETF | No |

In the end, investors’ worries about municipal bonds and their ability to keep cash flow going could be unfounded. The reality is, taxes and revenues remain robust. So much so, that the sector continues to see widespread credit upgrades, with downgrades and defaults being limited to very specialized and high-risk issues. With that, investors have a chance to score some very high values and income from the sector.

The Bottom Line

Municipal bonds have started to face plenty of questions as perceived tax shortfalls take hold. However, the headlines may just be an illusion. Tax receipts, budget shortfalls and smaller rainy-day funds haven’t occurred. In fact, upgrades for the sector keep coming – and that is a wonderful sign for investors looking to score high yields with a dose of safety.

1 Nuveen (January 2024). Municipal bonds: Resilient credit and higher yields offer opportunity

2 Western Asset (January 2024). Weekly Municipal Monitor—Year in Review