Often talked only from the standpoint of cities and counties, municipal debt issuances cover an expansive array of governmental entities at the state and local levels.

These entities, distinguished by their public governance, have the authority to issue municipal debt instruments for the purpose of securing financial resources to fund various public initiatives and infrastructure projects. Furthermore, depending on the capital need, each issuer will structure the debt issuance optimal for their operations, backed by their distinct revenue sources.

In this article, we will review different municipal debt issuers in the U.S. and the importance of understanding the inner workings of the issuing agency in order to adequately assess the potential risk-reward relationship.

Municipal Debt Structure

Before diving into the list of different municipal debt issuers, it’s important to understand the taxing authority for each governmental entity, which serves as the base of municipal debt issuances. The governmental agencies pledge the revenues generated through their respective authorities to raise capital through the municipal debt issuance process.

The taxing authority or revenue generation for governmental agencies basically steers the municipal debt transaction structure into two categories: general obligation debt vs. revenue-backed debt.

1. General Obligation Debt (GO Debt)

GO debt is secured by the full faith and credit of the issuer, typically a government entity like a city or county. It means the issuer commits to using its taxing authority to repay the bondholders, if necessary. The issuer may raise taxes or use other general revenue sources to meet its debt obligations. The use of proceeds for GO debt is typically related to the entire community such as parks, schools or public buildings.

2. Revenue-Backed Debt

Revenue-backed debt, on the other hand, is secured by the revenue generated from a specific project or source like user fees from a public utility (water, sewer, solid waste) or toll revenues from bridges or express lanes. These bonds are issued with the expectation that the income generated from the project or source will be sufficient to cover both the principal and interest payments on the bonds. The issuer’s general funds or taxing authority are not typically used to repay this type of debt.

When assessing the risk profile, GO debt typically carries a low risk profile due to its reliance on the entity’s taxing authority. Revenue-backed debt carries more risk because the repayment depends on the success of either the project or the revenue source. If the project underperforms or the revenue source doesn’t generate enough income, there may be challenges in repaying the debt.

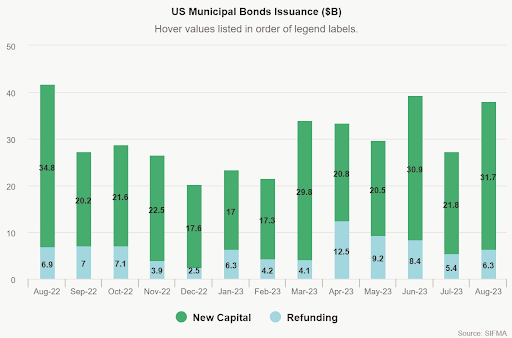

In 2023, we have seen a ramp-up in municipal debt issuances due to many local governments starting capital projects that may have been stalled during COVID or due to supply chain issues. However, we can see a lower volume of municipal debt refunding due to the high interest rate environment and less viability of refunding old debt and generating adequate savings for local governments. Securities Industry and Financial Markets Association (SIFMA) data below shows the aforementioned trend in total dollar issuances.

Source: SIFMA

Municipal Debt Issuers

Based on the infrastructure needs, governing authorities will proceed with the plan of funding, and the aforementioned risk profiles – including debt structures – can differ for every issuer and their governing criteria.

State and Local Governments

This category encompasses state governments, counties, cities, towns and municipalities. These governmental bodies frequently utilize bond issuances as a means to raise capital for critical projects, such as infrastructure development, public facility construction, and the refinancing of existing debt obligations. You will often see both general obligation and revenue bond issuances in this category, as city or county operations often cover general government operations and public utilities.

Special Districts

Special districts are established to serve specific and defined purposes, such as water supply, sewage management or educational services. These districts possess the authority to issue municipal bonds to finance projects associated with their designated functions using revenue-backed debt. More and more cities are also issuing debt for new housing developments called Community Facilities Districts (CFDs) and assess special tax on properties only within the new developed area, with the new revenue stream is pledged to raise capital.

Public Universities and Colleges

Public institutions of higher education, including universities and colleges, may engage in the issuance of municipal bonds to secure funding for campus expansion, infrastructure enhancement, research facilities and student accommodations. Again, the revenue streams will likely be unique to the university and will be pledged to issue revenue-backed debt.

Hospitals and Healthcare Organizations

Public hospitals and healthcare institutions that operate under governmental agencies may utilize municipal bond issuances to procure funding for capital projects, equipment acquisitions and healthcare service improvements. This is where you may see county or city government issuing the debt on behalf of the institution and pledging a special revenue stream.

Housing Finance Agencies

Again, depending on the complexity of operations or the size of housing agencies, there may be some level of partnership in raising capital with the local governing agency like a city or county. These agencies are tasked with issuing municipal bonds to support affordable housing initiatives, including the financing of housing projects and the provision of loans to homebuyers or developers.

Economic Development Agencies

Local or regional economic development agencies often exercise the option to issue municipal bonds as a mechanism for financing projects geared towards stimulating economic growth, such as industrial park development or community revitalization efforts. This is where we may be Public Private Partnerships (PPP) or other initiatives that cover an expansive area or jurisdiction and many governmental entities involved in the issuance of debt.

Water and Sewer Utilities

Depending on the size of the utility and its operations, publicly owned water and sewer utilities may resort to municipal bond issuances to secure resources for vital infrastructure upgrades, capacity expansion and the enhancement of water quality. In the recent years, we have seen more and more federal funding to enhance/revamp the existing infrastructures in the Unites States.

Transportation Authorities

Entities responsible for the operation of public transportation systems, including buses, subways and commuter rail services, frequently engage in municipal bond issuances to support infrastructure maintenance, expansion and improvement. Most transportation agencies are independent of cities or counties they serve and have their own revenue sources in the form of sales tax, fare revenues, regional financial support and grant fundings. These revenue sources will be pledged for debt financings.

Playing the Muni Market

These days, investors have several options to invest in muni bonds, with ETFs providing a cost-effective and convenient entry point.

Someone willing to take a safe bet on a wide range of investment-grade muni bonds can look into iShares National Muni Bond ETF (MUB). Risk averse investors can also consider Invesco Insured Municipal Bond ETF (PZA), which primarily invests in insured municipal bonds, including those issued by universities, school districts and transit agencies.

For those with higher risk appetite, an active ETF like Franklin Dynamic Municipal Bond ETF (FLMI) can provide a diversified exposure to a wide range of revenue-backed muni debt across different sectors, including industrial development, healthcare, education and housing.

Muni Bond ETFs

These funds are selected based on YTD total return, which ranges from -0.5% to 3.2%. They have expenses between 0.07% and 0.70% and have AUM ranging from $110M–$33B. Their yields are between 1.2% and 4.3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| RVNU | Xtrackers Municipal Infrastructure Revenue Bond ETF | $115M | 3.2% | 3% | 0.15% | ETF | No |

| FLMI | Franklin Dynamic Municipal Bond ETF | $111M | 2% | 4% | 0.30% | ETF | Yes |

| FMHI | First Trust Municipal High Income ETF | $409M | 1.8% | 4.1% | 0.70% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $532M | 1.6% | 3.2% | 0.35% | ETF | Yes |

| HYD | VanEck High Yield Muni ETF | $2.92B | 0.6% | 4.3% | 0.32% | ETF | No |

| PZA | Invesco National AMT-Free Municipal Bond ETF | $2.33B | 0.5% | 2.9% | 0.28% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $4.06B | -0.2% | 1.2% | 0.20% | ETF | No |

| MUB | iShares National Muni Bond ETF | $32.8B | -0.5% | 2.7% | 0.07% | ETF | No |

The Bottom Line

Things like governing authority, capital plan, financing structure, revenue pledge and infrastructure make any municipal debt issuance quite unique. These intricacies make municipal debt more than just a singular asset class. Investors should carefully study the financing structure and the potential risks before making their investments.

Check out other muni bond fund options here.